Answered step by step

Verified Expert Solution

Question

1 Approved Answer

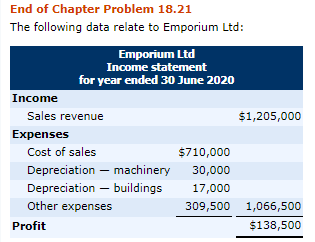

End of Chapter Problem 18.21 The following data relate to Emporium Ltd: Emporium Ltd Income statement for year ended 30 June 2020 Income Sales revenue

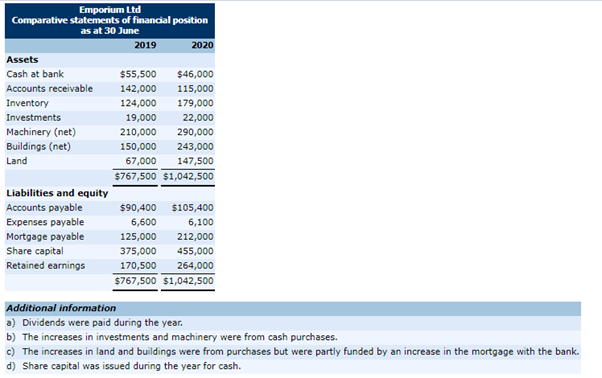

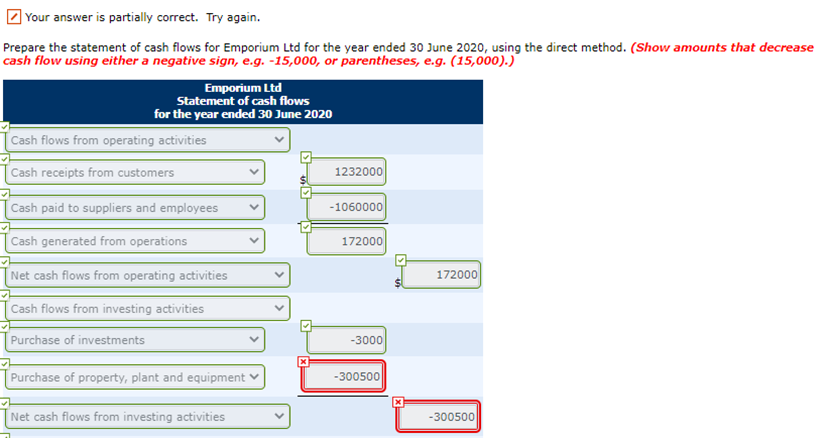

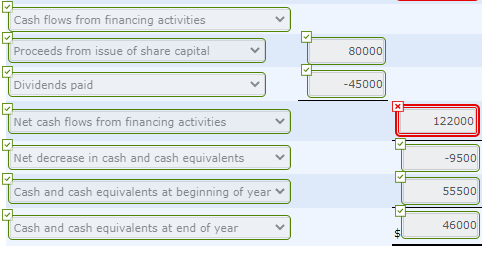

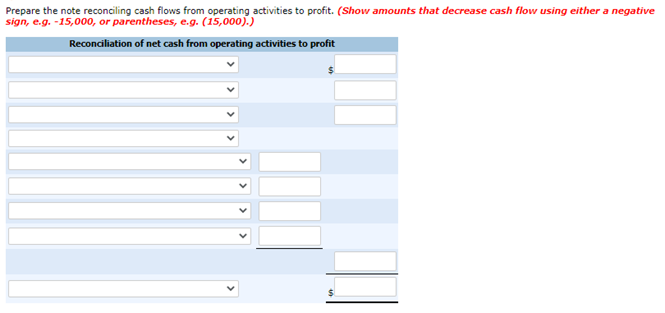

End of Chapter Problem 18.21 The following data relate to Emporium Ltd: Emporium Ltd Income statement for year ended 30 June 2020 Income Sales revenue $ $1,205,000 Expenses Cost of sales $710,000 Depreciation machinery 30,000 Depreciation buildings 17,000 Other expenses 309,500 1,066,500 Profit $138,500 Emporium Ltd Comparative statements of financial position as at 30 June 2019 2020 Assets Cash at bank $55,500 $46,000 Accounts receivable 142,000 115,000 Inventory 124,000 179,000 Investments 19,000 22,000 Machinery (net) 210,000 290,000 Buildings (net) 150,000 243,000 Land 67,000 147,500 $767,500 $1,042,500 Liabilities and equity Accounts payable $90,400 $105,400 Expenses payable 6,600 6,100 Mortgage payable 125,000 212,000 Share capital 375,000 455,000 Retained earnings 170,500 264,000 $767,500 $1,042,500 Additional information a) Dividends were paid during the year. b) The increases in investments and machinery were from cash purchases. c) The increases in land and buildings were from purchases but were partly funded by an increase in the mortgage with the bank. d) Share capital was issued during the year for cash. Your answer is partially correct. Try again. Prepare the statement of cash flows for Emporium Ltd for the year ended 30 June 2020, using the direct method. (Show amounts that decrease cash flow using either a negative sign, e.g. -15,000, or parentheses, e.g. (15,000).) Emporium Ltd Statement of cash flows for the year ended 30 June 2020 Cash flows from operating activities Cash receipts from customers 1232000 Cash paid to suppliers and employees - 1060000 Cash generated from operations 172000 Net cash flows from operating activities 172000 Cash flows from investing activities Purchase of investments -3000 Purchase of property, plant and equipment -300500 Net cash flows from investing activities -300500 Cash flows from financing activities Proceeds from issue of share capital 80000 Dividends paid -45000 Net cash flows from financing activities 122000 Net decrease in cash and cash equivalents -9500 Cash and cash equivalents at beginning of year 55500 Cash and cash equivalents at end of year 46000 Prepare the note reconciling cash flows from operating activities to profit. (Show amounts that decrease cash flow using either a negative sign, e.g. -15,000, or parentheses, e.g. (15,000).) Reconciliation of net cash from operating activities to profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started