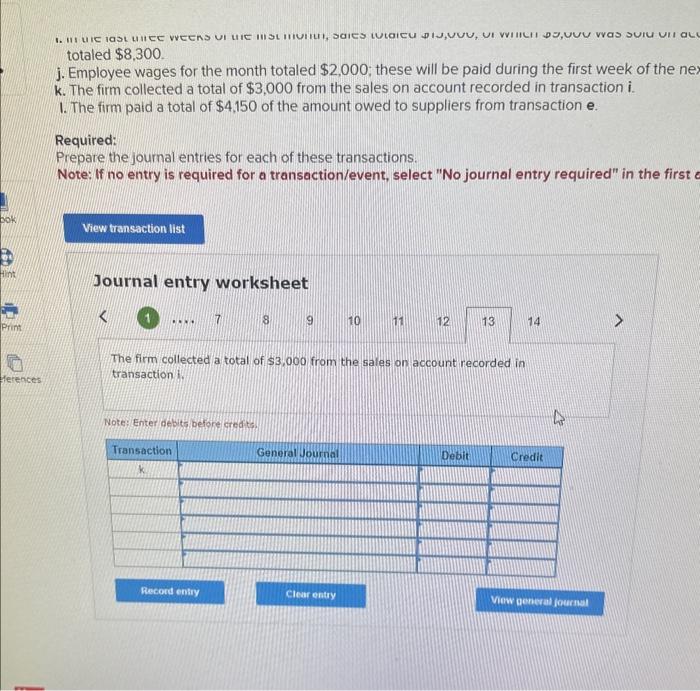

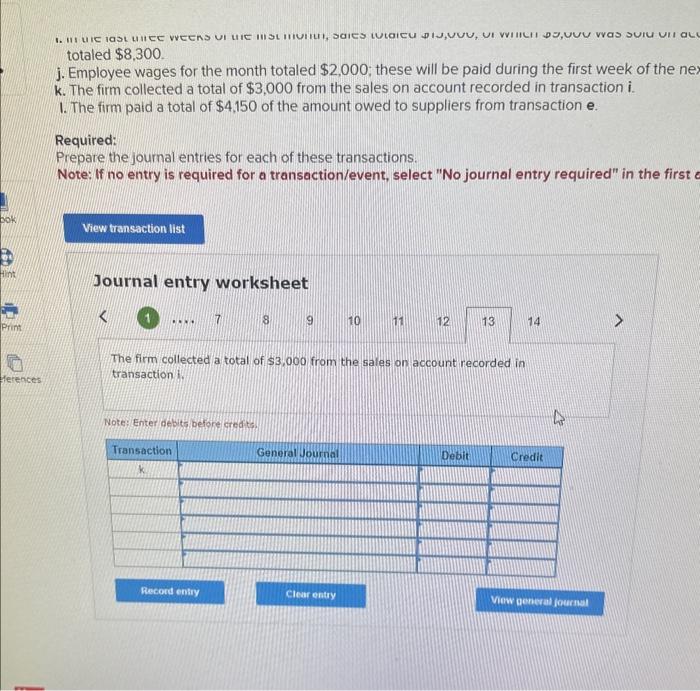

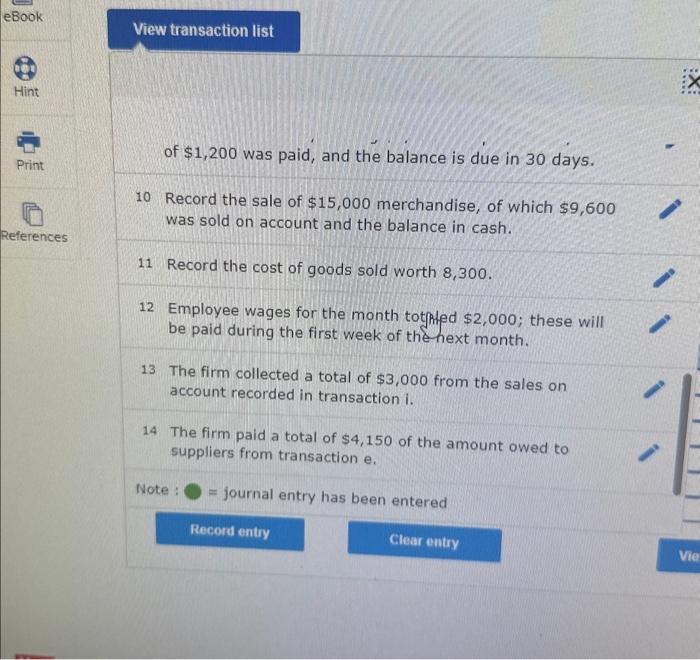

ences 1. aastunee weeks VI THE HISTOui, Saits LULAITU $IJ,VVV, UT WHICH WAS totaled $8,300. j. Employee wages for the month totaled $2,000; these will be paid during the first week of t k. The firm collected a total of $3,000 from the sales on account recorded in transaction i. 1. The firm paid a total of $4,150 of the amount owed to suppliers from transaction e. Required: Prepare the journal entries for each of these transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the View transaction list Journal entry worksheet

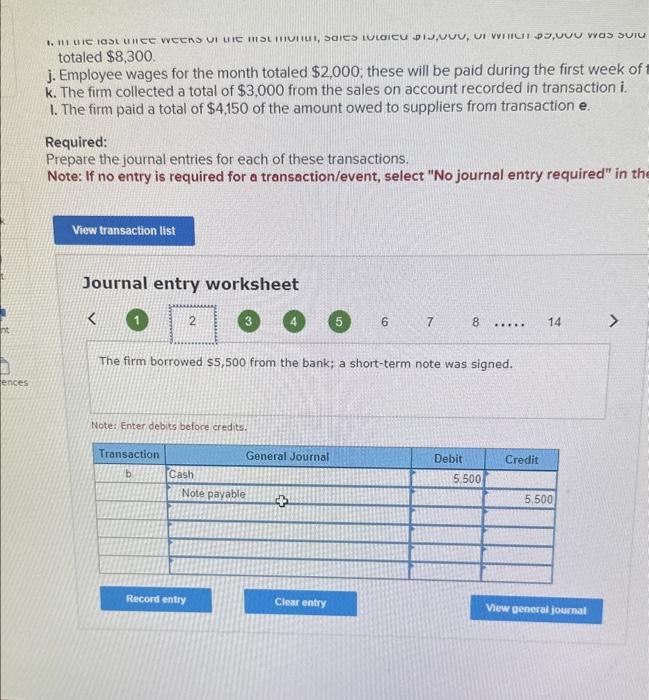

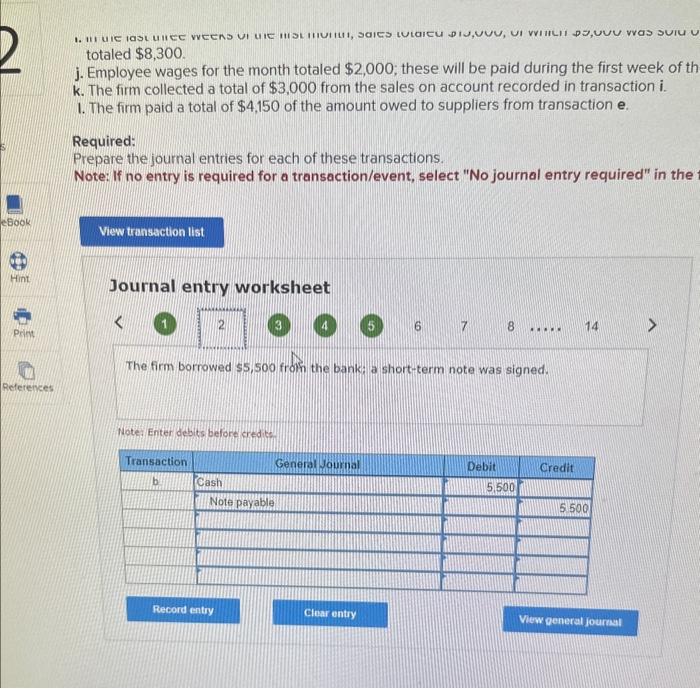

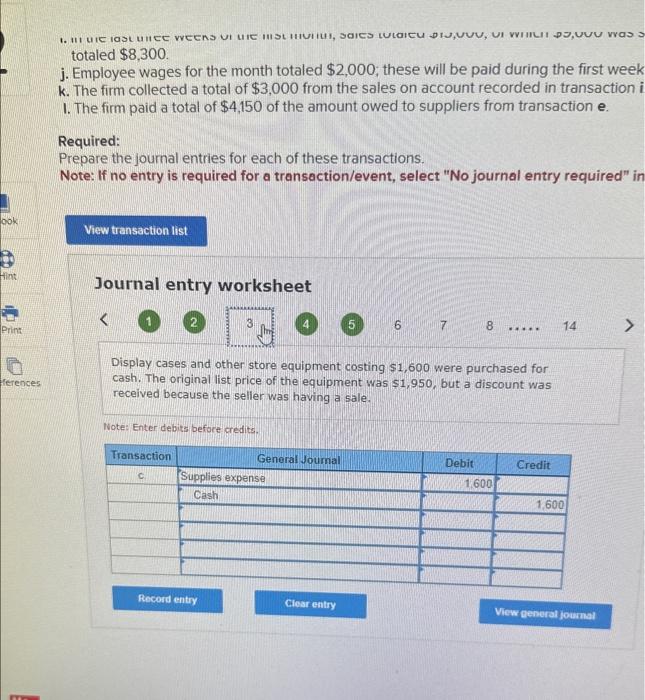

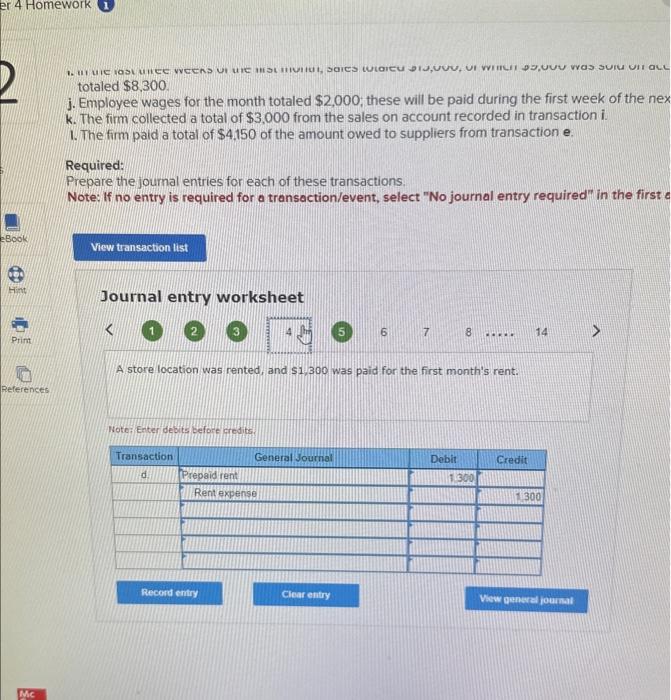

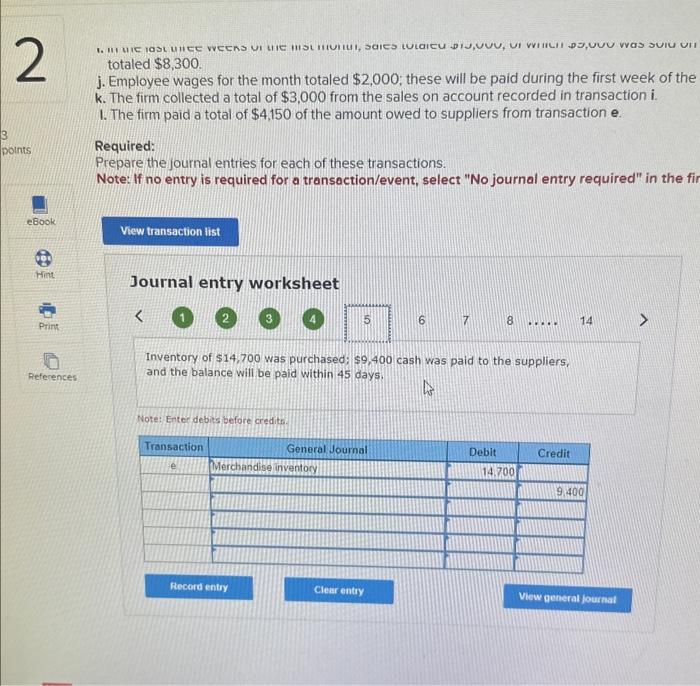

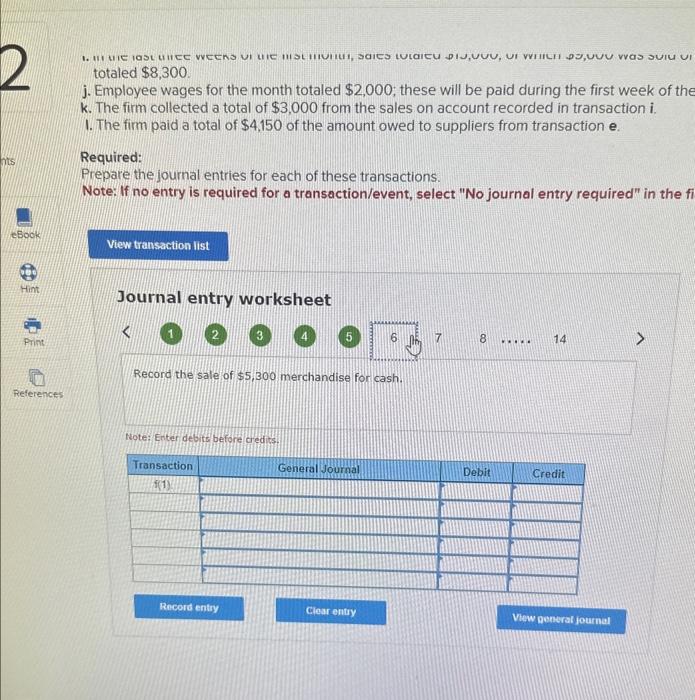

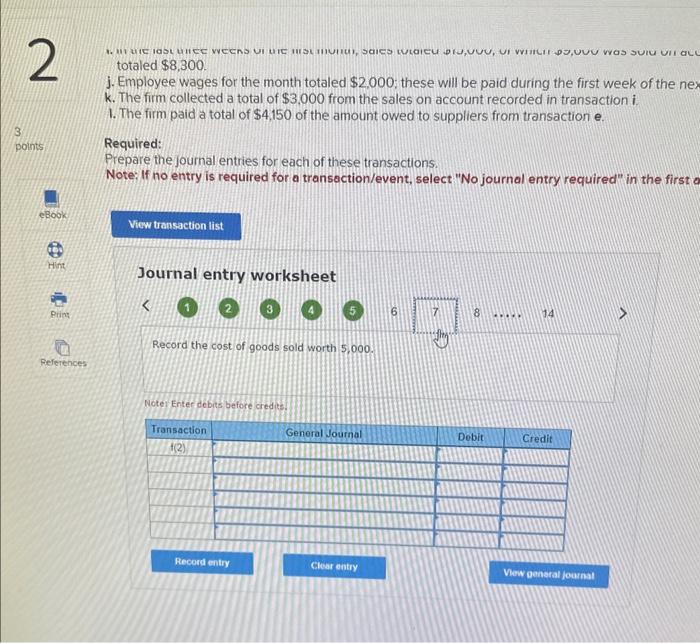

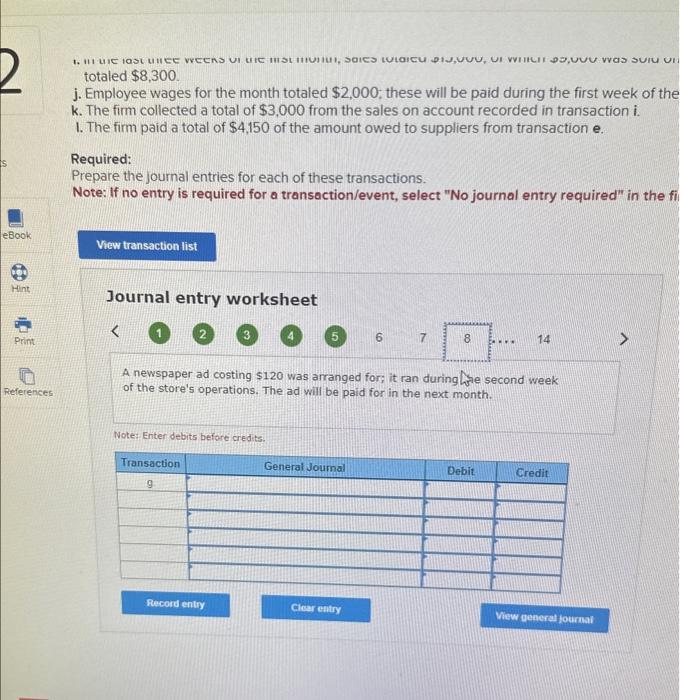

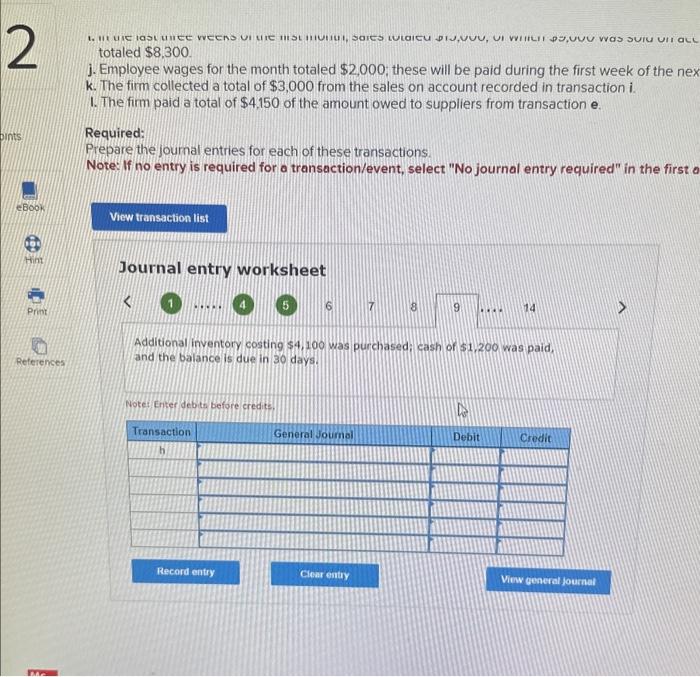

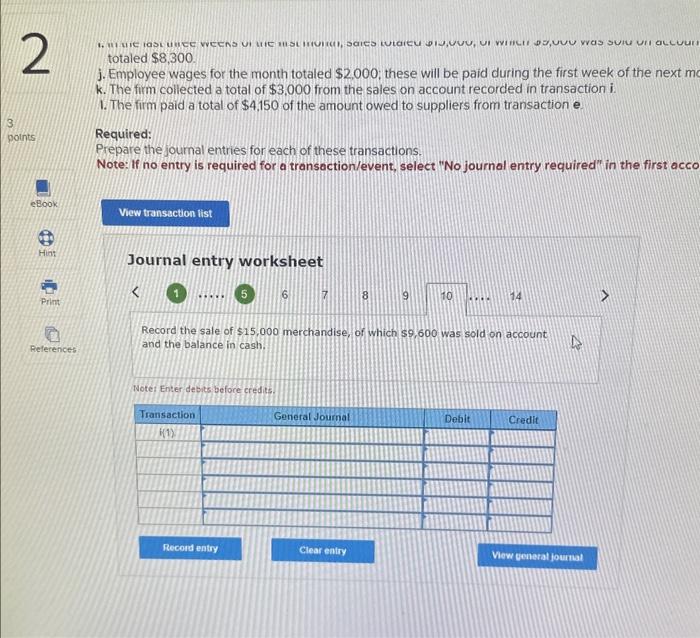

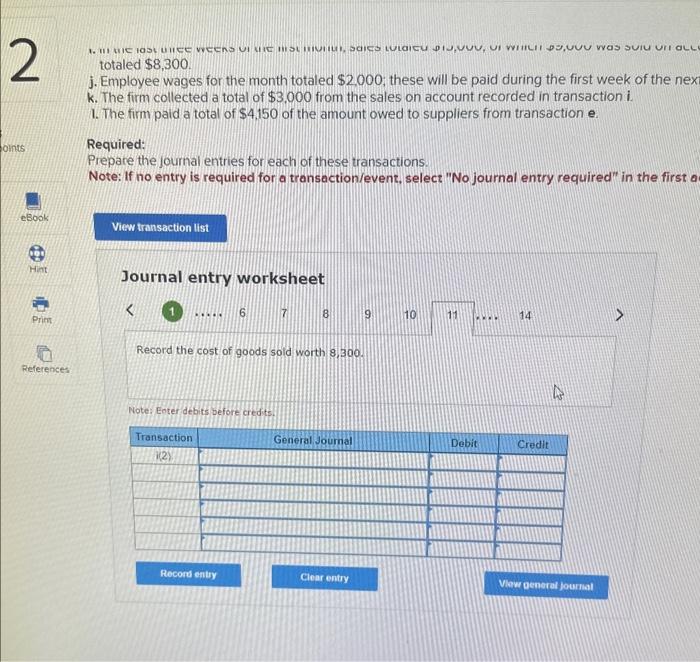

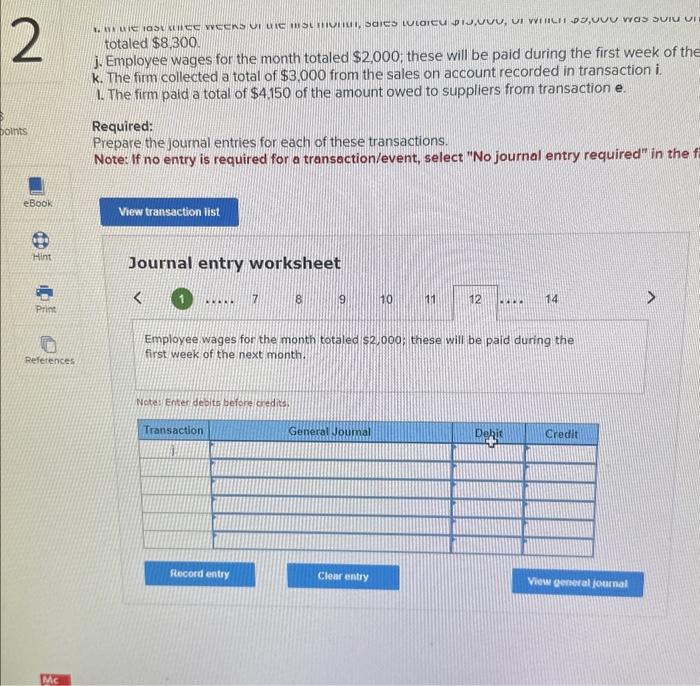

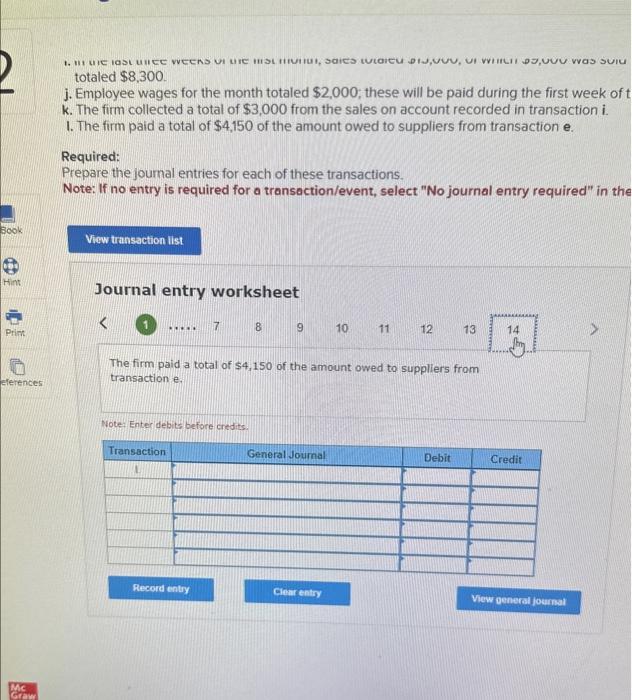

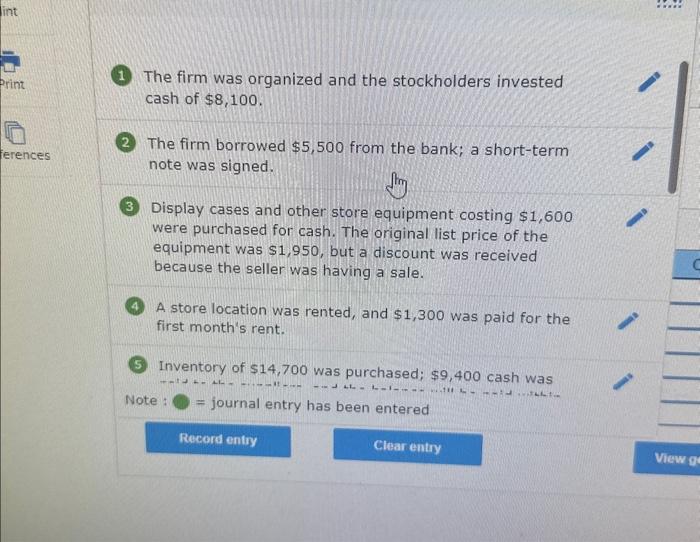

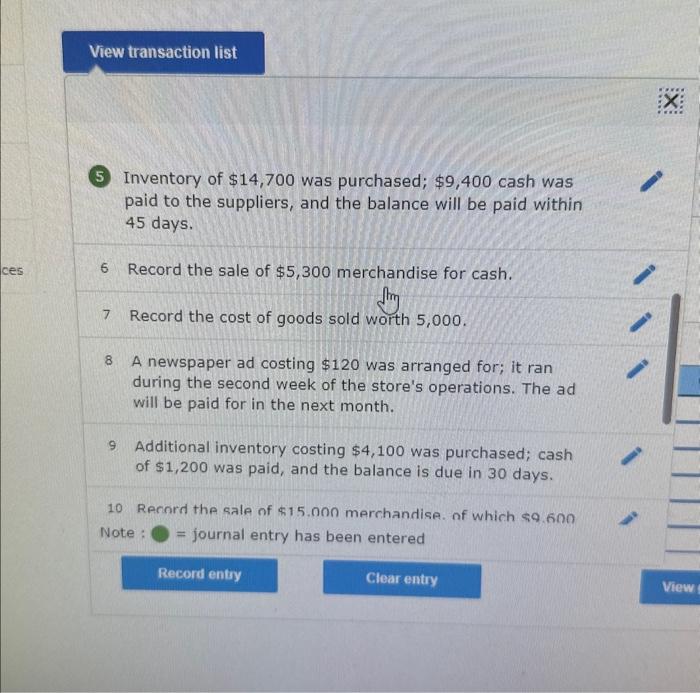

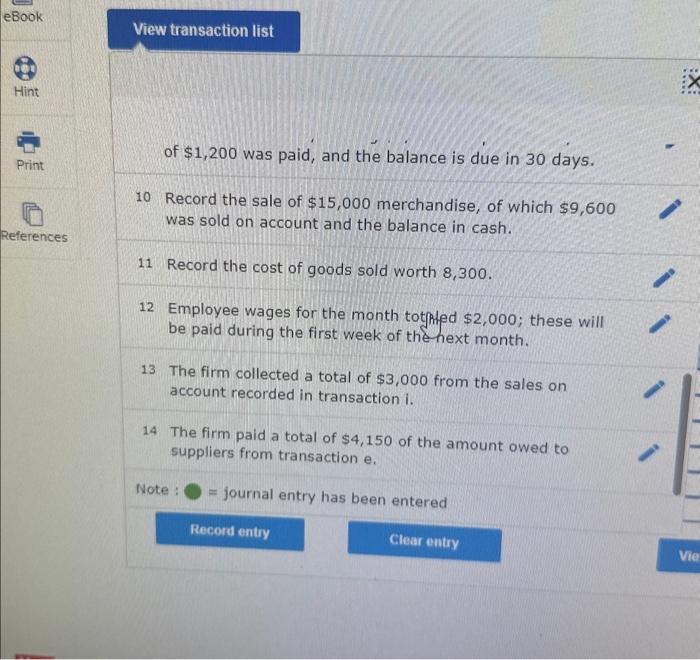

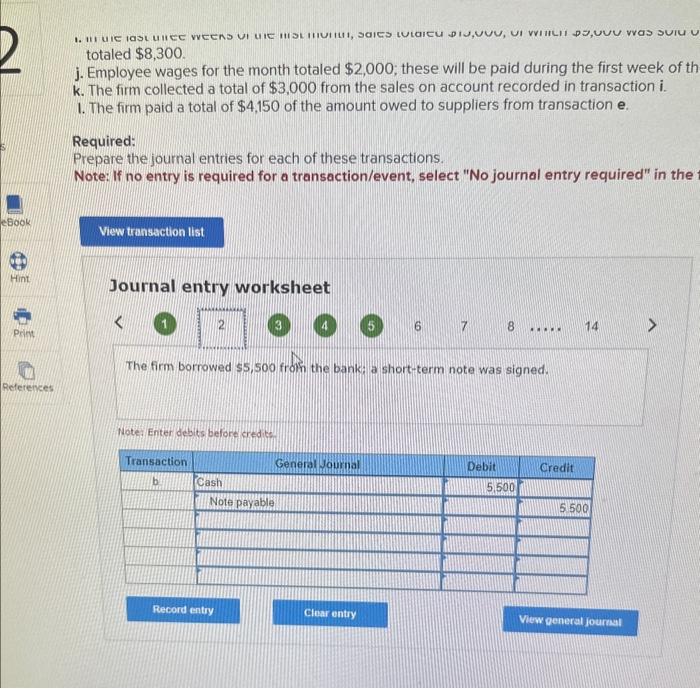

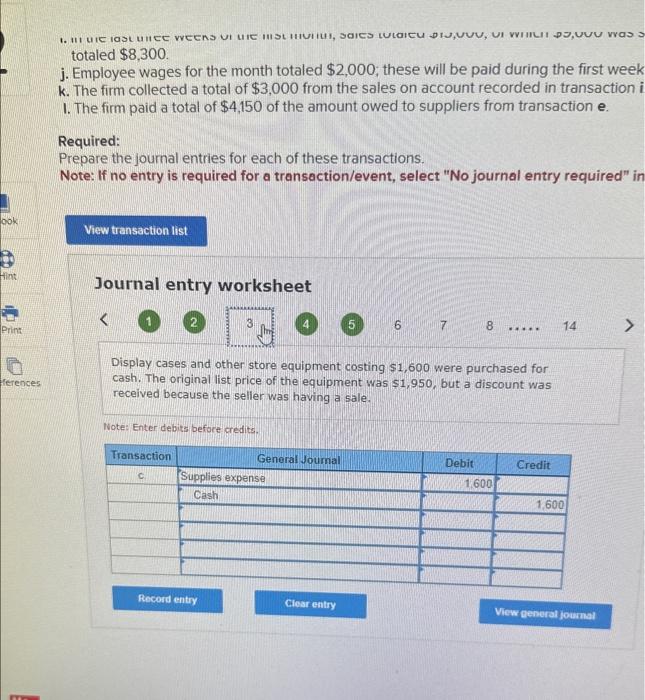

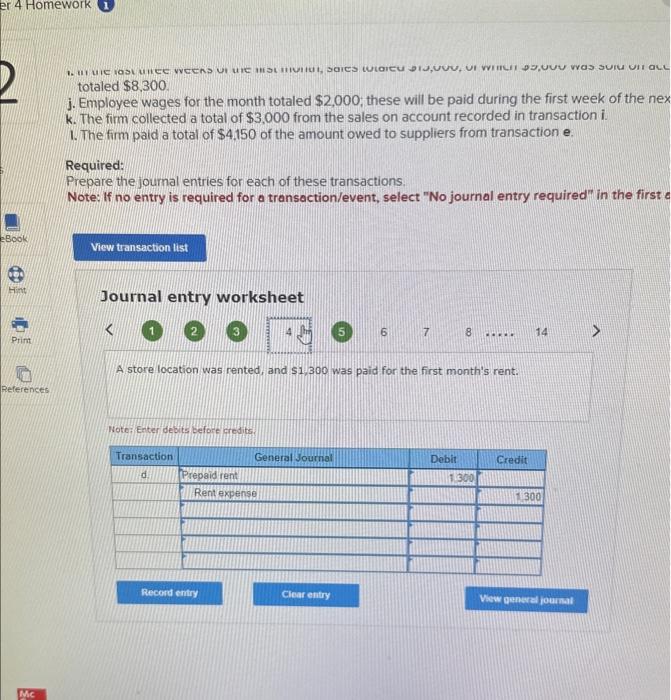

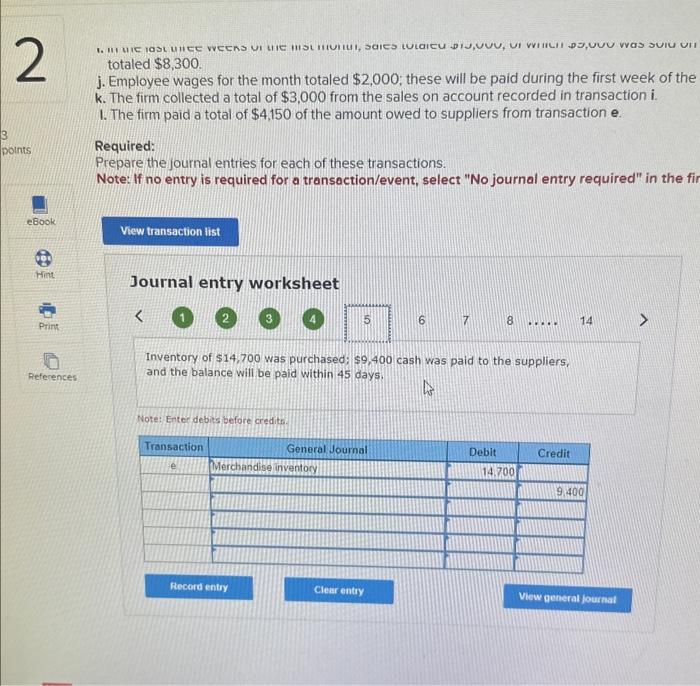

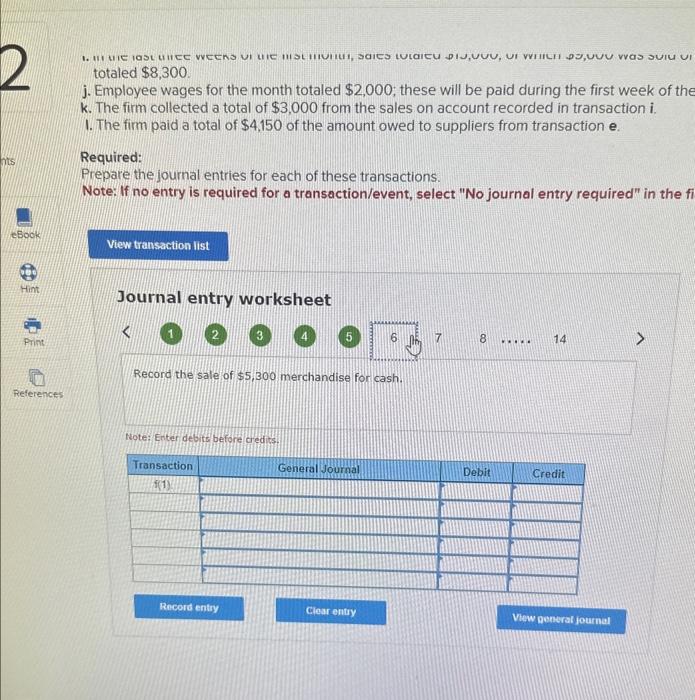

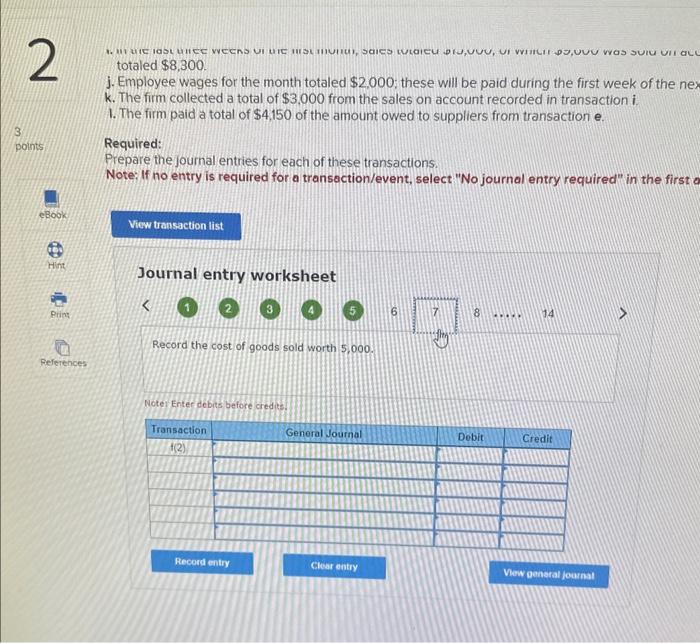

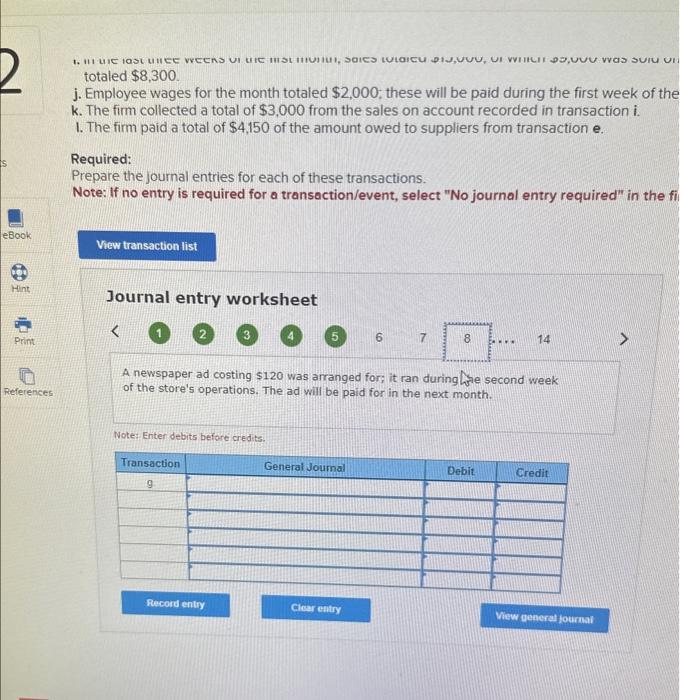

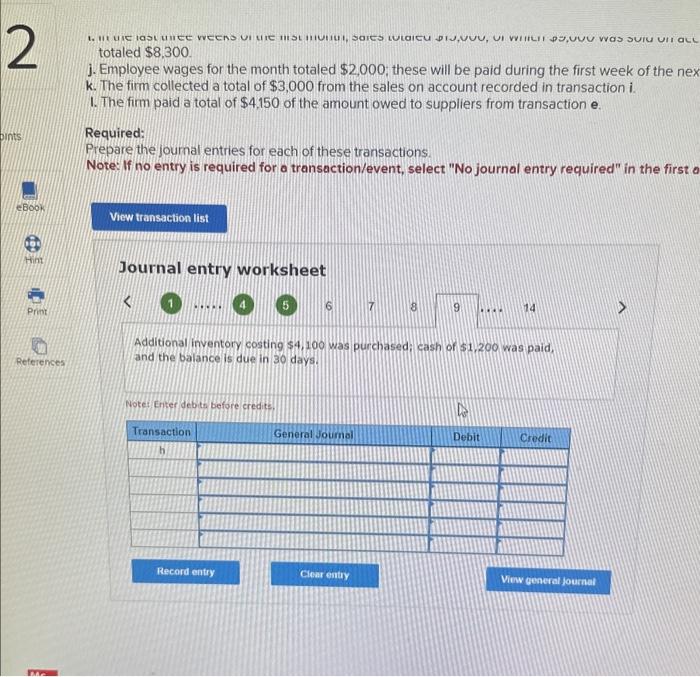

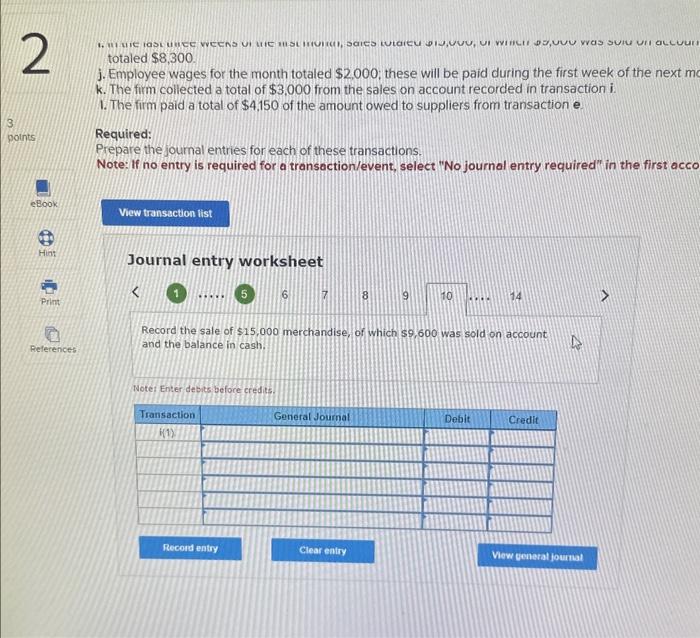

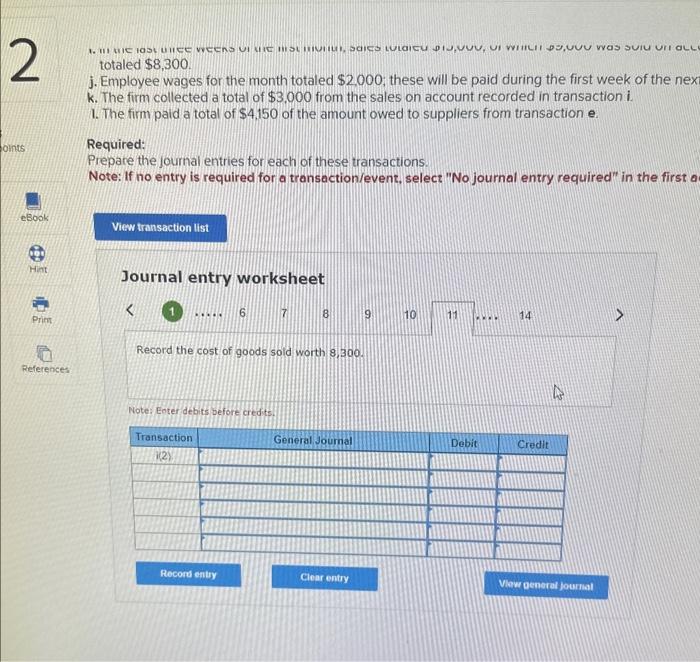

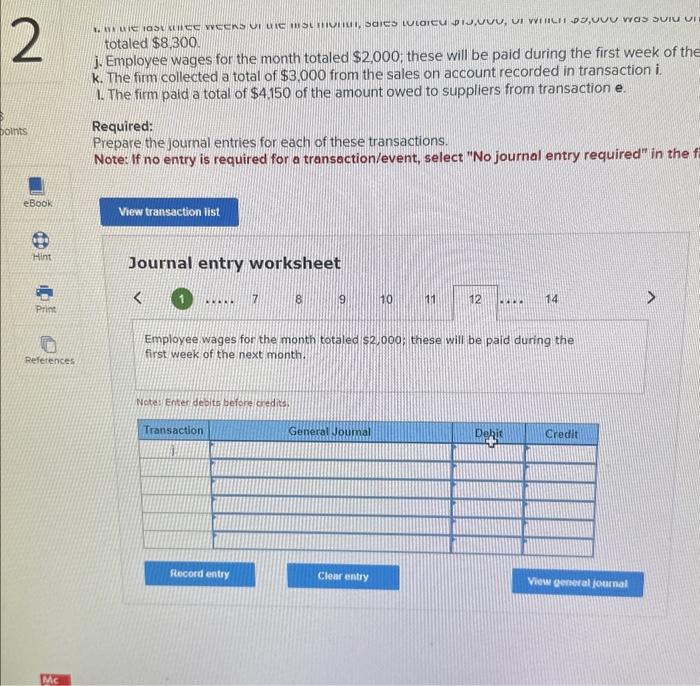

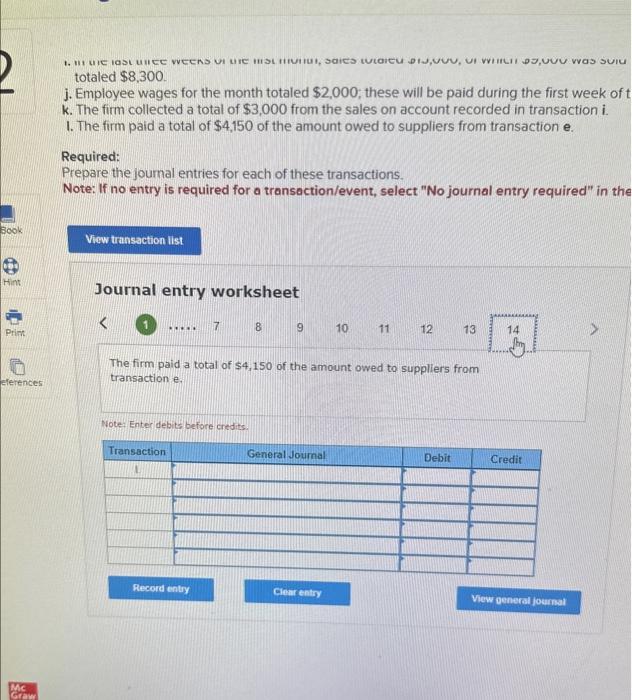

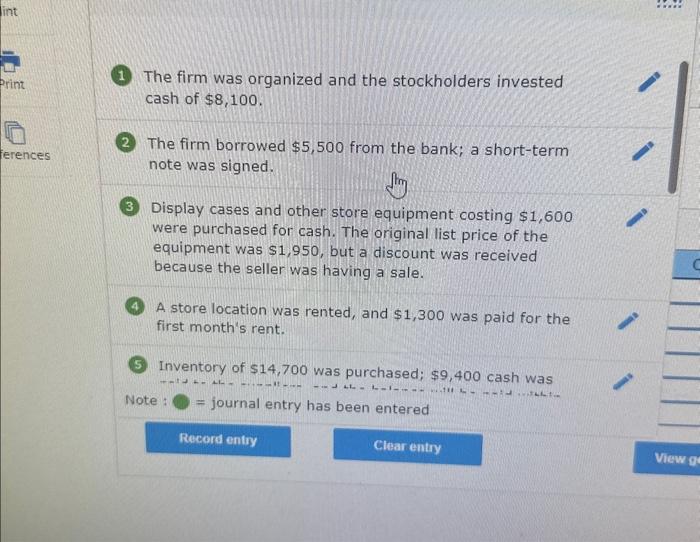

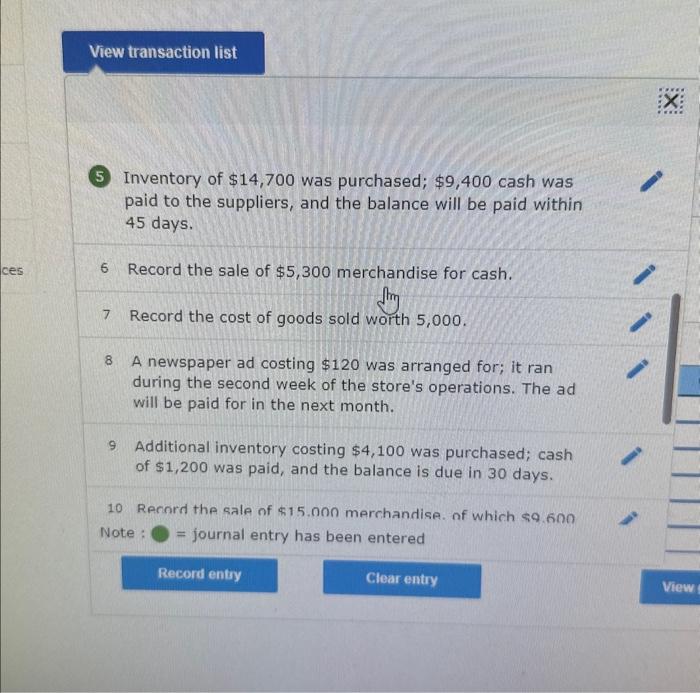

totaled $8,300. j. Employee wages for the month totaled $2,000; these will be paid during the first week of the nex k. The firm collected a total of $3,000 from the sales on account recorded in transaction i. i. The firm paid a total of $4,150 of the amount owed to suppliers from transaction e. Required: Prepare the journal entries for each of these transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first a Journal entry worksheet totaled $8,300. j. Employee wages for the month totaled $2,000; these will be paid during the first week of the nex k. The firm collected a total of $3,000 from the sales on account recorded in transaction i. 1. The firm paid a total of $4,150 of the amount owed to suppliers from transaction e. Required: Prepare the joumal entries for each of these transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first a Journal entry worksheet Additional inventory costing $4,100 was purchased; cash of $1,200 was paid, and the balance is due in 30 days. (7) Noter Eriter debto before credits, totaled $8,300. j. Employee wages for the month totaled $2,000; these will be paid during the first week of th k. The firm collected a total of $3,000 from the sales on account recorded in transaction i. i. The firm paid a total of $4,150 of the amount owed to suppliers from transaction e. Required: Prepare the journal entries for each of these transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the Journal entry worksheet The firm borrowed $5,500 from the bank: a short-term note was signed. Note: Enter debits before credite totaled $8,300. j. Employee wages for the month totaled $2,000; these will be paid during the first week of the ne; k. The firm collected a total of $3,000 from the sales on account recorded in transaction i. I. The firm paid a total of $4,150 of the amount owed to suppliers from transaction e. Required: Prepare the journal entries for each of these transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first Journal entry worksheet totaled $8,300. j. Employee wages for the month totaled $2,000; these will be paid during the first week of t k. The firm collected a total of $3,000 from the sales on account recorded in transaction i. I. The firm paid a total of $4,150 of the amount owed to suppliers from transaction e. Required: Prepare the journal entries for each of these transactions. Note: If no entry is required for a transoction/event, select "No journal entry required" in the Journal entry worksheet The firm paid a total of $4,150 of the amount owed to suppliers from transaction e. Note- Enter debits before credits. totaled $8,300. j. Employee wages for the month totaled $2,000; these will be paid during the first week of k. The firm collected a total of $3,000 from the sales on account recorded in transaction i. I. The firm paid a total of $4,150 of the amount owed to suppliers from transaction e. Required: Prepare the journal entries for each of these transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in th Journal entry worksheet The firm borrowed $5,500 from the bank; a short-term note was signed. Note: Enter debiks befoce credits. totaled $8,300. j. Employee wages for the month totaled $2,000; these will be paid during the first week of the nes k. The firm collected a total of $3,000 from the sales on account recorded in transaction i. 1. The firm paid a total of $4.150 of the amount owed to suppliers from transaction e. Required: Prepare the journal entries for each of these transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first Journal entry worksheet A store location was rented, and $1,300 was paid for the first month's rent. Note: Enter debits before credits. totaled $8,300. j. Employee wages for the month totaled \$2.000; these will be paid during the first week of the next m k. The firm collected a total of $3,000 from the sales on account recorded in transaction i. 1. The firm paid a total of $4,150 of the amount owed to suppliers from transaction e. Required: Prepare the joumal entries for each of these transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first acco Journal entry worksheet Record the sale of $15,000 merchandise, of which $9,600 was sold on account and the balance in cash. Wote: Enter debits before credits. The firm was organized and the stockholders invested cash of $8,100. The firm borrowed $5,500 from the bank; a short-term note was signed. flin Display cases and other store equipment costing $1,600 were purchased for cash. The original list price of the equipment was $1,950, but a discount was received because the seller was having a sale. A store location was rented, and $1,300 was paid for the first month's rent. Inventory of $14,700 was purchased; $9,400 cash was Note : = journal entry has been entered totaled $8,300. j. Employee wages for the month totaled $2,000; these will be paid during the first week of the k. The firm collected a total of $3,000 from the sales on account recorded in transaction i. 1. The firm paid a total of $4,150 of the amount owed to suppliers from transaction e. Required: Prepare the journal entries for each of these transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the fi Journal entry worksheet totaled $8,300. j. Employee wages for the month totaled $2,000; these will be paid during the first week of the k. The firm collected a total of $3,000 from the sales on account recorded in transaction i. I. The firm paid a total of $4,150 of the amount owed to suppliers from transaction e. Required: Prepare the journal entries for each of these transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the f Journal entry worksheet totaled $8,300. j. Employee wages for the month totaled $2,000; these will be paid during the first week of the k. The firm collected a total of $3,000 from the sales on account recorded in transaction i. i. The firm paid a total of $4,150 of the amount owed to suppliers from transaction e. Required: Prepare the journal entries for each of these transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the fin Journal entry worksheet Note: Enter debies before credits. Inventory of $14,700 was purchased; $9,400 cash was paid to the suppliers, and the balance will be paid within 45 days. 6 Record the sale of $5,300 merchandise for cash. sim 7 Record the cost of goods sold worth 5,000 . 8 A newspaper ad costing $120 was arranged for; it ran during the second week of the store's operations. The ad will be paid for in the next month. 9 Additional inventory costing $4,100 was purchased; cash of $1,200 was paid, and the balance is due in 30 days. 10 Rernord the sale of $15.000 merchandise. of which $9.600 Note : = journal entry has been entered totaled $8,300. j. Employee wages for the month totaled $2,000; these will be paid during the first week of the ne; k. The firm collected a total of $3,000 from the sales on account recorded in transaction i. 1. The firm paid a total of $4,150 of the amount owed to suppliers from transaction e. Required: Prepare the journal entries for each of these transactions. Note; If no entry is required for a transaction/event, select "No journal entry required" in the first totaled $8,300. j. Employee wages for the month totaled $2,000; these will be paid during the first week of the k. The firm collected a total of $3,000 from the sales on account recorded in transaction i. 1. The firm paid a total of $4,150 of the amount owed to suppliers from transaction e. Required: Prepare the joumal entries for each of these transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the f Journal entry worksheet Employee wages for the month totaled $2,000 : these will be paid during the first week of the next month. Note: Enter debits before credits. totaled $8,300. j. Employee wages for the month totaled $2,000; these will be paid during the first week k. The firm collected a total of $3,000 from the sales on account recorded in transaction i I. The firm paid a total of $4,150 of the amount owed to suppliers from transaction e. Required: Prepare the journal entries for each of these transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in Journal entry worksheet Display cases and other store equipment costing $1,600 were purchased for cash. The original list price of the equipment was $1,950, but a discount was received because the selier was having a sale. Note: Enter debits before credits. of $1,200 was paid, and the balance is due in 30 days. 10 Record the sale of $15,000 merchandise, of which $9,600 was sold on account and the balance in cash. 11 Record the cost of goods sold worth 8,300 . 12 Employee wages for the month totphled $2,000; these will be paid during the first week of the hext month. 13 The firm collected a total of $3,000 from the sales on account recorded in transaction i. 14 The firm paid a total of $4,150 of the amount owed to suppliers from transaction e. Note : = journal entry has been entered