Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Employment Information 1. Tanja's received salary of $93,500 in 2023. In addition, she was awarded a year-end bonus of $12,000, all of which is

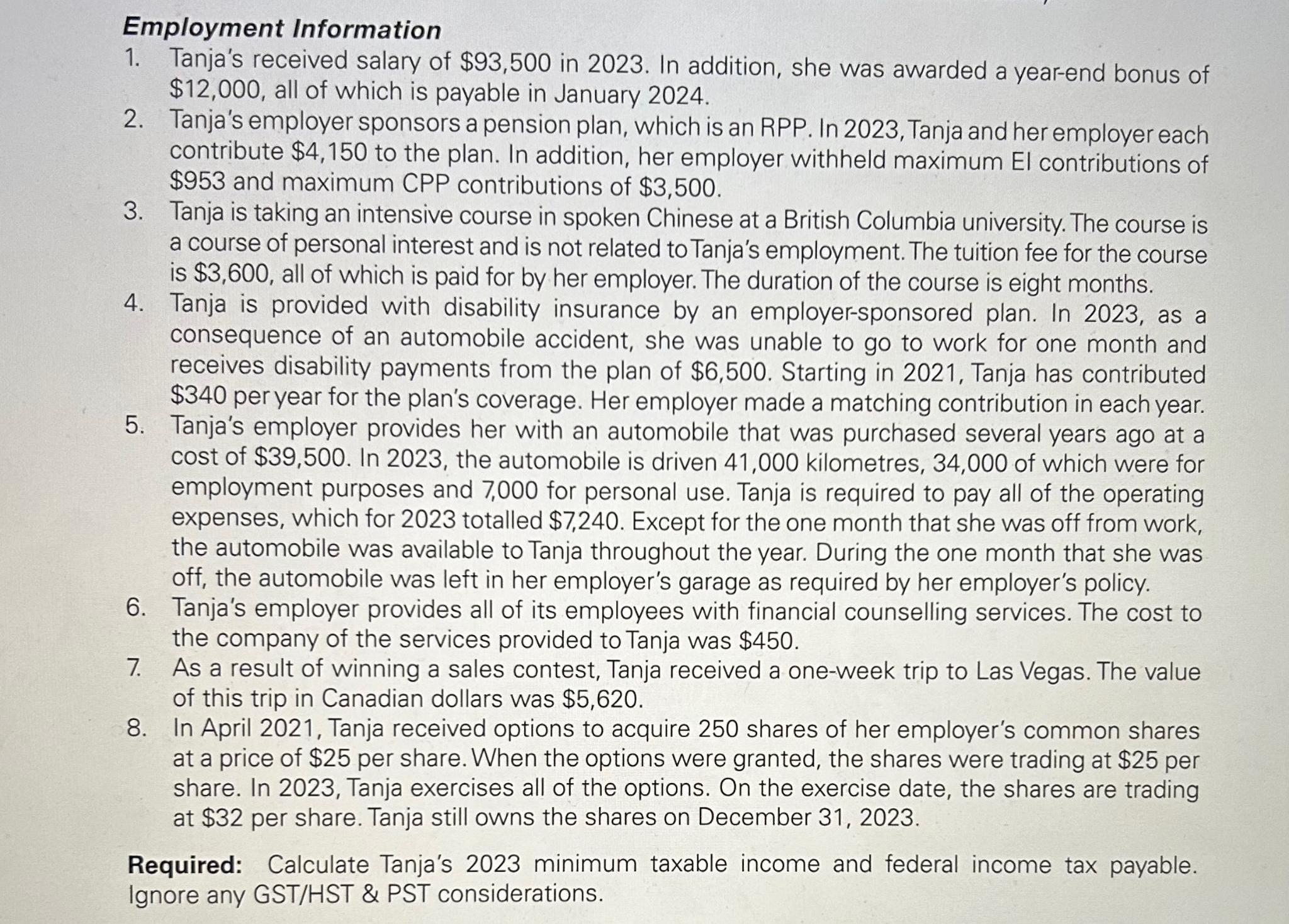

Employment Information 1. Tanja's received salary of $93,500 in 2023. In addition, she was awarded a year-end bonus of $12,000, all of which is payable in January 2024. 2. Tanja's employer sponsors a pension plan, which is an RPP. In 2023, Tanja and her employer each contribute $4,150 to the plan. In addition, her employer withheld maximum El contributions of $953 and maximum CPP contributions of $3,500. 3. Tanja is taking an intensive course in spoken Chinese at a British Columbia university. The course is a course of personal interest and is not related to Tanja's employment. The tuition fee for the course is $3,600, all of which is paid for by her employer. The duration of the course is eight months. 4. Tanja is provided with disability insurance by an employer-sponsored plan. In 2023, as a consequence of an automobile accident, she was unable to go to work for one month and receives disability payments from the plan of $6,500. Starting in 2021, Tanja has contributed $340 per year for the plan's coverage. Her employer made a matching contribution in each year. 5. Tanja's employer provides her with an automobile that was purchased several years ago at a cost of $39,500. In 2023, the automobile is driven 41,000 kilometres, 34,000 of which were for employment purposes and 7,000 for personal use. Tanja is required to pay all of the operating expenses, which for 2023 totalled $7,240. Except for the one month that she was off from work, the automobile was available to Tanja throughout the year. During the one month that she was off, the automobile was left in her employer's garage as required by her employer's policy. 6. Tanja's employer provides all of its employees with financial counselling services. The cost to the company of the services provided to Tanja was $450. 7. As a result of winning a sales contest, Tanja received a one-week trip to Las Vegas. The value of this trip in Canadian dollars was $5,620. 8. In April 2021, Tanja received options to acquire 250 shares of her employer's common shares at a price of $25 per share. When the options were granted, the shares were trading at $25 per share. In 2023, Tanja exercises all of the options. On the exercise date, the shares are trading at $32 per share. Tanja still owns the shares on December 31, 2023. Required: Calculate Tanja's 2023 minimum taxable income and federal income tax payable. Ignore any GST/HST & PST considerations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Tanjas 2023 minimum taxable income and federal income tax payable we need to consider t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started