Answered step by step

Verified Expert Solution

Question

1 Approved Answer

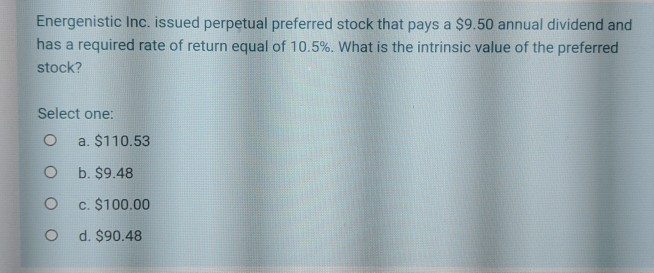

Energenistic Inc. issued perpetual preferred stock that pays a $9.50 annual dividend and has a required rate of return equal of 10.5%. What is the

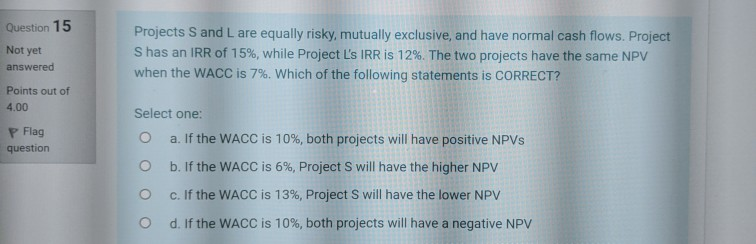

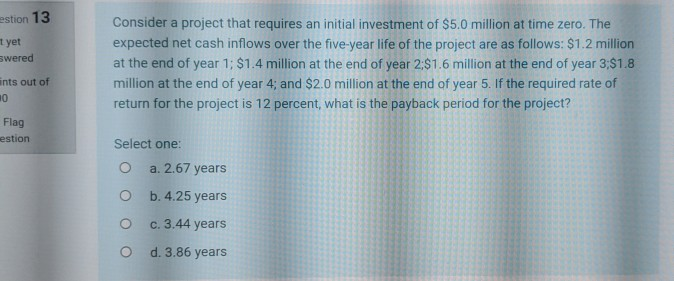

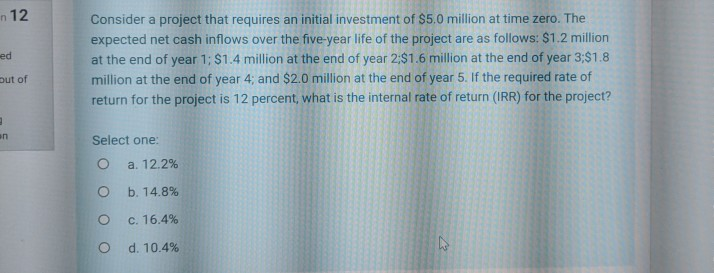

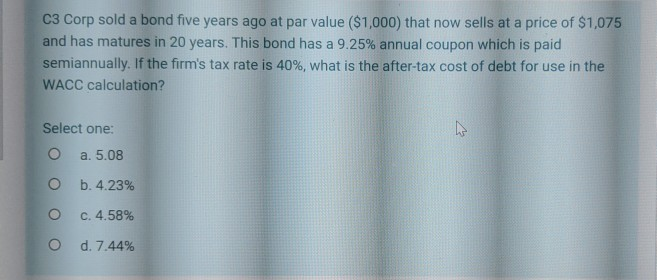

Energenistic Inc. issued perpetual preferred stock that pays a $9.50 annual dividend and has a required rate of return equal of 10.5%. What is the intrinsic value of the preferred stock? Select one: oa. $110.53 O b. $9.48 O c. $100.00 O d. $90.48 Question 15 Not yet answered Projects S and L are equally risky, mutually exclusive, and have normal cash flows. Project S has an IRR of 15%, while Project L's IRR is 12%. The two projects have the same NPV when the WACC is 7%. Which of the following statements is CORRECT? Points out of 4.00 P Flag question Select one: O a. If the WACC is 10%, both projects will have positive NPVs O b. If the WACC is 6%, Project S will have the higher NPV o c. If the WACC is 13%, Project S will have the lower NPV o d. If the WACC is 10%, both projects will have a negative NPV estion 13 1 yet swered Consider a project that requires an initial investment of $5.0 million at time zero. The expected net cash inflows over the five-year life of the project are as follows: $1.2 million at the end of year 1; $1.4 million at the end of year 2:$1.6 million at the end of year 3:$1.8 million at the end of year 4; and $2.0 million at the end of year 5. If the required rate of return for the project is 12 percent, what is the payback period for the project? ints out of Flag estion Select one: O a. 2.67 years O b.4.25 years o c.3.44 years O d. 3.86 years 12 Consider a project that requires an initial investment of $5.0 million at time zero. The expected net cash inflows over the five-year life of the project are as follows: $1.2 million at the end of year 1; $1.4 million at the end of year 2:$1.6 million at the end of year 3;$1.8 million at the end of year 4; and $2.0 million at the end of year 5. If the required rate of return for the project is 12 percent, what is the internal rate of return (IRR) for the project? But of Select one: o a. 12.2% O b. 14.8% O o c. 16.4% d. 10.4% C3 Corp sold a bond five years ago at par value ($1,000) that now sells at a price of $1,075 and has matures in 20 years. This bond has a 9.25% annual coupon which is paid semiannually. If the firm's tax rate is 40%, what is the after-tax cost of debt for use in the WACC calculation? Select one: O a. 5.08 ob.4.23% o c.4.58% d. 7.44%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started