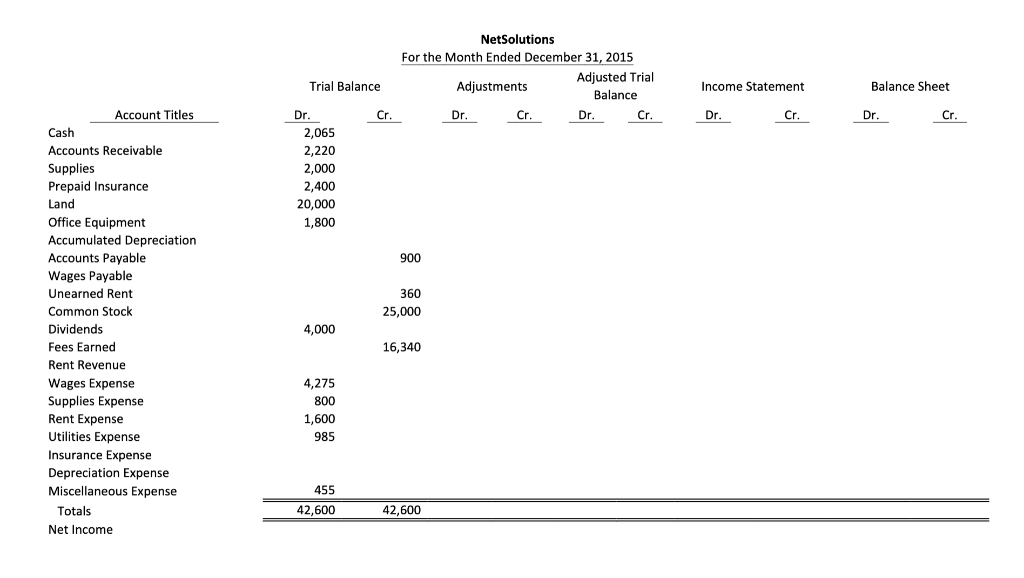

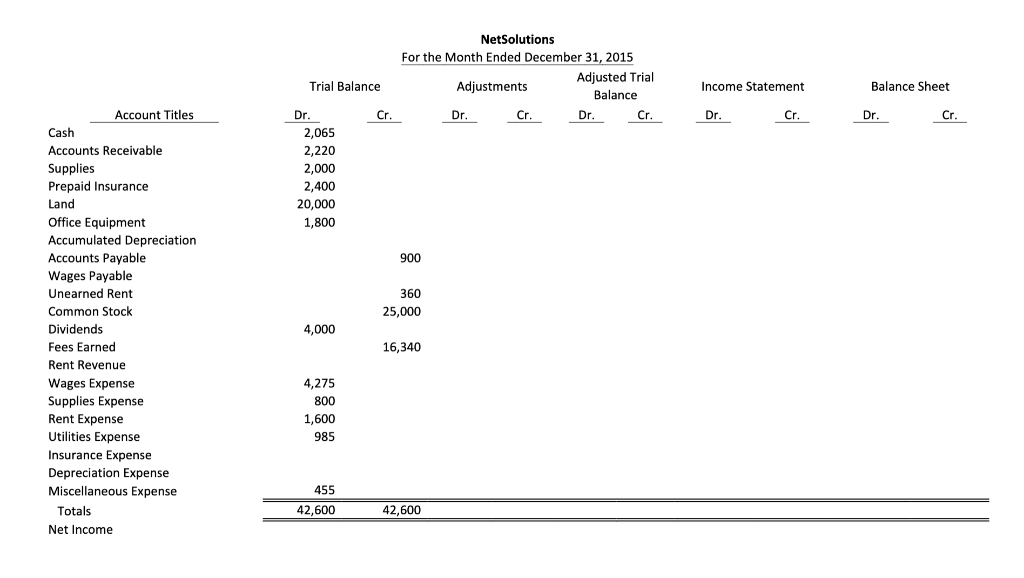

End-of-Period Spreadsheet Accountants often use spreadsheets for analyzing and summarizing data. Such spreadsheets are not a formal part of the accounting records. This is in contrast to the chart of accounts, the journal, and the ledger, which are essential parts of an accounting system. Spreadsheets are usually prepared by using a computer program such as Microsoft Excel The data on the next tab is an end of period spreadsheet used to summarize adjusting entries and their effects on the accounts. As illustrated in the chapter, the financial statements for NetSolutions can be prepared directly from the spreadsheets adjusted trial balance columns. NetSolutions started operations on December 1, 2015. The adjustements below are for Dec 31, 2015. Adjustments (a) Supplies-The cost of supplies on hand at the end of the period is $760. (b) Prepaid Insurance-The $2,400 balance of prepaid insurance represents the pre-payment of an insurance policy for 12 months beginning December 14. (c) Unearned Rent-The unearned rent account has a credit balance of $360. This balance represents the receipt of 3 months' rent, beginning with December. (d) Accrued Fees-Fees accrued at the end of December but not recorded total $500. (e) Wages-Wages accrued but not paid at the end of December total $250. (f) Depreciation-Depreciation of office equipment is $50 for the month of December. Once the adjustments are made in the adjustments columns, enter the adjusted trial balance. The Income Statement and Balance Sheet columns follow. Lastly, total the columns to ensure that DRECR and calculate Net Income. *Hint-the Adjusted trial balance is entered by combining the adjustments with the unadjusted balances for each account. The adjusted amounts are then extended to the adjusted trial balance. The adjusted trial balance amounts are extended to the Income Statement and Balance Sheet columns. To gain full credit for this assignment the following must be completed with the correct amounts: 1. Adjustments Columns with values and corresponding letter (in columns D and F) Ex: (a) XXX 2. Adjusted Trial Balance Columns 3. Income Statement Columns 4. Balance Sheet Columns 5. Column totals 6. Net Income Good Luck! NetSolutions For the Month Ended December 31, 2015 Adjusted Trial Adjustments Balance Trial Balance Income Statement Balance Sheet Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Cash 2,065 2,220 2,000 2,400 20,000 Accounts Receivable Supplies Prepaid Insurance Land Office Equipment Accumulated Depreciation Accounts Payable Wages Payable Unearned Rent 1,800 900 360 Common Stock 25,000 4,000 Dividends Fees Earned 16,340 Rent Revenue 4,275 800 1,600 985 Wages Expense Supplies Expense Rent Expense Utilities Expense Insurance Expense Depreciation Expense Miscellaneous Expense Totals 455 42,600 42,600 Net Income