Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Employee T's $401(k) balance is $60,000 ($20,000 of that is attributable to employer (BCD Inc.) contributions, and the balance is attributable to employee contributions).

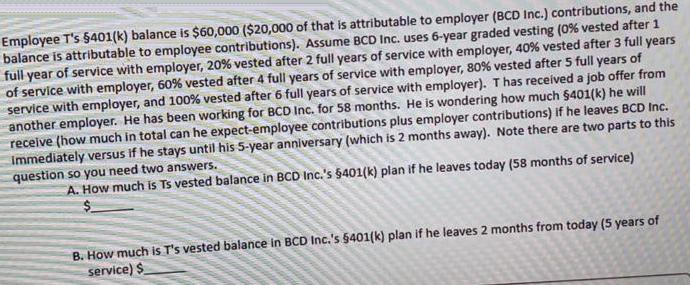

Employee T's $401(k) balance is $60,000 ($20,000 of that is attributable to employer (BCD Inc.) contributions, and the balance is attributable to employee contributions). Assume BCD Inc. uses 6-year graded vesting (0% vested after 1 full year of service with employer, 20% vested after 2 full years of service with employer, 40% vested after 3 full years of service with employer, 60% vested after 4 full years of service with employer, 80% vested after 5 full years of service with employer, and 100% vested after 6 full years of service with employer). T has received a job offer from another employer. He has been working for BCD Inc. for 58 months. He is wondering how much $401(k) he will receive (how much in total can he expect-employee contributions plus employer contributions) if he leaves BCD Inc. immediately versus if he stays until his 5-year anniversary (which is 2 months away). Note there are two parts to this question so you need two answers. A. How much is Ts vested balance in BCD Inc.'s 5401(k) plan if he leaves today (58 months of service) B. How much is T's vested balance in BCD Inc.'s 5401(k) plan if he leaves 2 months from today (5 years of service) $

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

A 36 000 20 000 employer contr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started