Answered step by step

Verified Expert Solution

Question

1 Approved Answer

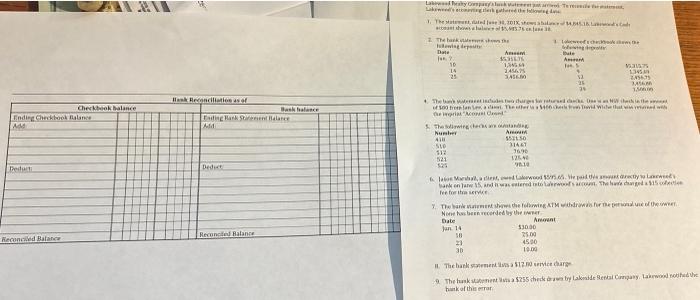

Ending Checkbook Balance Add: Deduct: Checkbook balance Reconciled Balance 600 Bank Reconciliation as of Bank balance Ending Bank Statement Balance Add: Deduct: Reconciled Balance Lakewood

Ending Checkbook Balance Add: Deduct: Checkbook balance Reconciled Balance 600 Bank Reconciliation as of Bank balance Ending Bank Statement Balance Add: Deduct: Reconciled Balance Lakewood Realty Company's bank statement just arrived. To reconcile the statement, Lakewood's accounting clerk gathered the following data: 1. The statement, dated June 30, 201X, shows a balance of $4,845.18. Lakewood's Cash account shows a balance of $5,485.76 on June 30. 2. The bank statement shows the following deposits: Date Jun. 7 10 14 25 Amount $5,315.75 1,345.69 2,456.75 3,456.80 5. The following checks are outstanding: Number 418 510 Amount $521.50 314.67 76.90 125.40 98.10 512 521 525 3. Lakewood's checkbook shows the following deposits: Date Amount Jun. 5 9 Jun. 14 18 23 30 12 25 4. The bank statement includes two charges for returned checks. One is an NSF check in the amount of $80 from Jan Lee, a client. The other is a $400 check from David Wiche that was returned with the imprint "Account Closed." 29 Amount $30.00 25.00 45.00 10.00 $5,315.75 6. Jason Marshall, a client, owed Lakewood $595.65. He paid this amount directly to Lakewood's bank on June 15, and it was entered into Lakewood's account. The bank charged a $15 collection fee for this service. 1,345.69 2,456.75 3,456.80 1,500.00 7. The bank statement shows the following ATM withdrawals for the personal use of the owner. None has been recorded by the owner. Date 8. The bank statement lists a $12.80 service charge. 9. The bank statement lists a $255 check drawn by Lakeside Rental Company. Lakewood notified the bank of this error.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started