Answered step by step

Verified Expert Solution

Question

1 Approved Answer

en you apply for a small-business loan, the lender will assess your ability to pay back the a. The lender will look for collateral (assets),

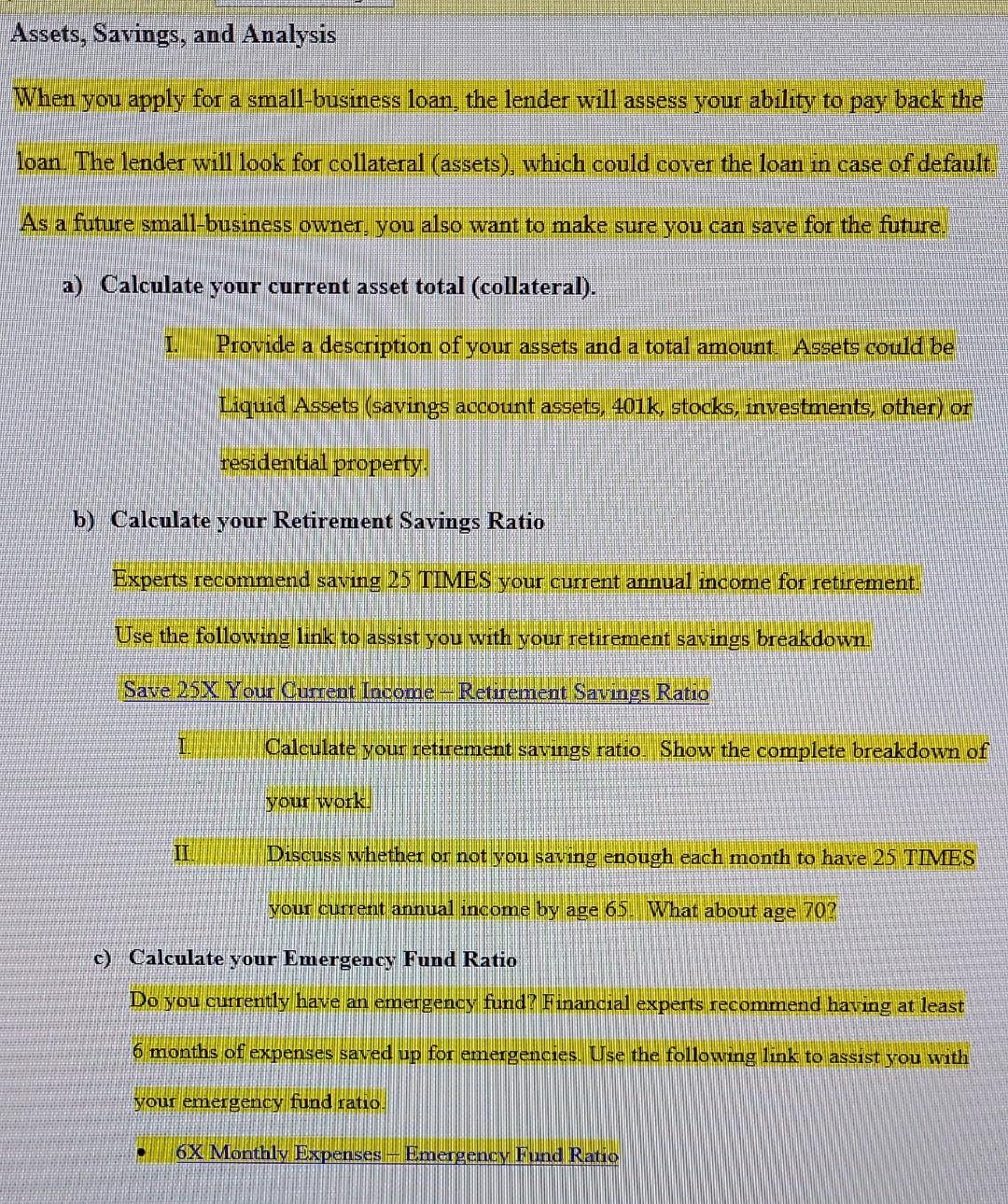

en you apply for a small-business loan, the lender will assess your ability to pay back the a. The lender will look for collateral (assets), which could cover the loan in case of default. a future small-business owner, you also want to make sure you can save for the future. a) Calculate your current asset total (collateral). I. Provide a description of your assets and a total amount Assets could be Liquid Assets (savings account assets, 401k, stocks, investments, other) or residential property. b) Calculate your Retirement Savings Ratio Experts recommend saving 25 TIMES your current annual income for retirement. Use the following link to assist you with your retirement savings breakdown. Save 25X Your Cumeat Iacome-Retirement Savings Ratio I. Calculate your retirement savings ratio. Show the complete breakdown of II Discuss whether or not you saving enough each month to have 25 TIMES your current annual income by age 65 . What about age 70 ? c) Calculate your Emergency Fund Ratio Do you currently have an emergency fund? Financial experts recommend having at least 6 months of expenses saved up for emergencies. Use the following link to assist you with your emergency fund ratio. - 6X Monthly Expenses - Emengency Fund Ratio en you apply for a small-business loan, the lender will assess your ability to pay back the a. The lender will look for collateral (assets), which could cover the loan in case of default. a future small-business owner, you also want to make sure you can save for the future. a) Calculate your current asset total (collateral). I. Provide a description of your assets and a total amount Assets could be Liquid Assets (savings account assets, 401k, stocks, investments, other) or residential property. b) Calculate your Retirement Savings Ratio Experts recommend saving 25 TIMES your current annual income for retirement. Use the following link to assist you with your retirement savings breakdown. Save 25X Your Cumeat Iacome-Retirement Savings Ratio I. Calculate your retirement savings ratio. Show the complete breakdown of II Discuss whether or not you saving enough each month to have 25 TIMES your current annual income by age 65 . What about age 70 ? c) Calculate your Emergency Fund Ratio Do you currently have an emergency fund? Financial experts recommend having at least 6 months of expenses saved up for emergencies. Use the following link to assist you with your emergency fund ratio. - 6X Monthly Expenses - Emengency Fund Ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started