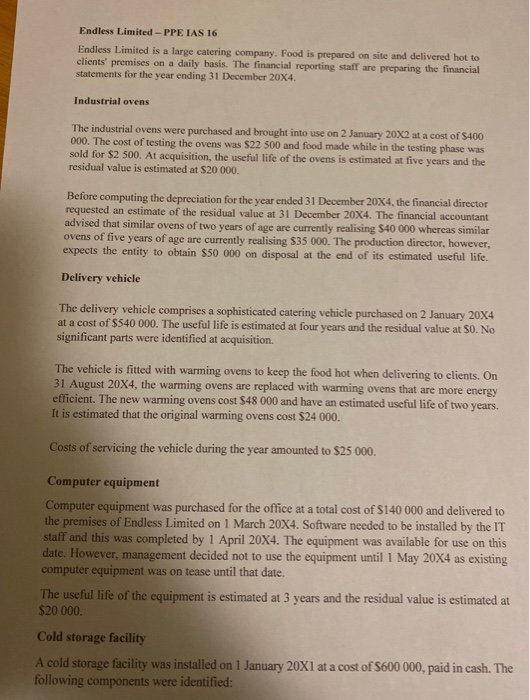

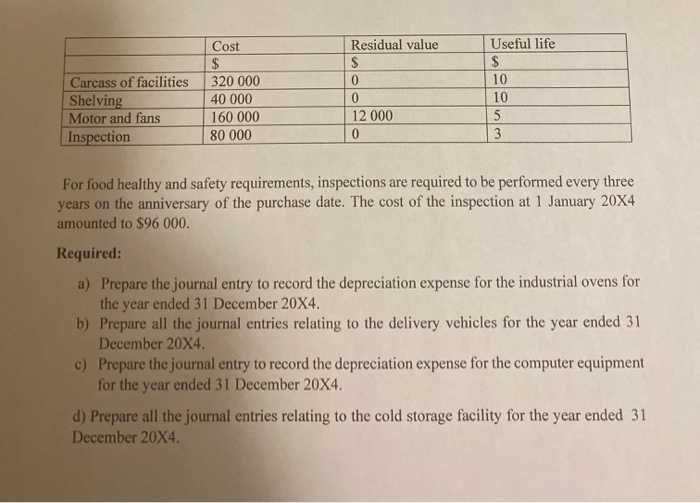

Endless Limited - PPE IAS 16 Endless Limited is a large catering company. Food is prepared on site and delivered hot to clients' premises on a daily basis. The financial reporting staff are preparing the financial statements for the year ending 31 December 20X4. Industrial ovens The industrial ovens were purchased and brought into use on 2 January 20X2 at a cost of $400 000. The cost of testing the ovens was 522 500 and food made while in the testing phase was sold for $2 500. At acquisition, the useful life of the ovens is estimated at five years and the residual value is estimated at $20 000 Before computing the depreciation for the year ended 31 December 20X4, the financial director requested an estimate of the residual value at 31 December 20X4. The financial accountant advised that similar ovens of two years of age are currently realising S40 000 whereas similar ovens of five years of age are currently realising $35 000. The production director, however, expects the entity to obtain $50 000 on disposal at the end of its estimated useful life. Delivery vehicle The delivery vehicle comprises a sophisticated catering vehicle purchased on 2 January 20X4 at a cost of $540 000. The useful life is estimated at four years and the residual value at So. No significant parts were identified at acquisition. The vehicle is fitted with warming ovens to keep the food hot when delivering to clients. On 31 August 20X4, the warming ovens are replaced with warming ovens that are more energy efficient. The new warming ovens cost $48 000 and have an estimated useful life of two years. It is estimated that the original warming ovens cost $24 000. Costs of servicing the vehicle during the year amounted to $25 000. Computer equipment Computer equipment was purchased for the office at a total cost of $140 000 and delivered to the premises of Endless Limited on 1 March 20X4. Software needed to be installed by the IT staff and this was completed by 1 April 20X4. The equipment was available for use on this date. However, management decided not to use the equipment until 1 May 20X4 as existing computer equipment was on tease until that date The useful life of the equipment is estimated at 3 years and the residual value is estimated at $20 000 Cold storage facility A cold storage facility was installed on 1 January 20X1 at a cost of $600 000, paid in cash. The following components were identified: Cost Residual value Useful life $ 10 Carcass of facilities Shelving Motor and fans Inspection 320 000 40 000 160 000 80 000 12 000 For food healthy and safety requirements, inspections are required to be performed every three years on the anniversary of the purchase date. The cost of the inspection at 1 January 20X4 amounted to $96 000. Required: a) Prepare the journal entry to record the depreciation expense for the industrial ovens for the year ended 31 December 20X4. b) Prepare all the journal entries relating to the delivery vehicles for the year ended 31 December 20X4. c) Prepare the journal entry to record the depreciation expense for the computer equipment for the year ended 31 December 20X4. d) Prepare all the journal entries relating to the cold storage facility for the year ended 31 December 20X4