Answered step by step

Verified Expert Solution

Question

1 Approved Answer

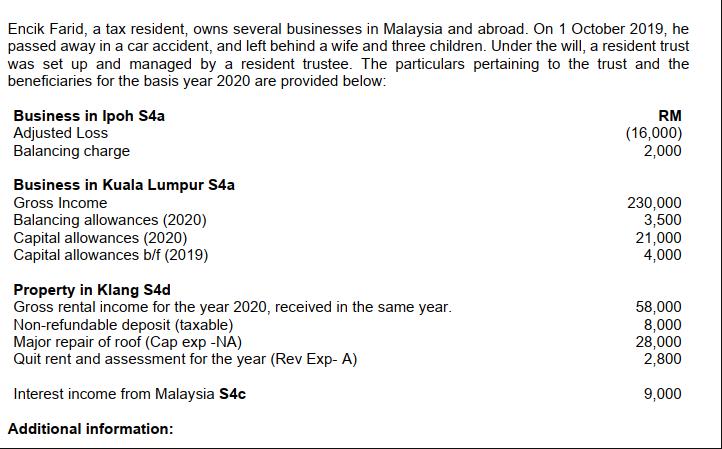

Encik Farid, a tax resident, owns several businesses in Malaysia and abroad. On 1 October 2019, he passed away in a car accident, and

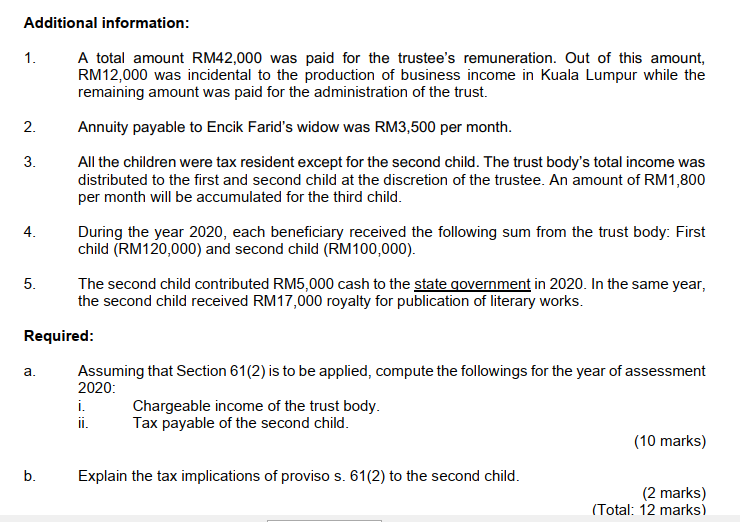

Encik Farid, a tax resident, owns several businesses in Malaysia and abroad. On 1 October 2019, he passed away in a car accident, and left behind a wife and three children. Under the will, a resident trust was set up and managed by a resident trustee. The particulars pertaining to the trust and the beneficiaries for the basis year 2020 are provided below: Business in Ipoh S4a Adjusted Loss Balancing charge Business in Kuala Lumpur S4a Gross Income Balancing allowances (2020) Capital allowances (2020) Capital allowances b/f (2019) Property in Klang S4d Gross rental income for the year 2020, received in the same year. Non-refundable deposit (taxable) Major repair of roof (Cap exp -NA) Quit rent and assessment for the year (Rev Exp- A) Interest income from Malaysia S4c Additional information: RM (16,000) 2,000 230,000 3,500 21,000 4,000 58,000 8,000 28,000 2,800 9,000 Additional information: A total amount RM42,000 was paid for the trustee's remuneration. Out of this amount, RM12,000 was incidental to the production of business income in Kuala Lumpur while the remaining amount was paid for the administration of the trust. Annuity payable to Encik Farid's widow was RM3,500 per month. All the children were tax resident except for the second child. The trust body's total income was distributed to the first and second child at the discretion of the trustee. An amount of RM1,800 per month will be accumulated for the third child. 1. 2. 3. 4. 5. a. During the year 2020, each beneficiary received the following sum from the trust body: First child (RM120,000) and second child (RM100,000). Required: b. The second child contributed RM5,000 cash to the state government in 2020. In the same year, the second child received RM17,000 royalty for publication of literary works. Assuming that Section 61(2) is to be applied, compute the followings for the year of assessment 2020: i. ii. Chargeable income of the trust body. Tax payable of the second child. Explain the tax implications of proviso s. 61(2) to the second child. (10 marks) (2 marks) (Total: 12 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

I Chargeable Income of the Trust Body Business Income Ipoh Business No taxable income adjusted loss ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started