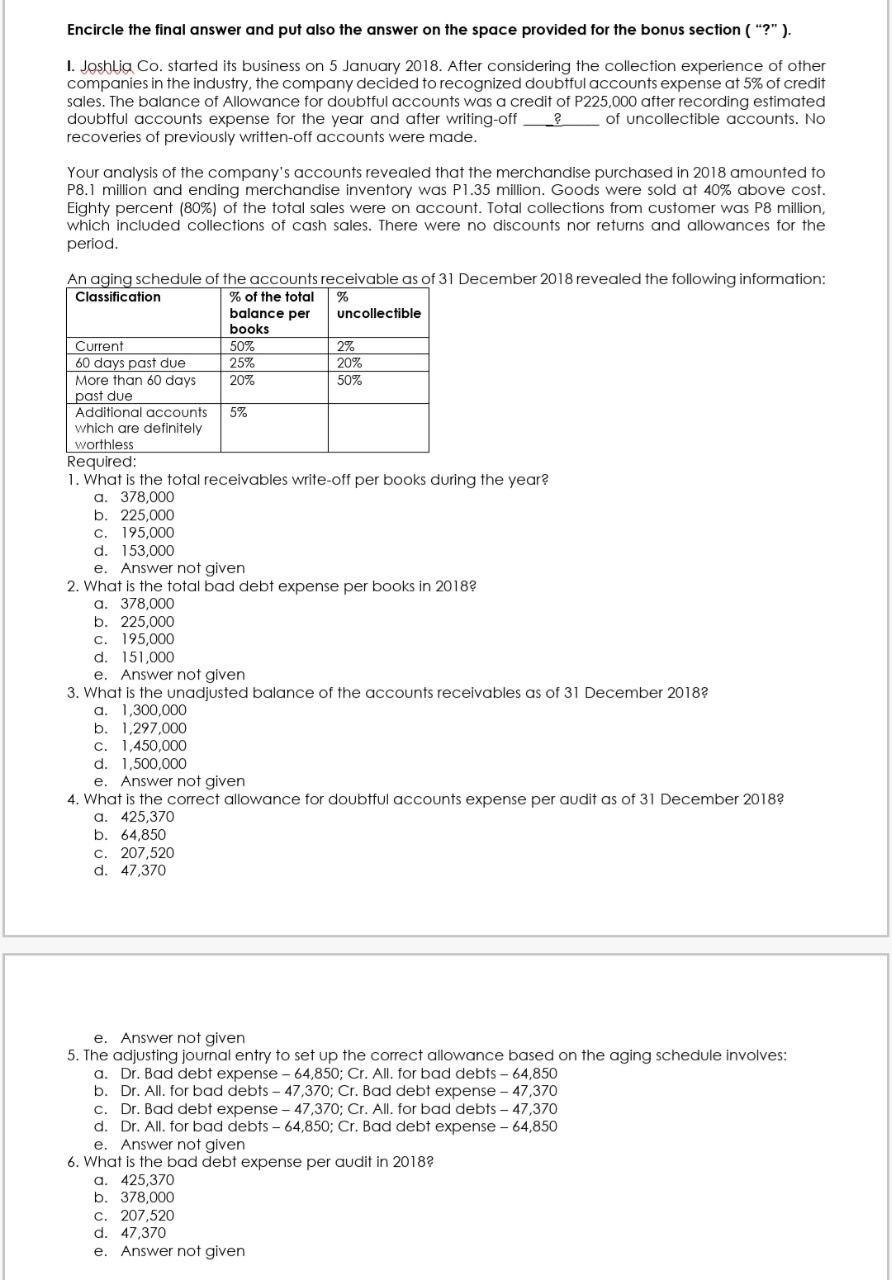

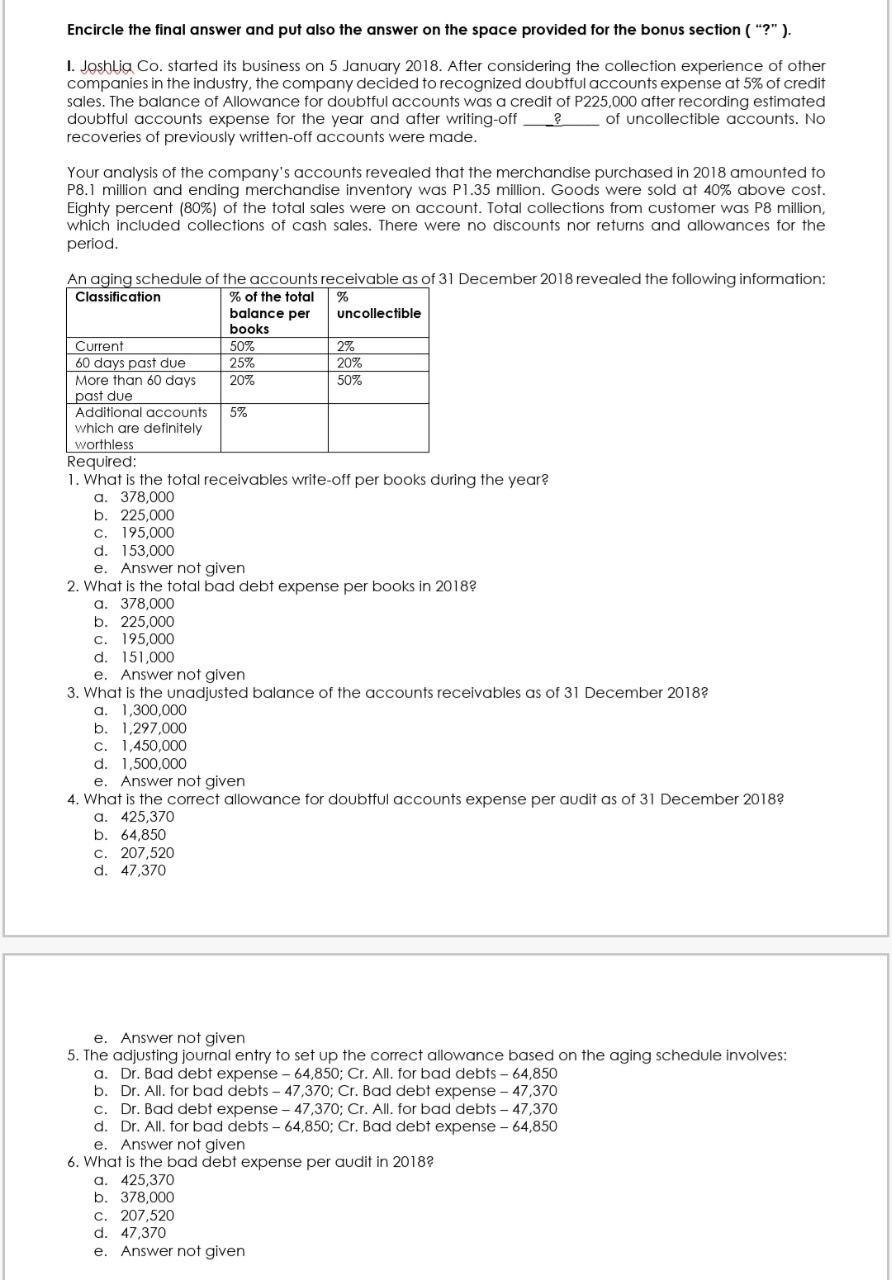

Encircle the final answer and put also the answer on the space provided for the bonus section ("?"). I. Joshtiq Co. started its business on 5 January 2018. After considering the collection experience of other companies in the industry, the company decided to recognized doubtful accounts expense at 5% of credit sales. The balance of Allowance for doubtful accounts was a credit of P225,000 after recording estimated doubtful accounts expense for the year and after writing-off of uncollectible accounts. No recoveries of previously written-off accounts were made. Your analysis of the company's accounts revealed that the merchandise purchased in 2018 amounted to P8.1 million and ending merchandise inventory was P1.35 million. Goods were sold at 40% above cost. Eighty percent (80%) of the total sales were on account. Total collections from customer was P8 million, which included collections of cash sales. There were no discounts nor returns and allowances for the period. 1. What is the total receivables write-off per books during the year? a. 378,000 b. 225,000 c. 195,000 d. 153,000 e. Answer not given 2. What is the total bad debt expense per books in 2018 ? a. 378,000 b. 225,000 c. 195,000 d. 151,000 e. Answer not given 3. What is the unadjusted balance of the accounts receivables as of 31 December 2018 ? a. 1,300,000 b. 1,297,000 c. 1,450,000 d. 1,500,000 e. Answer not given 4. What is the correct allowance for doubtful accounts expense per audit as of 31 December 2018 ? a. 425,370 b. 64,850 c. 207,520 d. 47,370 e. Answer not given 5. The adjusting journal entry to set up the correct allowance based on the aging schedule involves: a. Dr. Bad debt expense 64,850; Cr. All. for bad debts 64,850 b. Dr. All. for bad debts - 47,370; Cr. Bad debt expense 47,370 c. Dr. Bad debt expense 47,370; Cr. All. for bad debts 47,370 d. Dr. All. for bad debts 64,850; Cr. Bad debt expense 64,850 e. Answer not given 6. What is the bad debt expense per audit in 2018 ? a. 425,370 b. 378,000 c. 207,520 d. 47,370 e. Answer not given Encircle the final answer and put also the answer on the space provided for the bonus section ("?"). I. Joshtiq Co. started its business on 5 January 2018. After considering the collection experience of other companies in the industry, the company decided to recognized doubtful accounts expense at 5% of credit sales. The balance of Allowance for doubtful accounts was a credit of P225,000 after recording estimated doubtful accounts expense for the year and after writing-off of uncollectible accounts. No recoveries of previously written-off accounts were made. Your analysis of the company's accounts revealed that the merchandise purchased in 2018 amounted to P8.1 million and ending merchandise inventory was P1.35 million. Goods were sold at 40% above cost. Eighty percent (80%) of the total sales were on account. Total collections from customer was P8 million, which included collections of cash sales. There were no discounts nor returns and allowances for the period. 1. What is the total receivables write-off per books during the year? a. 378,000 b. 225,000 c. 195,000 d. 153,000 e. Answer not given 2. What is the total bad debt expense per books in 2018 ? a. 378,000 b. 225,000 c. 195,000 d. 151,000 e. Answer not given 3. What is the unadjusted balance of the accounts receivables as of 31 December 2018 ? a. 1,300,000 b. 1,297,000 c. 1,450,000 d. 1,500,000 e. Answer not given 4. What is the correct allowance for doubtful accounts expense per audit as of 31 December 2018 ? a. 425,370 b. 64,850 c. 207,520 d. 47,370 e. Answer not given 5. The adjusting journal entry to set up the correct allowance based on the aging schedule involves: a. Dr. Bad debt expense 64,850; Cr. All. for bad debts 64,850 b. Dr. All. for bad debts - 47,370; Cr. Bad debt expense 47,370 c. Dr. Bad debt expense 47,370; Cr. All. for bad debts 47,370 d. Dr. All. for bad debts 64,850; Cr. Bad debt expense 64,850 e. Answer not given 6. What is the bad debt expense per audit in 2018 ? a. 425,370 b. 378,000 c. 207,520 d. 47,370 e. Answer not given