Answered step by step

Verified Expert Solution

Question

1 Approved Answer

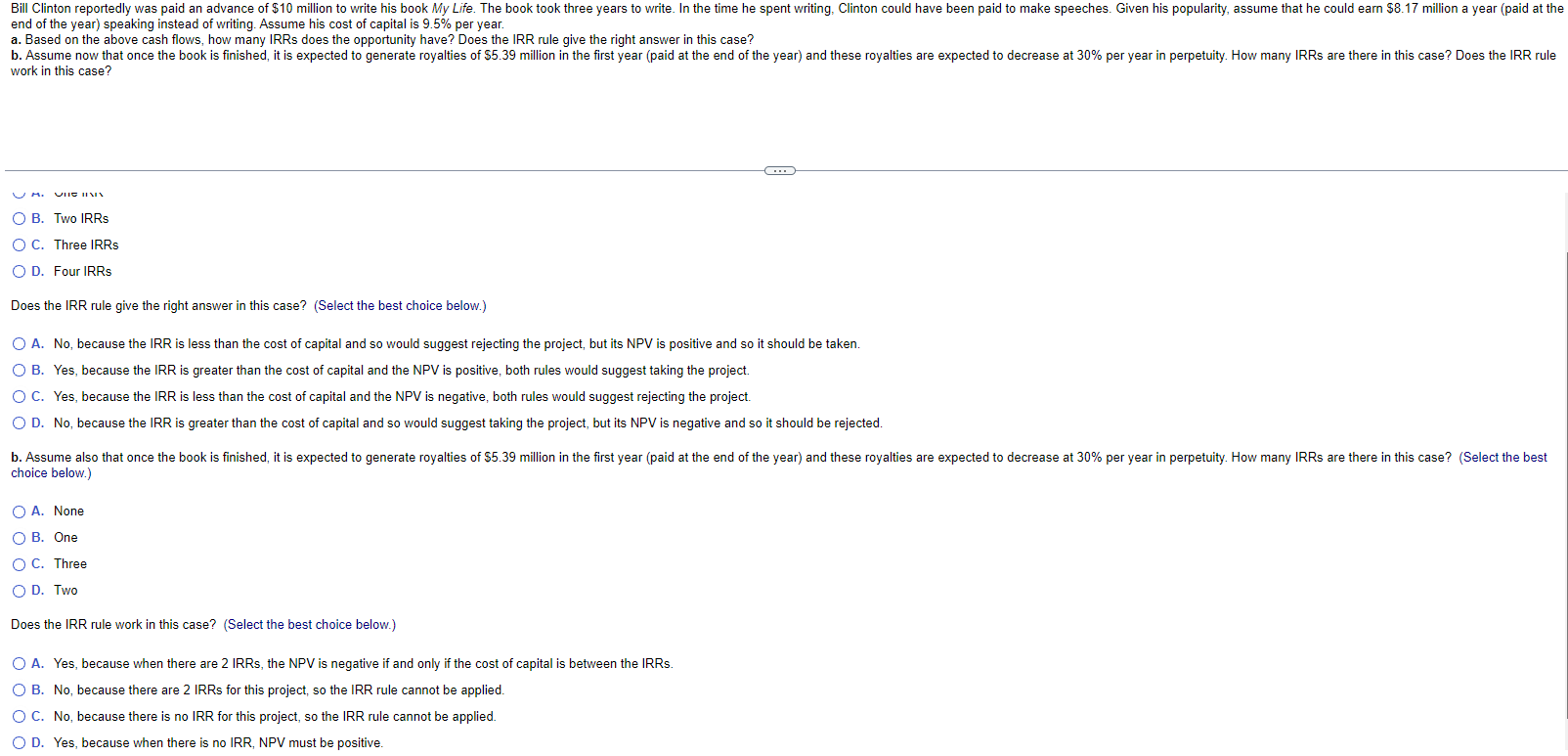

end of the year) speaking instead of writing. Assume his cost of capital is 9.5% per year. a. Based on the above cash flows, how

end of the year) speaking instead of writing. Assume his cost of capital is 9.5% per year. a. Based on the above cash flows, how many IRRs does the opportunity have? Does the IRR rule give the right answer in this case? work in this case? B. Two IRRs C. Three IRRs D. Four IRRs Does the IRR rule give the right answer in this case? (Select the best choice below.) A. No, because the IRR is less than the cost of capital and so would suggest rejecting the project, but its NPV is positive and so it should be taken. B. Yes, because the IRR is greater than the cost of capital and the NPV is positive, both rules would suggest taking the project. C. Yes, because the IRR is less than the cost of capital and the NPV is negative, both rules would suggest rejecting the project. D. No, because the IRR is greater than the cost of capital and so would suggest taking the project, but its NPV is negative and so it should be rejected. choice below.) A. None B. One C. Three D. Two Does the IRR rule work in this case? (Select the best choice below.) A. Yes, because when there are 2 IRRs, the NPV is negative if and only if the cost of capital is between the IRRs. B. No, because there are 2 IRRs for this project, so the IRR rule cannot be applied. C. No, because there is no IRR for this project, so the IRR rule cannot be applied. D. Yes, because when there is no IRR, NPV must be positive

end of the year) speaking instead of writing. Assume his cost of capital is 9.5% per year. a. Based on the above cash flows, how many IRRs does the opportunity have? Does the IRR rule give the right answer in this case? work in this case? B. Two IRRs C. Three IRRs D. Four IRRs Does the IRR rule give the right answer in this case? (Select the best choice below.) A. No, because the IRR is less than the cost of capital and so would suggest rejecting the project, but its NPV is positive and so it should be taken. B. Yes, because the IRR is greater than the cost of capital and the NPV is positive, both rules would suggest taking the project. C. Yes, because the IRR is less than the cost of capital and the NPV is negative, both rules would suggest rejecting the project. D. No, because the IRR is greater than the cost of capital and so would suggest taking the project, but its NPV is negative and so it should be rejected. choice below.) A. None B. One C. Three D. Two Does the IRR rule work in this case? (Select the best choice below.) A. Yes, because when there are 2 IRRs, the NPV is negative if and only if the cost of capital is between the IRRs. B. No, because there are 2 IRRs for this project, so the IRR rule cannot be applied. C. No, because there is no IRR for this project, so the IRR rule cannot be applied. D. Yes, because when there is no IRR, NPV must be positive Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started