Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Energetic Sdn Bhd (ESB) was founded in 2017 and very specialize in manufacturing sport shoes. Mr. Ramlee, the cost accountant of ESB reported that beginning

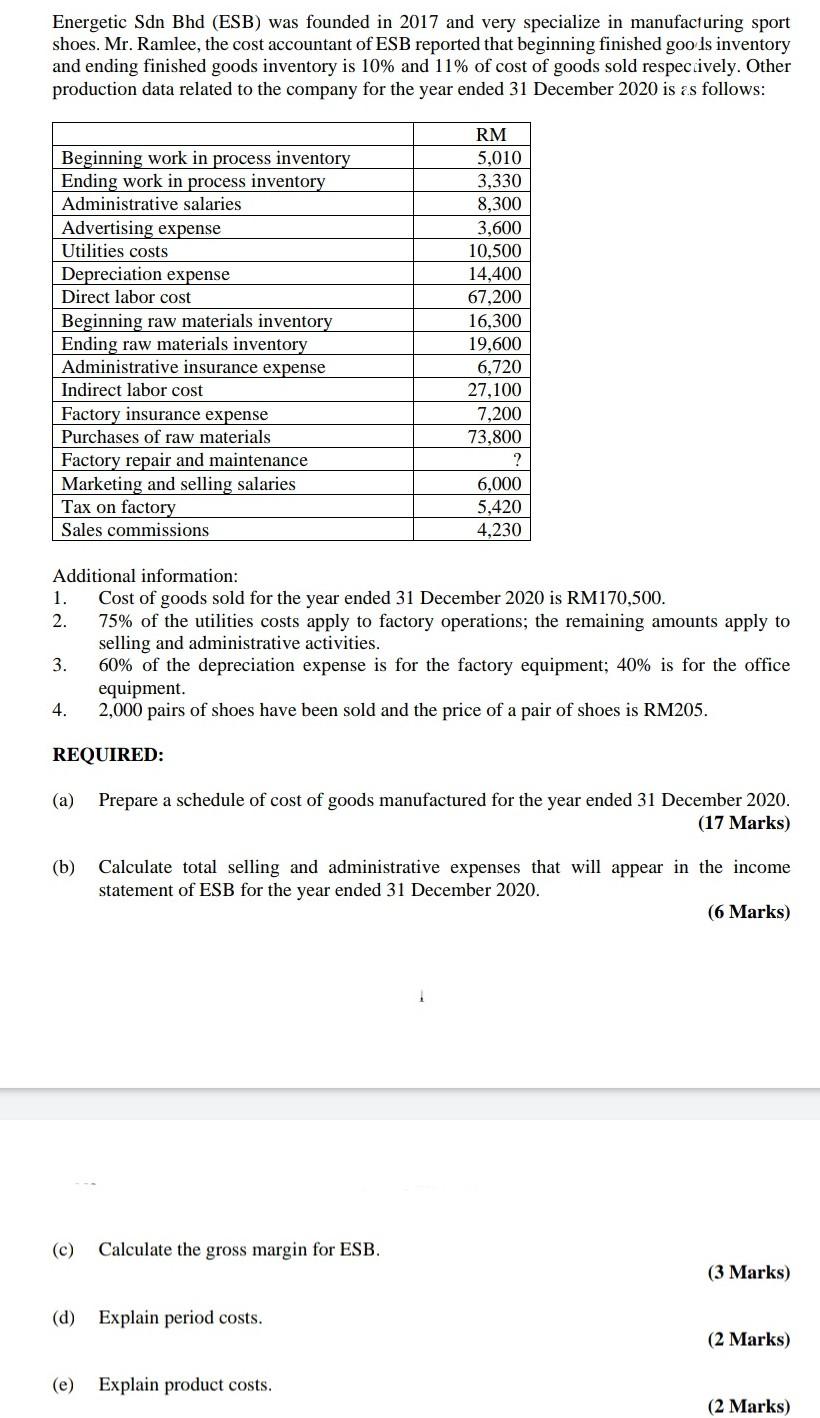

Energetic Sdn Bhd (ESB) was founded in 2017 and very specialize in manufacturing sport shoes. Mr. Ramlee, the cost accountant of ESB reported that beginning finished goo is inventory and ending finished goods inventory is 10% and 11% of cost of goods sold respectively. Other production data related to the company for the year ended 31 December 2020 is as follows: Beginning work in process inventory Ending work in process inventory Administrative salaries Advertising expense Utilities costs Depreciation expense Direct labor cost Beginning raw materials inventory Ending raw materials inventory Administrative insurance expense Indirect labor cost Factory insurance expense Purchases of raw materials Factory repair and maintenance Marketing and selling salaries Tax on factory Sales commissions RM 5,010 3,330 8,300 3,600 10,500 14,400 67,200 16,300 19,600 6,720 27,100 7,200 73,800 ? 6,000 5,420 4,230 Additional information: 1. Cost of goods sold for the year ended 31 December 2020 is RM170,500. 2. 75% of the utilities costs apply to factory operations; the remaining amounts apply to selling and administrative activities. 3. 60% of the depreciation expense is for the factory equipment; 40% is for the office equipment. 4. 2,000 pairs of shoes have been sold and the price of a pair of shoes is RM205. REQUIRED: (a) Prepare a schedule of cost of goods manufactured for the year ended 31 December 2020. (17 Marks) (b) Calculate total selling and administrative expenses that will appear in the income statement of ESB for the year ended 31 December 2020. (6 Marks) (c) Calculate the gross margin for ESB. (3 Marks) (d) Explain period costs. (2 Marks) (e) Explain product costs. (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started