Answered step by step

Verified Expert Solution

Question

1 Approved Answer

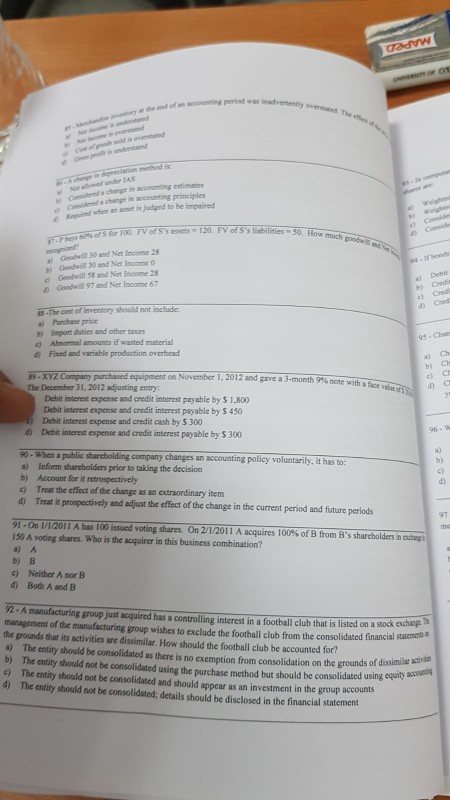

end of accounting period w under IAS Reqidhem en eiset is judged to be impaired s of'S for 100 FV of S's assets-120. FV of

end of accounting period w under IAS Reqidhem en eiset is judged to be impaired s of'S for 100 FV of S's assets-120. FV of S's liabiliie Goodwill 30 and Net Income 28 Good-ill 30nd Ne bome 0 Goodwill 58 and Net Income 28 e) 4 Goodwill 97 and Net Income 67 a) Debit b) Credin c) Credi d) Cred E -The oost of inventory should not include b) Import duties and other taxes c) Ahnormal amounts if wasted material d) Fixed and variable production overhead 95 Chan 89.XYZC ongunyPurchasedequipmentonNovember1.2012 andgavea3-month9%note The December 31, 2012 adjusting entry a) Ch b) Ch c) Ch d) c withface_he Debit interest expense and credit interest payable by $ 1,800 Debit interest expense and credit interest payable by $450 Debit isterest expense and credit cash by $ 300 d) Debit interest expense and credit interest payable by $ 300 96- W 0- When a public shareholding company changes an ) b) c) d) a) Inform sharcholders prior to taking the decision accounting policy voluntarily, it has to: b) Account for it retrospectively c) Treat the effect of the change as an extraordinary item d) Treat it prospectively and adjust the efect of the change in the current period and future periods 91-On 1/1/2011 A has 100 issued voting shares. On 2 I 2011 A acquires 100% of B from B's shareholders na nga 150 A voting shares. Who is the acquirer in this business combination? 97 a) A b) B c) Neither A nor B d) Both A and B 2 A manufacturing group just acquired has a controlling interest in a football club that is listed on a stock management of the manufacturing group wishes to exclude the football club from the consolidated financial the grounds that its activities are dissimilar. How should the football club be accounted for? is listed on a stock enchage statements a) The entity should be consolidated as there is no exemption from consolidation on the grounds of dissimiia b) The entity should not be consolidated using the purchase method but should be consolidated using equity c) The entity should not be consolidated and should appear as an investment in the group accounts d) The entity should not be consolidated; details should be disclosed in the financial statement end of accounting period w under IAS Reqidhem en eiset is judged to be impaired s of'S for 100 FV of S's assets-120. FV of S's liabiliie Goodwill 30 and Net Income 28 Good-ill 30nd Ne bome 0 Goodwill 58 and Net Income 28 e) 4 Goodwill 97 and Net Income 67 a) Debit b) Credin c) Credi d) Cred E -The oost of inventory should not include b) Import duties and other taxes c) Ahnormal amounts if wasted material d) Fixed and variable production overhead 95 Chan 89.XYZC ongunyPurchasedequipmentonNovember1.2012 andgavea3-month9%note The December 31, 2012 adjusting entry a) Ch b) Ch c) Ch d) c withface_he Debit interest expense and credit interest payable by $ 1,800 Debit interest expense and credit interest payable by $450 Debit isterest expense and credit cash by $ 300 d) Debit interest expense and credit interest payable by $ 300 96- W 0- When a public shareholding company changes an ) b) c) d) a) Inform sharcholders prior to taking the decision accounting policy voluntarily, it has to: b) Account for it retrospectively c) Treat the effect of the change as an extraordinary item d) Treat it prospectively and adjust the efect of the change in the current period and future periods 91-On 1/1/2011 A has 100 issued voting shares. On 2 I 2011 A acquires 100% of B from B's shareholders na nga 150 A voting shares. Who is the acquirer in this business combination? 97 a) A b) B c) Neither A nor B d) Both A and B 2 A manufacturing group just acquired has a controlling interest in a football club that is listed on a stock management of the manufacturing group wishes to exclude the football club from the consolidated financial the grounds that its activities are dissimilar. How should the football club be accounted for? is listed on a stock enchage statements a) The entity should be consolidated as there is no exemption from consolidation on the grounds of dissimiia b) The entity should not be consolidated using the purchase method but should be consolidated using equity c) The entity should not be consolidated and should appear as an investment in the group accounts d) The entity should not be consolidated; details should be disclosed in the financial statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started