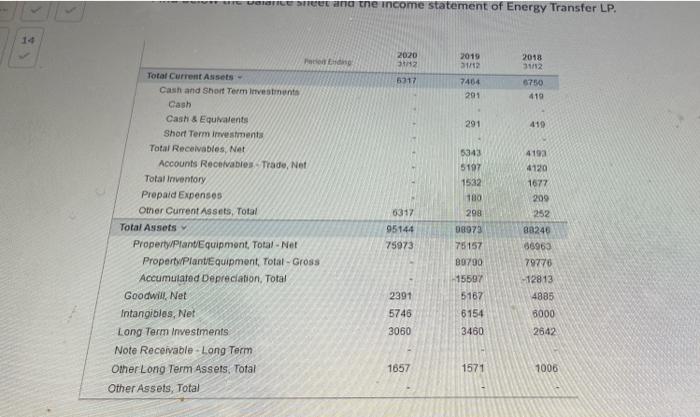

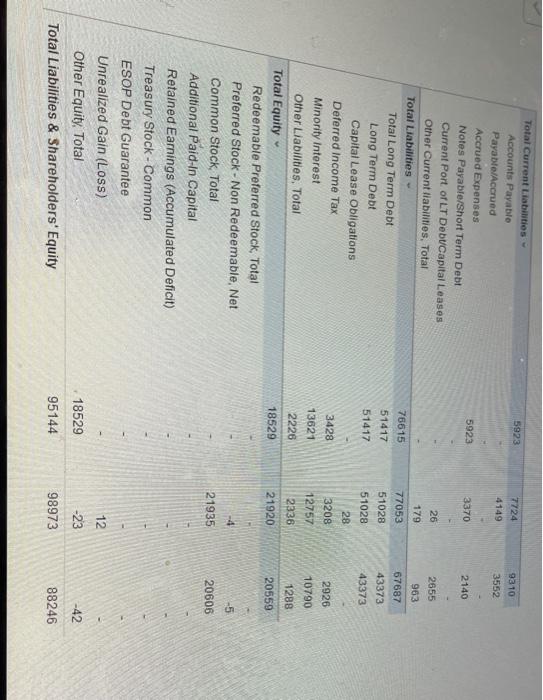

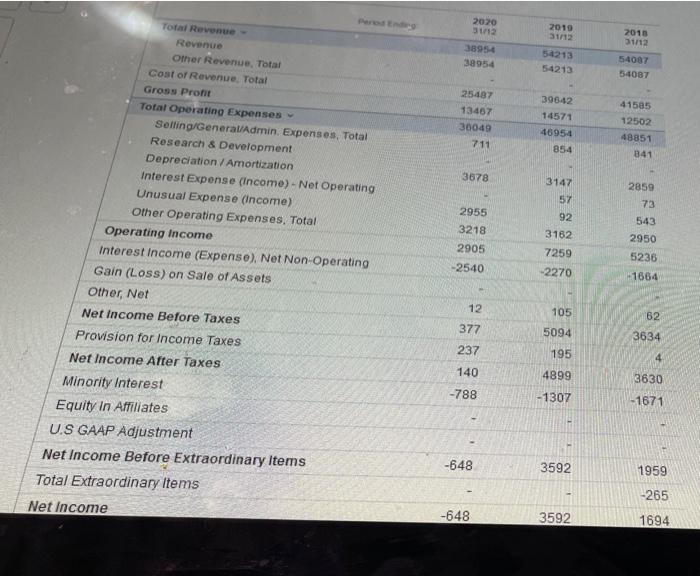

Energy Transfer LP owns and operates a portfolio of energy assets. The Company's operations include complementary natural gas midstream, crude oil, natural gas liquids (NGL) and refined product transportation. You are working for a wealth management company and you have been asked to discuss the following aspects for Energy Transfer LP. Aspect 1: Profitability Aspect 2: Short term solvency Aspect 3: Current Asset liquidity Aspect 4: Capital structure Find below the Balance sheet and the income statement of Energy Transfer LP. Lee and the income statement of Energy Transfer LP. 14 2020 32 6717 2018 3112 2019 31/12 7464 291 6750 419 291 419 4193 5343 5197 1532 100 298 4120 1677 209 252 6317 Patie Total Current Assets Cash and Short Term investments Cash Cash & Equivalents Short Term investments Total Receivables, Net Accounts Receivablo Trade, Net Total Inventory Prepaid Expenses Omer Current Assets, Total Total Assets Property/Plant Equipment, Total-Net Property/PlantEquipment, Total - Gross Accumulated Depreciation, Total Goodwill, Net Intangibles, Net Long Term Investments Note Receivable - Long Term Other Long Term Assets. Total Other Assets, Total 95144 75973 08973 75157 89790 15597 5167 6154 3460 80246 36963 79776 -12813 4885 8000 2542 2391 5746 3060 1657 1571 1006 5923 7724 9310 3552 4149 5923 3370 2140 26 179 2655 963 76615 51417 77053 51028 51028 67687 43373 43373 51417 28 3208 12757 3428 13621 2226 Total Current Liabilities Accounts Payablo Payable/Accrued Accrued Expenses Notes Payable/Short Term Debt Current Port of LT Debt Capital Leases Other Current liabilities. Total Total Liabilities Total Long Term Debt Long Term Debt Capital Lease Obligations Deferred Income Tax Minority interest Other Liabilities. Total Total Equity Redeemable Preferred Stock, Total Preferred Stock - Non Redeemable, Net Common Stock, Total Additional Paid-In Capital Retained Earnings (Accumulated Deficit) Treasury Stock - Common ESOP Debt Guarantee Unrealized Gain (Loss) Other Equity, Total Total Liabilities & Shareholders' Equity 2926 10790 2336 1288 18529 21920 20559 -4 -5 21935 20606 12 18529 -23 -42 95144 98973 88246 2019 31/12 2020 3012 38954 38954 2010 31/12 544213 54213 54007 54087 25487 13467 30049 711 39642 14571 46954 854 41585 12502 48851 341 3678 3147 57 2859 73 2955 3218 2905 -2540 543 2950 Total Revenue Revenue Other Revenue, Total Coat of Revenue. Total Gross Pront Total Operating Expenses Selling/General/Admin Expenses. Total Research & Development Depreciation / Amortization Interest Expense (Income) - Net Operating Unusual Expense (Income) Other Operating Expenses. Total Operating Income Interest Income (Expense), Net Non-Operating Gain (Loss) on Sale of Assets Other, Net Net Income Before Taxes Provision for Income Taxes Net Income After Taxes Minority interest Equity In Affiliates U.S GAAP Adjustment Net Income Before Extraordinary Items Total Extraordinary items Net Income 92 3162 7259 -2270 5236 1664 12 105 62 377 5094 3634 237 195 4 140 4899 3630 -788 - 1307 -1671 -648 3592 1959 -265 -648 3592 1694 Question 4 (10 points) Listen > Aspect 5: Capital structure Ratios Discussion