Question

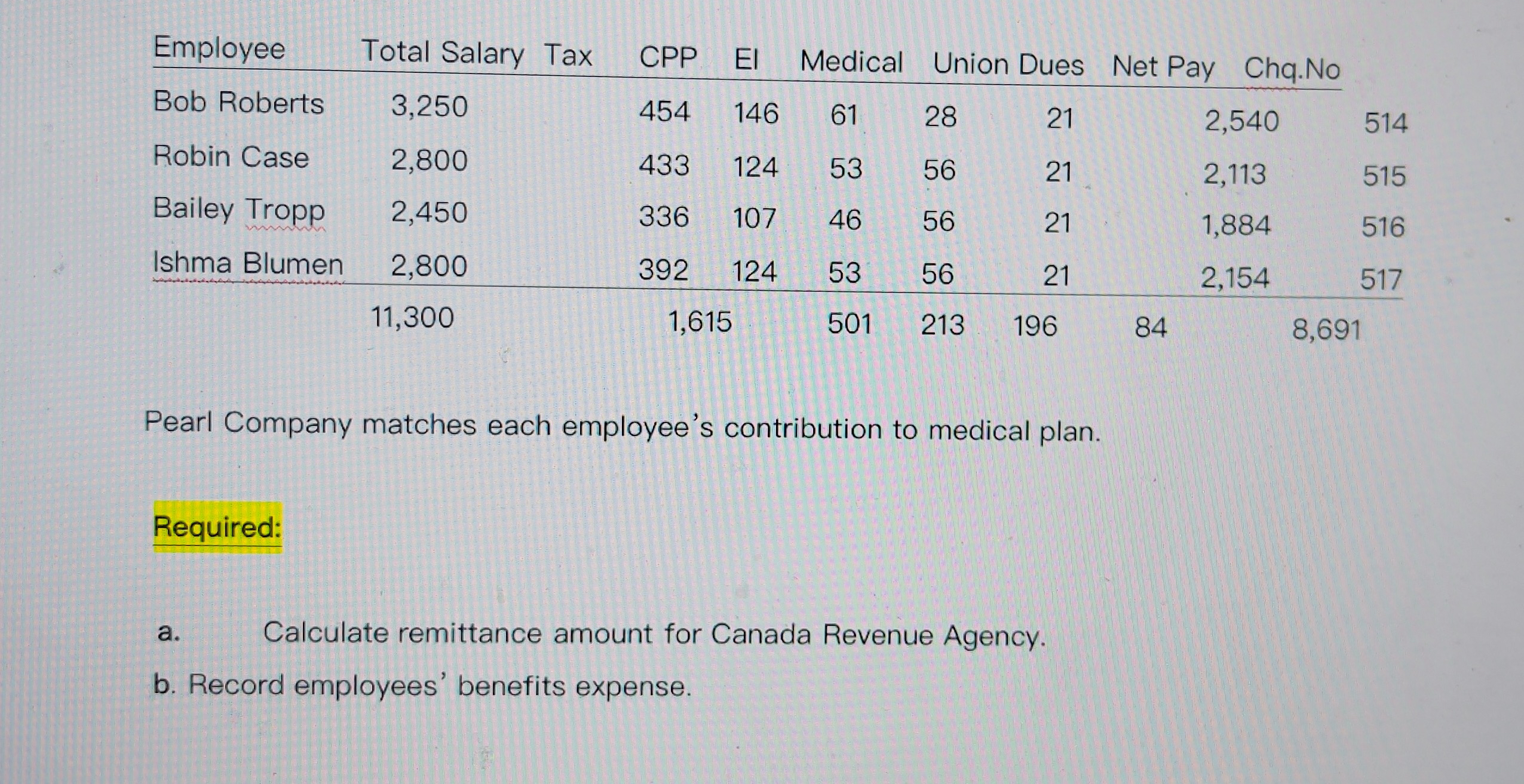

Employee Total Salary Tax CPP Medical Union Dues Net Pay Chq.No Bob Roberts 3,250 454 146 61 28 21 2,540 514 Robin Case 2,800

Employee Total Salary Tax CPP Medical Union Dues Net Pay Chq.No Bob Roberts 3,250 454 146 61 28 21 2,540 514 Robin Case 2,800 433 124 53 56 Bailey Tropp 2,450 336 107 46 56 Ishma Blumen 2,800 392 124 53 56 222 21 2,113 515 21 1,884 516 21 2,154 517 11,300 1,615 501 213 196 84 8,691 Pearl Company matches each employee's contribution to medical plan. Required: a. Calculate remittance amount for Canada Revenue Agency. b. Record employees' benefits expense.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Accounting A Practical Approach

Authors: Jeffrey Slater, Debra Good

13th Canadian edition

134616316, 134166698, 9780134632407 , 978-0134166698

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App