Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Engineering economics You are considering the purchase of a parking deck close to your office building The parking deck is a 15-year old structure with

Engineering economics

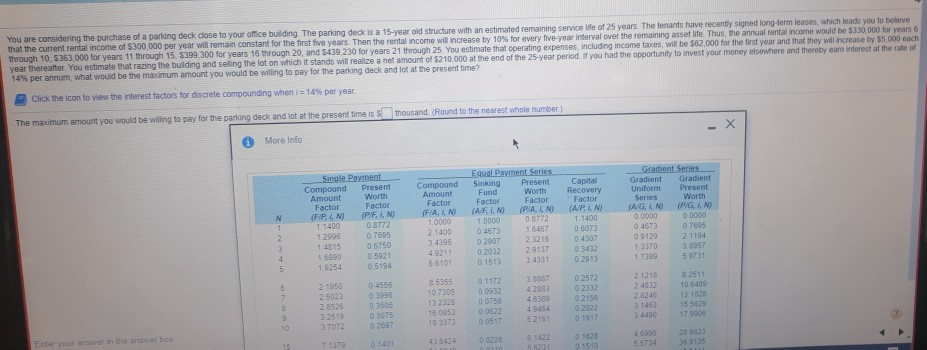

You are considering the purchase of a parking deck close to your office building The parking deck is a 15-year old structure with an estimated remaining service life of 25 years. The tenants have recently signed long-term leases, which leads you to believe that the current rental income of $300,000 per year will remain constant for the first five years. Then the rental income will increase by 10% for every five-year interval over the remaining asset life. Thus, the annual rental income would be $330,000 for years 6 through 10.5363,000 for years 11 through 15. 5399 300 for years 16 through 20 and 5439,230 for years 21 through 25. You estimate that operating expenses, including income taxes, will be 562,000 for the first year and that they will increase by $5,000 each year thereafter. You estimate that razing the building and selling the lot on which it stands will realize a net amount of $210,000 at the end of the 25-year period. If you had the opportunity to invest your money elsewhere and thereby cam interest at the rate of 14% per annum, what would be the maximum amount you would be willing to pay for the parking deck and lot at the present time? Click the icon to view the interest factors for discrete compounding when i = 14% per year The macimum amount you would be willing to pay for the parking deck and lot at the present time is thousand (Round to the nearest whole number) More Info N 1 2 3 4 Single Payment Compound Present Amount Worth Factor Factor (F/P.IN (P/F, I, N) 1.1400 08772 1.2996 07695 1 4815 0.5750 1 6990 0.5921 19254 0.5194 2.950 04556 2.5023 03990 2 8520 0 3500 3 2510 03075 37072 Compound Amount Factor IFIA, INO 1000 2 1400 3.4390 4.921 8 6100 Equal Payment Series Sinking Present Fund Worth Factor Factor (AFN) (PIA, INO 10000 0.8772 04673 1.6467 02907 2.3216 0.2032 29137 01513 3.4331 Gradient Series Gradient Gradient Uniform Series Worth (ANG, (P/G, 0.0000 00000 4673 0.7695 09129 2 1194 1 3370 1 7399 5.9731 Capital Recovery Factor (APN) 1.1400 0 6072 04302 03.032 0.2913 6 8 5355 107305 13 2220 15 0853 19 3373 7 0 1172 0 0932 0 0756 00622 00517 3.8887 4.2883 4.6389 49484 5256 0.2572 02332 02150 2022 2 1218 2 4032 2 8240 3 1453 3.6490 10 5489 13 1028 15 5629 17 0005 9 9 28. 0623 Enter your answer in the answer box 46999 55734 74379 438424 15 04401 162 01510 5231Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started