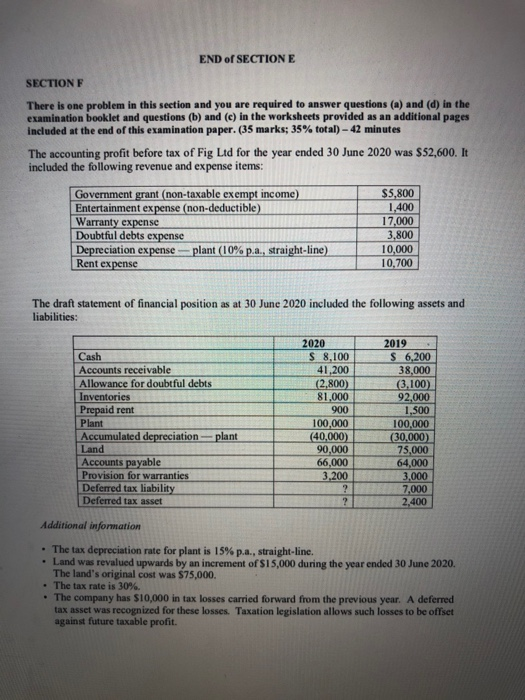

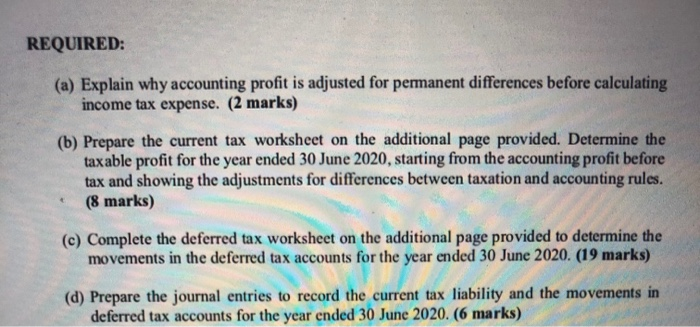

END of SECTION E SECTION F There is one problem in this section and you are required to answer questions (a) and (d) in the examination booklet and questions (b) and (c) in the worksheets provided as an additional pages included at the end of this examination paper. (35 marks; 35% total) - 42 minutes The accounting profit before tax of Fig Lid for the year ended 30 June 2020 was $52,600. It included the following revenue and expense items: Government grant (non-taxable exempt income) Entertainment expense (non-deductible) Warranty expense Doubtful debts expense Depreciation expense - plant (10% p.a., straight-line) Rent expense $5,800 1,400 17,000 3,800 10,000 10,700 The draft statement of financial position as at 30 June 2020 included the following assets and liabilities: Cash Accounts receivable Allowance for doubtful debts Inventories Prepaid rent Plant Accumulated depreciation - plant Land Accounts payable Provision for warranties Deferred tax liability Deferred tax asset 2020 $ 8,100 41,200 (2.800) 81,000 900 100,000 (40,000) 90,000 66,000 3,200 ? ? 2019 $ 6,200 38,000 (3.100) 92,000 1,500 100,000 (30,000) 75,000 64,000 3.000 7.000 2,400 Additional information The tax depreciation rate for plant is 15% p.a., straight-line. Land was revalued upwards by an increment of $15,000 during the year ended 30 June 2020. The land's original cost was $75,000 The tax rate is 30% The company has $10,000 in tax losses carried forward from the previous year. A deferred tax asset was recognized for these losses. Taxation legislation allows such losses to be offset against future taxable profit. REQUIRED: (a) Explain why accounting profit is adjusted for permanent differences before calculating income tax expense. (2 marks) (b) Prepare the current tax worksheet on the additional page provided. Determine the taxable profit for the year ended 30 June 2020, starting from the accounting profit before tax and showing the adjustments for differences between taxation and accounting rules. (8 marks) (c) Complete the deferred tax worksheet on the additional page provided to determine the movements in the deferred tax accounts for the year ended 30 June 2020. (19 marks) (d) Prepare the journal entries to record the current tax liability and the movements in deferred tax accounts for the year ended 30 June 2020. (6 marks) END of SECTION E SECTION F There is one problem in this section and you are required to answer questions (a) and (d) in the examination booklet and questions (b) and (c) in the worksheets provided as an additional pages included at the end of this examination paper. (35 marks; 35% total) - 42 minutes The accounting profit before tax of Fig Lid for the year ended 30 June 2020 was $52,600. It included the following revenue and expense items: Government grant (non-taxable exempt income) Entertainment expense (non-deductible) Warranty expense Doubtful debts expense Depreciation expense - plant (10% p.a., straight-line) Rent expense $5,800 1,400 17,000 3,800 10,000 10,700 The draft statement of financial position as at 30 June 2020 included the following assets and liabilities: Cash Accounts receivable Allowance for doubtful debts Inventories Prepaid rent Plant Accumulated depreciation - plant Land Accounts payable Provision for warranties Deferred tax liability Deferred tax asset 2020 $ 8,100 41,200 (2.800) 81,000 900 100,000 (40,000) 90,000 66,000 3,200 ? ? 2019 $ 6,200 38,000 (3.100) 92,000 1,500 100,000 (30,000) 75,000 64,000 3.000 7.000 2,400 Additional information The tax depreciation rate for plant is 15% p.a., straight-line. Land was revalued upwards by an increment of $15,000 during the year ended 30 June 2020. The land's original cost was $75,000 The tax rate is 30% The company has $10,000 in tax losses carried forward from the previous year. A deferred tax asset was recognized for these losses. Taxation legislation allows such losses to be offset against future taxable profit. REQUIRED: (a) Explain why accounting profit is adjusted for permanent differences before calculating income tax expense. (2 marks) (b) Prepare the current tax worksheet on the additional page provided. Determine the taxable profit for the year ended 30 June 2020, starting from the accounting profit before tax and showing the adjustments for differences between taxation and accounting rules. (8 marks) (c) Complete the deferred tax worksheet on the additional page provided to determine the movements in the deferred tax accounts for the year ended 30 June 2020. (19 marks) (d) Prepare the journal entries to record the current tax liability and the movements in deferred tax accounts for the year ended 30 June 2020. (6 marks)