Answered step by step

Verified Expert Solution

Question

1 Approved Answer

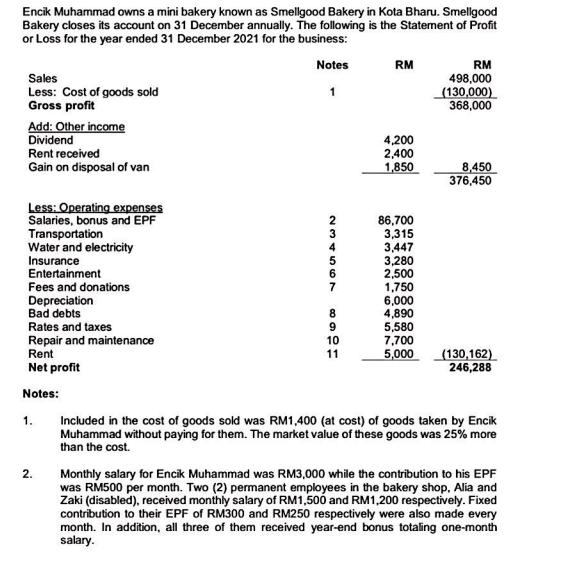

Encik Muhammad owns a mini bakery known as Smellgood Bakery in Kota Bharu. Smellgood Bakery closes its account on 31 December annually. The following

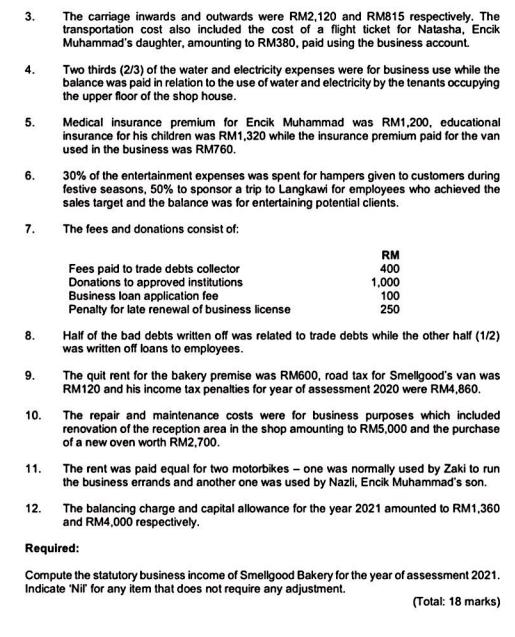

Encik Muhammad owns a mini bakery known as Smellgood Bakery in Kota Bharu. Smellgood Bakery closes its account on 31 December annually. The following is the Statement of Profit or Loss for the year ended 31 December 2021 for the business: Notes RM Sales RM 498,000 (130,000) 1 Less: Cost of goods sold Gross profit 368,000 Add: Other income Dividend 4,200 Rent received 2,400 Gain on disposal of van 1,850 8,450 376,450 Less: Operating expenses Salaries, bonus and EPF Transportation 86,700 3,315 3,447 Water and electricity Insurance 3,280 Entertainment 2,500 Fees and donations 1,750 6,000 Depreciation Bad debts 4,890 Rates and taxes 9 5,580 Repair and maintenance 10 7,700 Rent 11 5,000 (130,162) 246,288 Net profit Notes: 1. Included in the cost of goods sold was RM1,400 (at cost) of goods taken by Encik Muhammad without paying for them. The market value of these goods was 25% more than the cost. 2. Monthly salary for Encik Muhammad was RM3,000 while the contribution to his EPF was RM500 per month. Two (2) permanent employees in the bakery shop, Alia and Zaki (disabled), received monthly salary of RM1,500 and RM1,200 respectively. Fixed contribution to their EPF of RM300 and RM250 respectively were also made every month. In addition, all three of them received year-end bonus totaling one-month salary. 23450 50 6 7 8 3. The carriage inwards and outwards were RM2,120 and RM815 respectively. The transportation cost also included the cost of a flight ticket for Natasha, Encik Muhammad's daughter, amounting to RM380, paid using the business account. 4. Two thirds (2/3) of the water and electricity expenses were for business use while the balance was paid in relation to the use of water and electricity by the tenants occupying the upper floor of the shop house. 5. Medical insurance premium for Encik Muhammad was RM1,200, educational insurance for his children was RM1,320 while the insurance premium paid for the van used in the business was RM760. 6. 30% of the entertainment expenses was spent for hampers given to customers during festive seasons, 50% to sponsor a trip to Langkawi for employees who achieved the sales target and the balance was for entertaining potential clients. 7. The fees and donations consist of: RM 400 Fees paid to trade debts collector Donations to approved institutions Business loan application fee 1,000 100 Penalty for late renewal of business license 250 8. Half of the bad debts written off was related to trade debts while the other half (1/2) was written off loans to employees. 9. The quit rent for the bakery premise was RM600, road tax for Smellgood's van was RM120 and his income tax penalties for year of assessment 2020 were RM4,860. 10. The repair and maintenance costs were for business purposes which included renovation of the reception area in the shop amounting to RM5,000 and the purchase of a new oven worth RM2,700. 11. The rent was paid equal for two motorbikes - one was normally used by Zaki to run the business errands and another one was used by Nazli, Encik Muhammad's son. 12. The balancing charge and capital allowance for the year 2021 amounted to RM1,360 and RM4,000 respectively. Required: Compute the statutory business income of Smellgood Bakery for the year of assessment 2021. Indicate 'Nil for any item that does not require any adjustment. (Total: 18 marks)

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Statutory business income of Smellgood Bakery for the year of assessment 2021 Sales 498000 Less Cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started