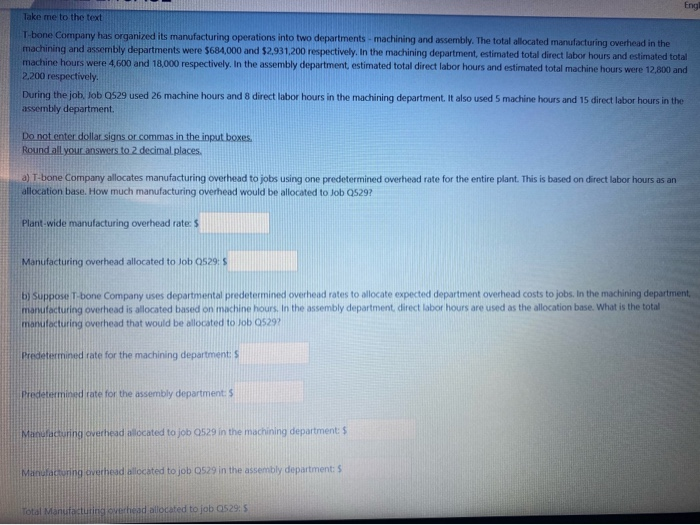

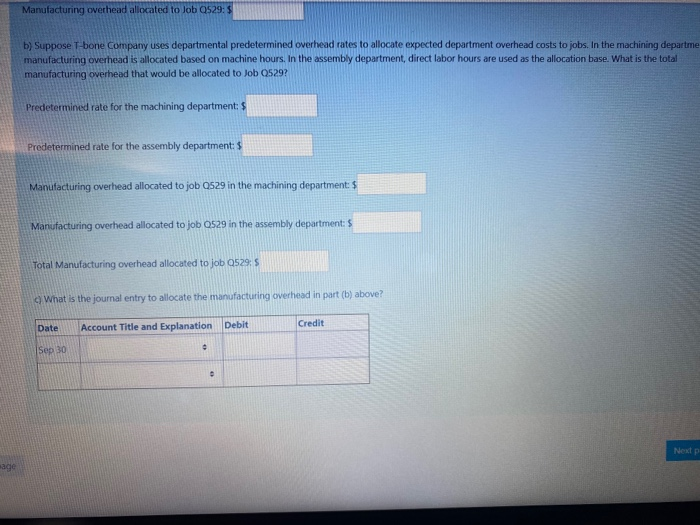

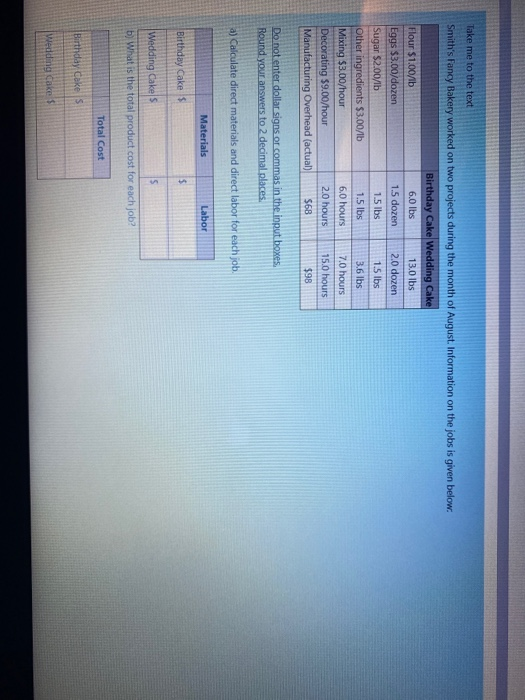

Eng Take me to the text T-bone Company has organized its manufacturing operations into two departments - machining and assembly. The total allocated manufacturing overhead in the machining and assembly departments were 5684,000 and $2.931,200 respectively. In the machining department, estimated total direct labor hours and estimated total machine hours were 4,600 and 18,000 respectively. In the assembly department, estimated total direct labor hours and estimated total machine hours were 12,800 and 2,200 respectively, During the job, Job 0529 used 26 machine hours and 8 direct labor hours in the machining department. It also used 5 machine hours and 15 direct labor hours in the assembly department. Do not enter dollar signs or commas in the input boxes Round all your answers to 2 decimal places 3) T-bone Company allocates manufacturing overhead to jobs using one predetermined overhead rate for the entire plant. This is based on direct labor hours as an allocation base. How much manufacturing overhead would be allocated to Job Q5297 Plant-wide manufacturing overhead rates Manufacturing overhead allocated to job 0529: $ b) suppose T-bone Company uses departmental predetermined overhead rates to allocate expected department overhead costs to jobs. In the machining department, manufacturing overhead is allocated based on machine hours. In the assembly department direct labor hours are used as the allocation base. What is the total manufacturing overhead that would be allocated to job 05292 Predetermined rate for the machining departments Predetermined rate for the assembly department: Manufacturing overhead allocated to job 0529 in the machining departments Manufacturing overhead allocated to job 0529 in the assembly departments Total Manufacturing overhead allocated to job 0529: 5 Manufacturing overhead allocated to Job Q529: $ b) Suppose T-bone Company uses departmental predetermined overhead rates to allocate expected department overhead costs to jobs. In the machining departme manufacturing overhead is allocated based on machine hours. In the assembly department, direct labor hours are used as the allocation base. What is the total manufacturing overhead that would be allocated to Job 0529? Predetermined rate for the machining department: $ Predetermined rate for the assembly department: $ Manufacturing overhead allocated to job 0529 in the machining department: $ Manufacturing overhead allocated to job 0529 in the assembly department: $ Total Manufacturing overhead allocated to job 0529: S What is the journal entry to allocate the manufacturing overhead in part (b) above? Date Account Title and Explanation Debit Credit Sep 30 Nextp age Take me to the text Smith's Fancy Bakery worked on two projects during the month of August. Information on the jobs is given below. Birthday Cake Wedding Cake Flour $1.00/1b 6.0 lbs 13.0 lbs Eggs $3.00/dozen 1.5 dozen 2.0 dozen Sugar $2.00/1b 1.5 lbs 1.5 lbs Other ingredients $3.00/b 1.5 lbs 3.6 lbs Mixing $3.00/hour 6.0 hours 7.0 hours Decorating $9.00/hour 2.0 hours 15.0 hours Manufacturing Overhead (actual) $68 $98 Do not enter dollar signs or commas in the loput boxes, Round your answers to 2 decimal places a) Calculate direct materials and direct labor for each job. Materials Labor Birthday Cakes 5 Wedding Cakes S b) What is the total product cost for each job? Total Cost Birthday Cakes Wedding Cakes