Answered step by step

Verified Expert Solution

Question

1 Approved Answer

^Ending cash balance Chapter 10 Practice Saved Help Save & Exit Submit Check my work 2 Required information Part 2 of 2 [The following information

^Ending cash balance

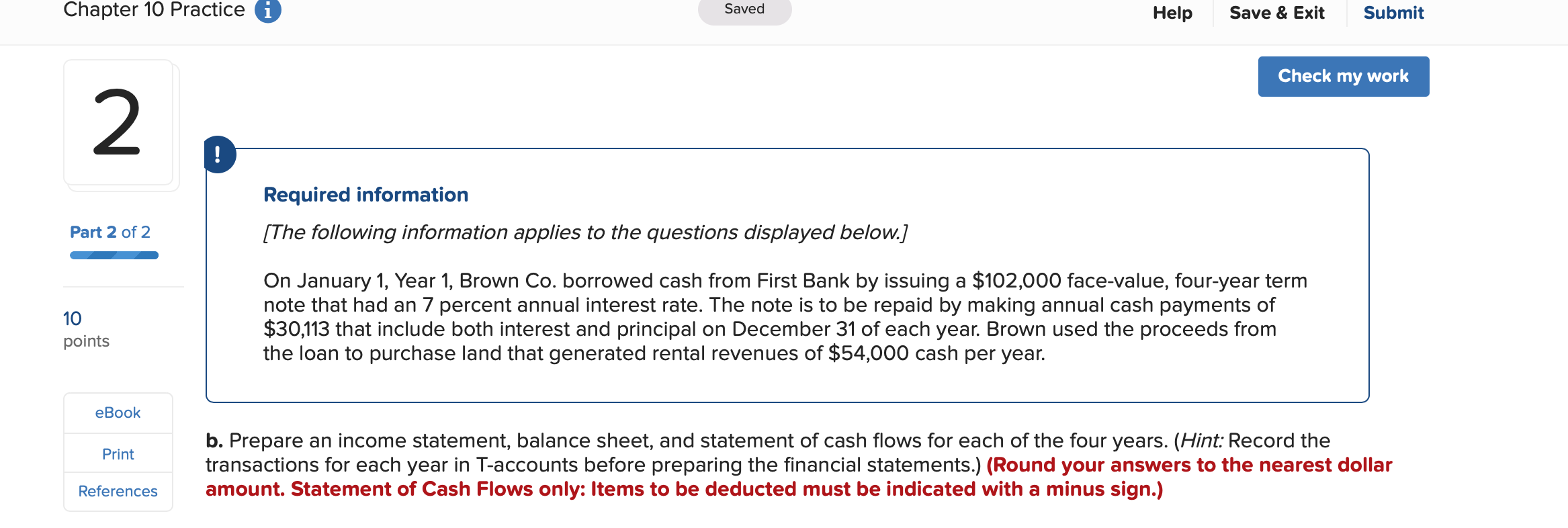

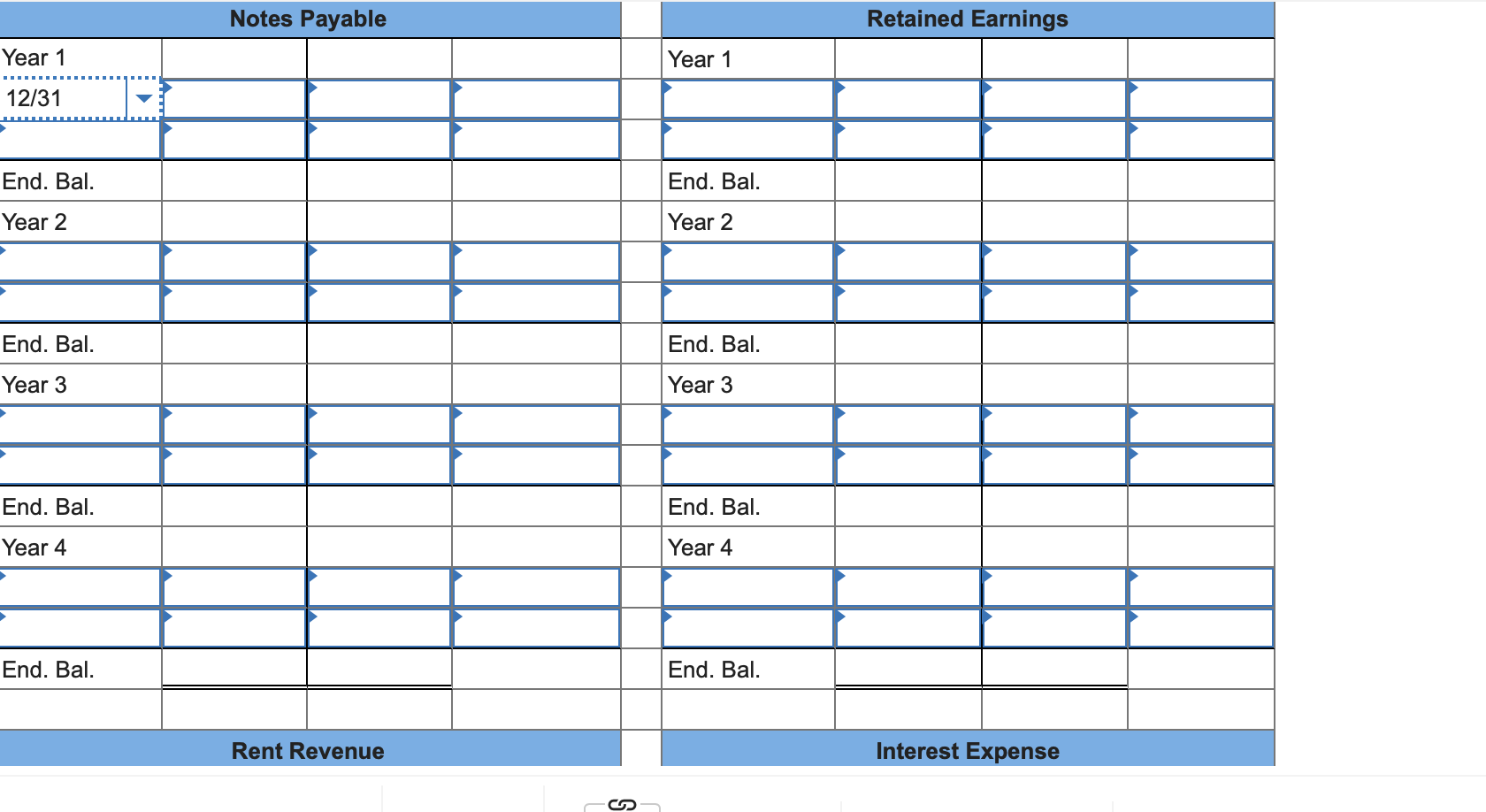

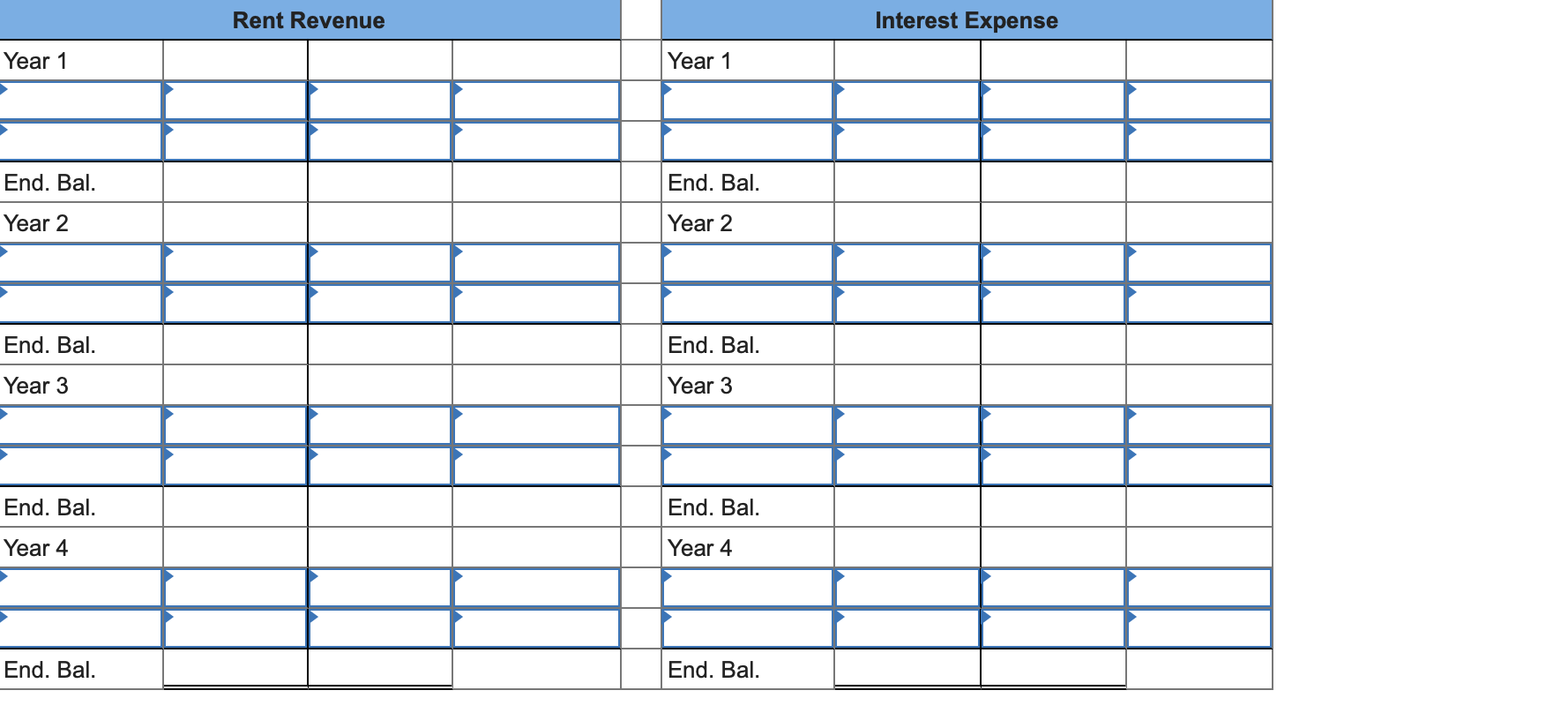

Chapter 10 Practice Saved Help Save & Exit Submit Check my work 2 Required information Part 2 of 2 [The following information applies to the questions displayed below.] 10 points On January 1, Year 1, Brown Co. borrowed cash from First Bank by issuing a $102,000 face-value, four-year term note that had an 7 percent annual interest rate. The note is to be repaid by making annual cash payments of $30,113 that include both interest and principal on December 31 of each year. Brown used the proceeds from the loan to purchase land that generated rental revenues of $54,000 cash per year. eBook Print b. Prepare an income statement, balance sheet, and statement of cash flows for each of the four years. (Hint: Record the transactions for each year in T-accounts before preparing the financial statements.) (Round your answers to the nearest dollar amount. Statement of Cash Flows only: Items to be deducted must be indicated with a minus sign.) References Notes Payable Retained Earnings Year 1 Year 1 12/31 End. Bal. End. Bal. Year 2 Year 2 End. Bal. End. Bal. Year 3 Year 3 End. Bal. End. Bal. Year 4 Year 4 End. Bal. End. Bal. Rent Revenue Interest Expense Rent Revenue Interest Expense Year 1 Year 1 End. Bal. End. Bal. Year 2 Year 2 End. Bal. End. Bal. Year 3 Year 3 End. Bal. End. Bal. Year 4 Year 4 End. Bal. End. Bal. Required information Statements of Cash Flows For the Year Ended December 31 Year 1 Year 2 Year 3 Year 4 Cash flows from operating activities: Net cash flow from operating activities: Cash flow from investing activities: Net cash flow from investing activities Cash flow from financing activities: Net cash flow from financing activities Net change in cashStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started