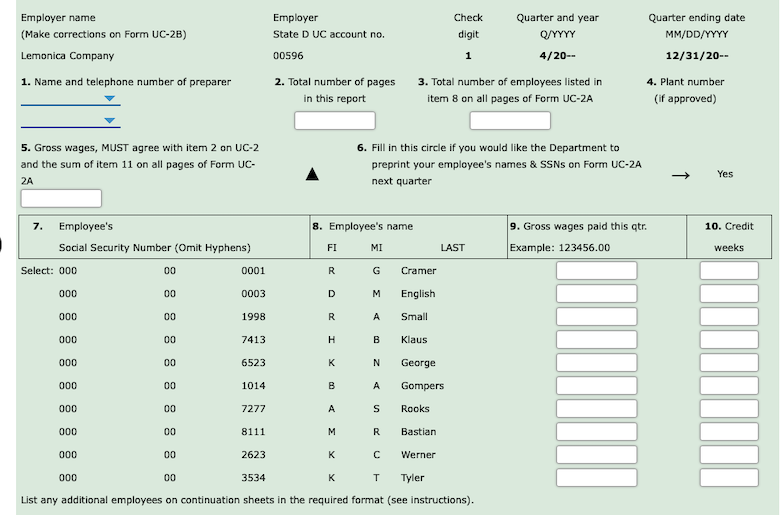

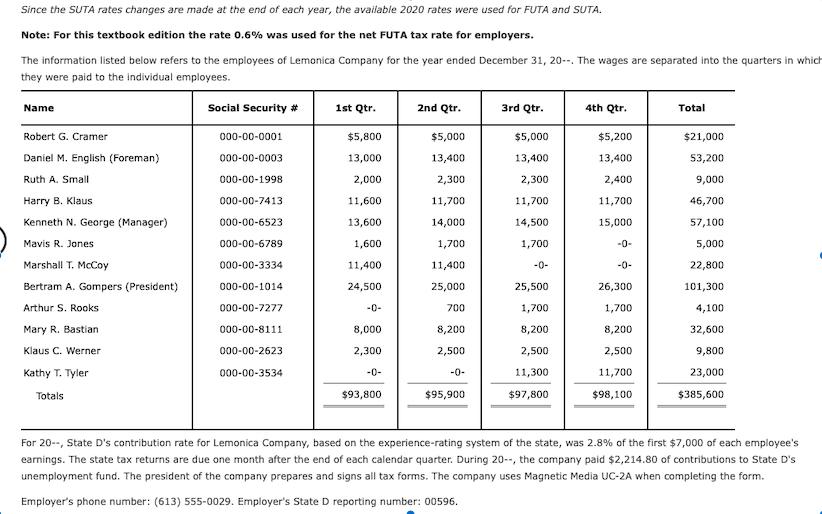

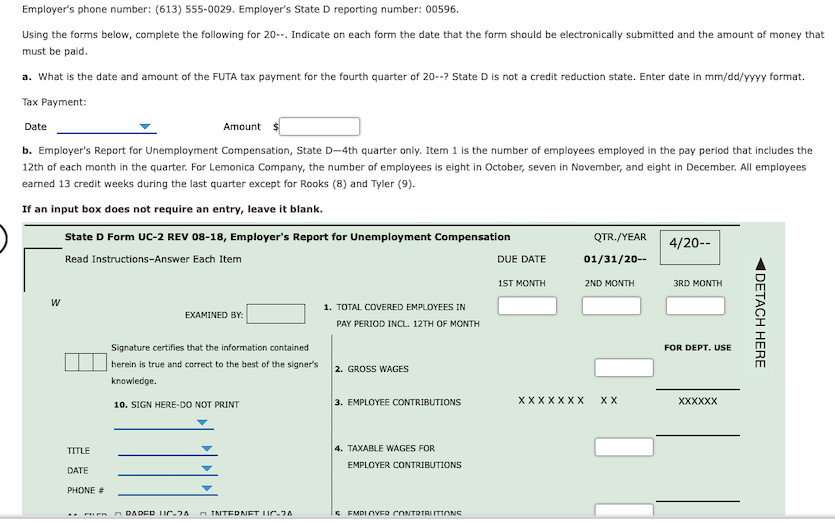

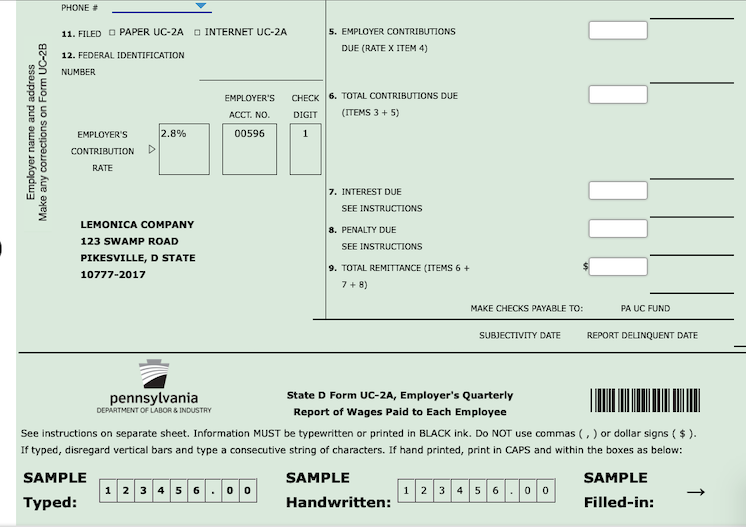

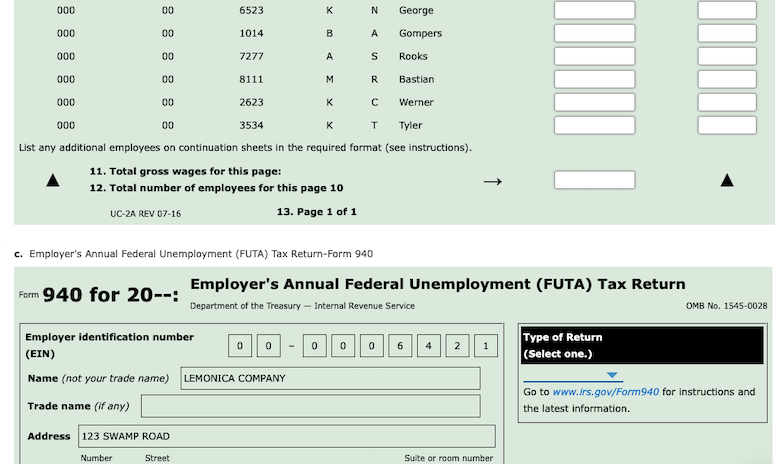

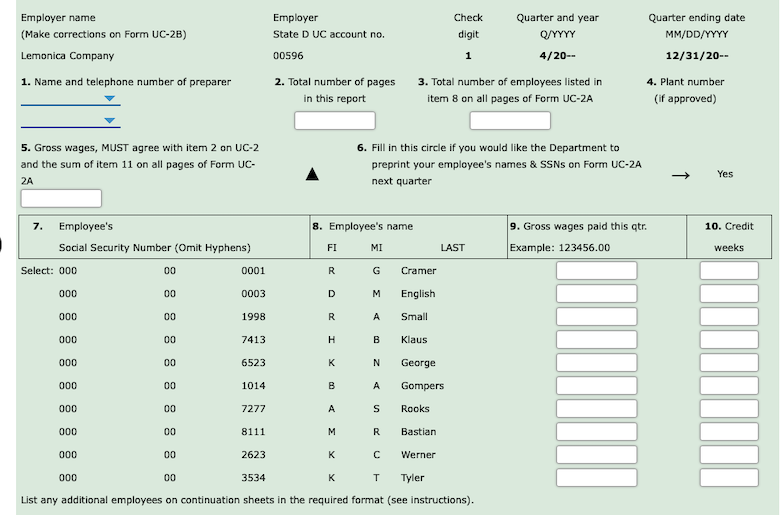

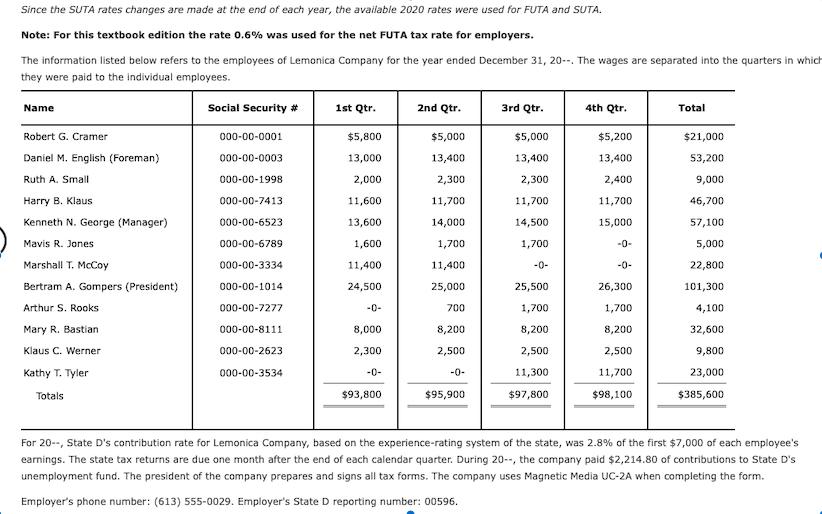

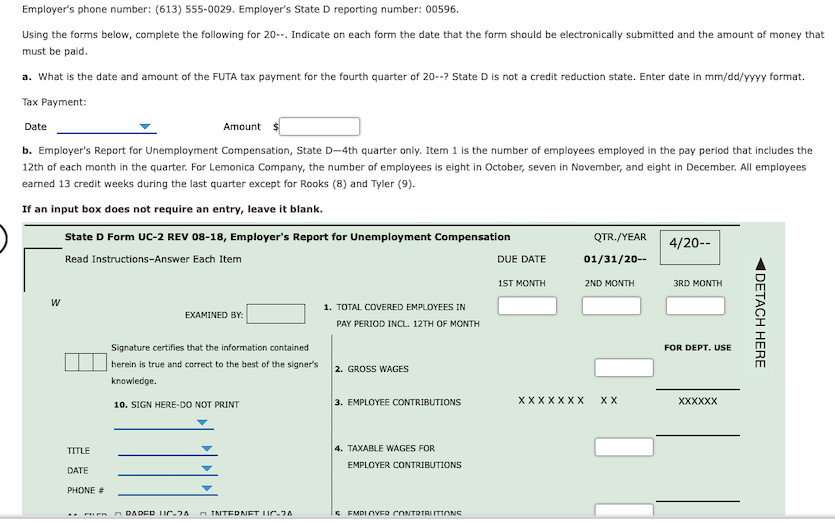

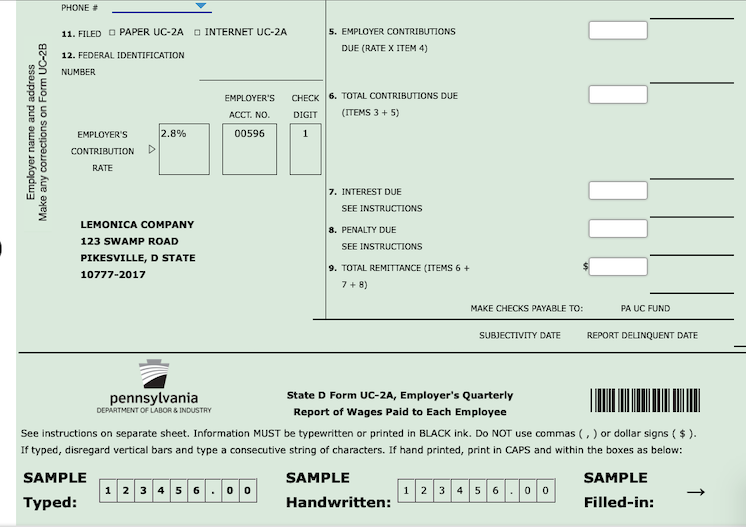

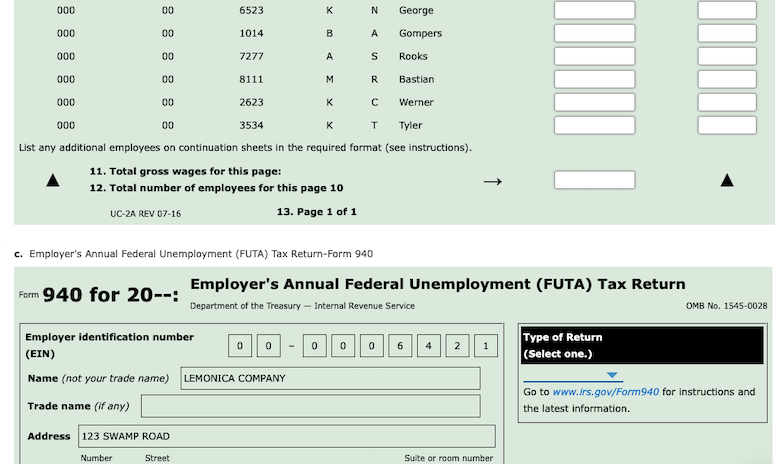

Employer name (Make corrections on Form UC-2B) Lemonica Company 1. Name and telephone number of preparer Employer State D UC account no. 00596 2. Total number of pages in this report Check Quarter and year digit Q/YYYY 1 4/20- 3. Total number of employees listed in item 8 on all pages of Form UC-2A Quarter ending date MM/DD/YYYY 12/31/20 - 4. Plant number (if approved) 5. Gross wages, MUST agree with item 2 on UC-2 and the sum of item 11 on all pages of Form UC- 6. Fill in this circle if you would like the Department to preprint your employee's names & SSNs on Form UC-ZA next quarter Yes 2A 10. Credit 7. Employee's Social Security Number (Omit Hyphens) Select: 000 00 0001 8. Employee's name MI 9. Gross wages paid this qtr. Example: 123456.00 FI LAST weeks R G Cramer 000 00 0003 D M English 000 00 1998 R A Small 000 00 7413 H Klaus B N 000 00 6523 George 000 00 1014 B A Gompers 000 00 7277 S Rooks 000 00 8111 M 20 Bastian 000 00 2623 K Werner 000 00 3534 K T Tyler List any additional employees on continuation sheets in the required format (see instructions). 4th Qtr. Since the SUTA rates changes are made at the end of each year, the available 2020 rates were used for FUTA and SUTA. Note: For this textbook edition the rate 0.6% was used for the net FUTA tax rate for employers. The information listed below refers to the employees of Lemonica Company for the year ended December 31, 20--. The wages are separated into the quarters in which they were paid to the individual employees. Name Social Security # 1st Qtr. 2nd Qtr. 3rd Qtr. Total Robert G. Cramer 000-00-0001 $5,800 $5,000 $5,000 $5,200 $21,000 Daniel M. English (Foreman) 000-00-0003 13,000 13,400 13,400 13,400 53,200 Ruth A Small 000-00-1998 2,000 2,300 2,300 2,400 9,000 Harry B. Klaus 000-00-7413 11,600 11,700 11,700 11,700 46,700 Kenneth N. George (Manager) 000-00-6523 13,600 14,000 14,500 15,000 57,100 Mavis R. Jones 000-00-6789 1,600 1,700 1,700 -0- 5,000 Marshall T. McCoy 000-00-3334 11,400 11,400 -0- 22,800 Bertram A. Gompers (President) 000-00-1014 24,500 25,000 25,500 26,300 101,300 Arthur S. Rooks 000-00-7277 -0- 700 1,700 1,700 4,100 Mary R. Bastian 000-00-8111 8,000 8,200 8,200 8,200 32,600 Klaus C. Werner 000-00-2623 2,300 2,500 2,500 2,500 9,800 Kathy T. Tyler 000-00-3534 11,300 11,700 23,000 Totals $93,800 $95,900 $97,800 $98,100 $385,600 For 20--, State D's contribution rate for Lemonica Company, based on the experience-rating system of the state, was 2.8% of the first $7,000 of each employee's earnings. The state tax returns are due one month after the end of each calendar quarter. During 20--, the company paid $2,214.80 of contributions to State D's unemployment fund. The president of the company prepares and signs all tax forms. The company uses Magnetic Media UC-2A when completing the form. Employer's phone number: (613) 555-0029. Employer's State Dreporting number: 00596. Employer's phone number: (613) 555-0029. Employer's State Dreporting number: 00596. Using the forms below, complete the following for 20--. Indicate on each form the date that the form should be electronically submitted and the amount of money that must be paid a. What is the date and amount of the FUTA tax payment for the fourth quarter of 20--? State D is not a credit reduction state. Enter date in mm/dd/yyyy format. Tax Payment: Date Amount $ b. Employer's Report for Unemployment Compensation, State D-4th quarter only. Item 1 is the number of employees employed in the pay period that includes the 12th of each month in the quarter. For Lemonica Company, the number of employees is eight in October, seven in November, and eight in December. All employees earned 13 credit weeks during the last quarter except for Rooks (8) and Tyler (9). If an input box does not require an entry, leave it blank. State D Form UC-2 REV 08-18, Employer's Report for Unemployment Compensation QTR./YEAR 4/20-- Read Instructions-Answer Each Item DUE DATE 01/31/20- 1ST MONTH 2ND MONTH w EXAMINED BY: 1. TOTAL COVERED EMPLOYEES IN PAY PERIOD INCL. 12TH OF MONTH Signature certifies that the information contained FOR DEPT. USE herein is true and correct to the best of the signer's 2. GROSS WAGES knowledge. 10. SIGN HERE-DO NOT PRINT 3. EMPLOYEE CONTRIBUTIONS X X X X X X X XXXXXX 3RD MONTH DETACH HERE X X TITLE 4. TAXABLE WAGES FOR EMPLOYER CONTRIBUTIONS DATE PHONE # - FR DADED II.A INTERNET TIC.A SFMDI OVER CONTRTRITIONS PHONE + 11. FILED PAPER UC-2A O INTERNET UC-2A 5. EMPLOYER CONTRIBUTIONS DUE (RATE X ITEM 4) 12. FEDERAL IDENTIFICATION NUMBER EMPLOYER'S CHECK 6. TOTAL CONTRIBUTIONS DUE DIGIT (ITEMS 3 + 5) ACCT. NO. Employer name and address Make any corrections on Form UC-2B EMPLOYER'S 2.8% 00596 1 CONTRIBUTION RATE 7. INTEREST DUE SEE INSTRUCTIONS 8. PENALTY DUE SEE INSTRUCTIONS LEMONICA COMPANY 123 SWAMP ROAD PIKESVILLE, D STATE 10777-2017 111 9. TOTAL REMITTANCE (ITEMS 6 + 7 + 8) MAKE CHECKS PAYABLE TO: PA UC FUND SUBJECTIVITY DATE REPORT DELINQUENT DATE pennsylvania State D Form UC-2A, Employer's Quarterly DEPARTMENT OF LABOR & INDUSTRY Report of Wages Paid to Each Employee See instructions on separate sheet. Information MUST be typewritten or printed in BLACK ink. Do NOT use commas (, ) or dollar signs ($). If typed, disregard vertical bars and type a consecutive string of characters. If hand printed, print in CAPS and within the boxes as below: SAMPLE SAMPLE SAMPLE 1 2 3 4 5 6 . 0 0 1 2 3 4 5 600 Typed: Handwritten: Filled-in: 000 00 6523 K N George 000 00 1014 B A Gompers 000 00 7277 S Rooks 000 00 8111 M R Bastian 000 00 2623 K Werner 00 T 000 3534 Tyler List any additional employees on continuation sheets in the required format (see instructions). 11. Total gross wages for this page: 12. Total number of employees for this page 10 UC-2A REV 07-16 13. Page 1 of 1 1 OMB No. 1545-0028 c. Employer's Annual Federal Unemployment (FUTA) Tax Return-Form 940 Employer's Annual Federal Unemployment (FUTA) Tax Return Form 940 for 20--: Department of the Treasury Internal Revenue Service Employer identification number Type of Return 0 006 (EIN) (Select one.) Name (not your trade name) LEMONICA COMPANY Go to www.irs.gov/Form 940 for instructions and Trade name (if any) the latest information. 0 0 4 2 Address 123 SWAMP ROAD Number Street Suite or room number Employer name (Make corrections on Form UC-2B) Lemonica Company 1. Name and telephone number of preparer Employer State D UC account no. 00596 2. Total number of pages in this report Check Quarter and year digit Q/YYYY 1 4/20- 3. Total number of employees listed in item 8 on all pages of Form UC-2A Quarter ending date MM/DD/YYYY 12/31/20 - 4. Plant number (if approved) 5. Gross wages, MUST agree with item 2 on UC-2 and the sum of item 11 on all pages of Form UC- 6. Fill in this circle if you would like the Department to preprint your employee's names & SSNs on Form UC-ZA next quarter Yes 2A 10. Credit 7. Employee's Social Security Number (Omit Hyphens) Select: 000 00 0001 8. Employee's name MI 9. Gross wages paid this qtr. Example: 123456.00 FI LAST weeks R G Cramer 000 00 0003 D M English 000 00 1998 R A Small 000 00 7413 H Klaus B N 000 00 6523 George 000 00 1014 B A Gompers 000 00 7277 S Rooks 000 00 8111 M 20 Bastian 000 00 2623 K Werner 000 00 3534 K T Tyler List any additional employees on continuation sheets in the required format (see instructions). 4th Qtr. Since the SUTA rates changes are made at the end of each year, the available 2020 rates were used for FUTA and SUTA. Note: For this textbook edition the rate 0.6% was used for the net FUTA tax rate for employers. The information listed below refers to the employees of Lemonica Company for the year ended December 31, 20--. The wages are separated into the quarters in which they were paid to the individual employees. Name Social Security # 1st Qtr. 2nd Qtr. 3rd Qtr. Total Robert G. Cramer 000-00-0001 $5,800 $5,000 $5,000 $5,200 $21,000 Daniel M. English (Foreman) 000-00-0003 13,000 13,400 13,400 13,400 53,200 Ruth A Small 000-00-1998 2,000 2,300 2,300 2,400 9,000 Harry B. Klaus 000-00-7413 11,600 11,700 11,700 11,700 46,700 Kenneth N. George (Manager) 000-00-6523 13,600 14,000 14,500 15,000 57,100 Mavis R. Jones 000-00-6789 1,600 1,700 1,700 -0- 5,000 Marshall T. McCoy 000-00-3334 11,400 11,400 -0- 22,800 Bertram A. Gompers (President) 000-00-1014 24,500 25,000 25,500 26,300 101,300 Arthur S. Rooks 000-00-7277 -0- 700 1,700 1,700 4,100 Mary R. Bastian 000-00-8111 8,000 8,200 8,200 8,200 32,600 Klaus C. Werner 000-00-2623 2,300 2,500 2,500 2,500 9,800 Kathy T. Tyler 000-00-3534 11,300 11,700 23,000 Totals $93,800 $95,900 $97,800 $98,100 $385,600 For 20--, State D's contribution rate for Lemonica Company, based on the experience-rating system of the state, was 2.8% of the first $7,000 of each employee's earnings. The state tax returns are due one month after the end of each calendar quarter. During 20--, the company paid $2,214.80 of contributions to State D's unemployment fund. The president of the company prepares and signs all tax forms. The company uses Magnetic Media UC-2A when completing the form. Employer's phone number: (613) 555-0029. Employer's State Dreporting number: 00596. Employer's phone number: (613) 555-0029. Employer's State Dreporting number: 00596. Using the forms below, complete the following for 20--. Indicate on each form the date that the form should be electronically submitted and the amount of money that must be paid a. What is the date and amount of the FUTA tax payment for the fourth quarter of 20--? State D is not a credit reduction state. Enter date in mm/dd/yyyy format. Tax Payment: Date Amount $ b. Employer's Report for Unemployment Compensation, State D-4th quarter only. Item 1 is the number of employees employed in the pay period that includes the 12th of each month in the quarter. For Lemonica Company, the number of employees is eight in October, seven in November, and eight in December. All employees earned 13 credit weeks during the last quarter except for Rooks (8) and Tyler (9). If an input box does not require an entry, leave it blank. State D Form UC-2 REV 08-18, Employer's Report for Unemployment Compensation QTR./YEAR 4/20-- Read Instructions-Answer Each Item DUE DATE 01/31/20- 1ST MONTH 2ND MONTH w EXAMINED BY: 1. TOTAL COVERED EMPLOYEES IN PAY PERIOD INCL. 12TH OF MONTH Signature certifies that the information contained FOR DEPT. USE herein is true and correct to the best of the signer's 2. GROSS WAGES knowledge. 10. SIGN HERE-DO NOT PRINT 3. EMPLOYEE CONTRIBUTIONS X X X X X X X XXXXXX 3RD MONTH DETACH HERE X X TITLE 4. TAXABLE WAGES FOR EMPLOYER CONTRIBUTIONS DATE PHONE # - FR DADED II.A INTERNET TIC.A SFMDI OVER CONTRTRITIONS PHONE + 11. FILED PAPER UC-2A O INTERNET UC-2A 5. EMPLOYER CONTRIBUTIONS DUE (RATE X ITEM 4) 12. FEDERAL IDENTIFICATION NUMBER EMPLOYER'S CHECK 6. TOTAL CONTRIBUTIONS DUE DIGIT (ITEMS 3 + 5) ACCT. NO. Employer name and address Make any corrections on Form UC-2B EMPLOYER'S 2.8% 00596 1 CONTRIBUTION RATE 7. INTEREST DUE SEE INSTRUCTIONS 8. PENALTY DUE SEE INSTRUCTIONS LEMONICA COMPANY 123 SWAMP ROAD PIKESVILLE, D STATE 10777-2017 111 9. TOTAL REMITTANCE (ITEMS 6 + 7 + 8) MAKE CHECKS PAYABLE TO: PA UC FUND SUBJECTIVITY DATE REPORT DELINQUENT DATE pennsylvania State D Form UC-2A, Employer's Quarterly DEPARTMENT OF LABOR & INDUSTRY Report of Wages Paid to Each Employee See instructions on separate sheet. Information MUST be typewritten or printed in BLACK ink. Do NOT use commas (, ) or dollar signs ($). If typed, disregard vertical bars and type a consecutive string of characters. If hand printed, print in CAPS and within the boxes as below: SAMPLE SAMPLE SAMPLE 1 2 3 4 5 6 . 0 0 1 2 3 4 5 600 Typed: Handwritten: Filled-in: 000 00 6523 K N George 000 00 1014 B A Gompers 000 00 7277 S Rooks 000 00 8111 M R Bastian 000 00 2623 K Werner 00 T 000 3534 Tyler List any additional employees on continuation sheets in the required format (see instructions). 11. Total gross wages for this page: 12. Total number of employees for this page 10 UC-2A REV 07-16 13. Page 1 of 1 1 OMB No. 1545-0028 c. Employer's Annual Federal Unemployment (FUTA) Tax Return-Form 940 Employer's Annual Federal Unemployment (FUTA) Tax Return Form 940 for 20--: Department of the Treasury Internal Revenue Service Employer identification number Type of Return 0 006 (EIN) (Select one.) Name (not your trade name) LEMONICA COMPANY Go to www.irs.gov/Form 940 for instructions and Trade name (if any) the latest information. 0 0 4 2 Address 123 SWAMP ROAD Number Street Suite or room number