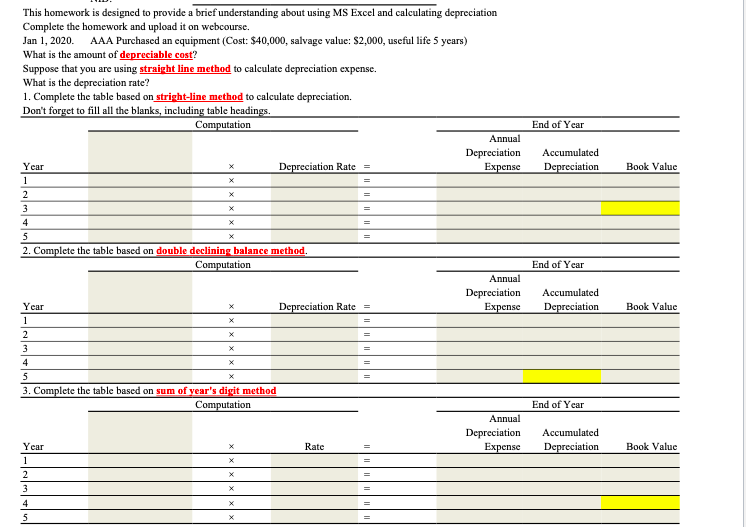

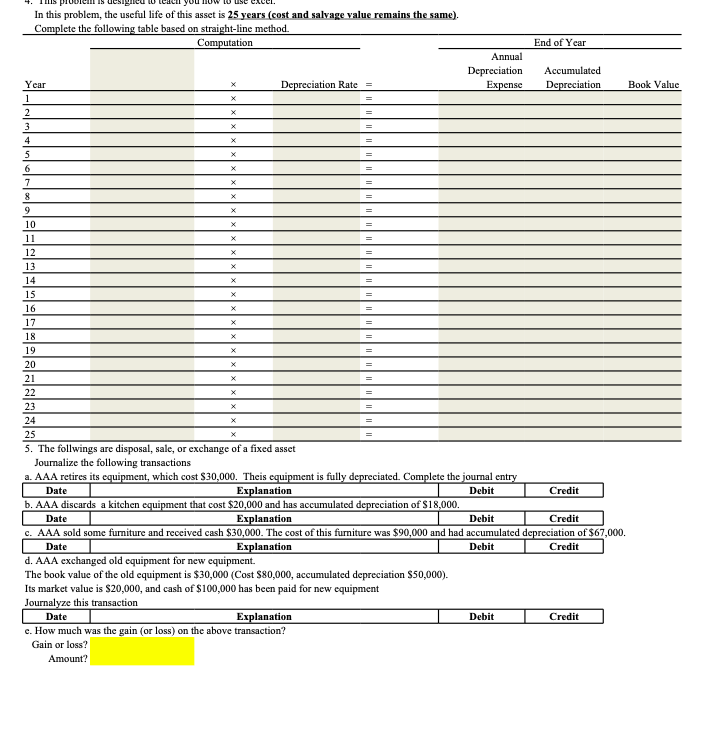

End of Year Accumulated Depreciation Book Value This homework is designed to provide a brief understanding about using MS Excel and calculating depreciation Complete the homework and upload it on webcourse. Jan 1, 2020. AAA Purchased an equipment (Cost: 540,000, salvage value: $2,000, useful life 5 years) What is the amount of depreciable cost? Suppose that you are using straight line method to calculate depreciation expense. What is the depreciation rate? 1. Complete the table based on stright-line method to calculate depreciation. Don't forget to fill all the blanks, including table headings. Computation Annual Depreciation Year Depreciation Rate = Expense 1 2 3 4 5 2. Complete the table based on double declining balance method. Computation Annual Depreciation Year Depreciation Rate = Expense 1 2 3 4 5 3. Complete the table based on sum of year's digit method Computation Annual Depreciation Year Rate Expense 1 2 3 4 5 End of Year Accumulated Depreciation Book Value X End of Year Accumulated Depreciation Book Value In this problem, the useful life of this asset is 25 years (cost and salvage value remains the same). Complete the following table based on straight-line method. Computation End of Year Annual Depreciation Expense Accumulated Depreciation X Depreciation Rate = Book Value X X X X X X X X Year 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 X X X X X X X Date Credit Date Debit Debit 5. The follwings are disposal, sale, or exchange of a fixed asset Journalize the following transactions a. AAA retires its equipment, which cost $30,000. Theis equipment is fully depreciated. Complete the journal entry Explanation Debit b. AAA discards a kitchen equipment that cost $20,000 and has accumulated depreciation of $18,000. Explanation Credit c. AAA sold some furniture and received cash $30,000. The cost of this furniture was $90,000 and had accumulated depreciation of $67,000. Date Explanation Credit d. AAA exchanged old equipment for new equipment. The book value of the old equipment is $30,000 (Cost $80,000, accumulated depreciation $50,000). Its market value is $20,000, and cash of $100,000 has been paid for new equipment Journalyze this transaction Date Explanation Credit c. How much was the gain (or loss) on the above transaction? Gain or loss? Amount? Debit