Engineering economy,

please solve quickly

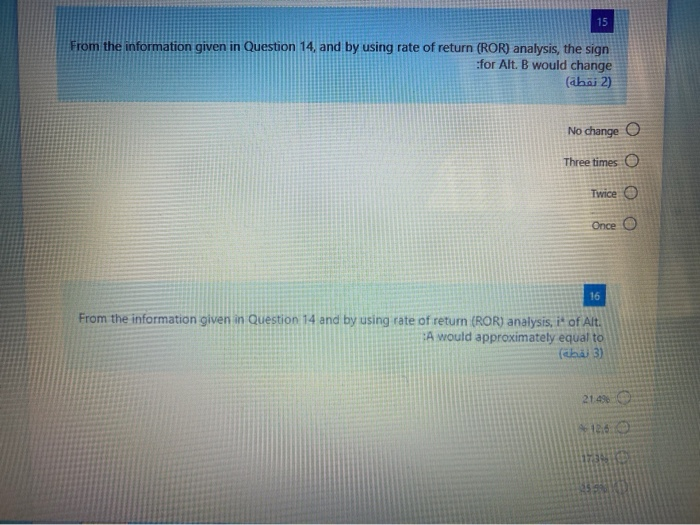

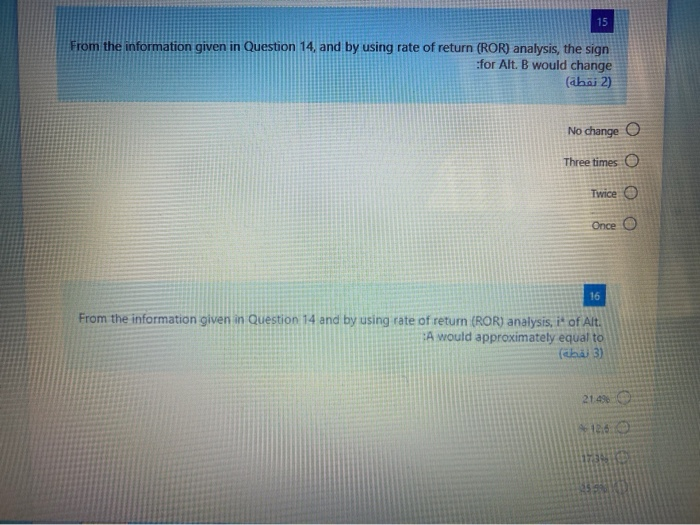

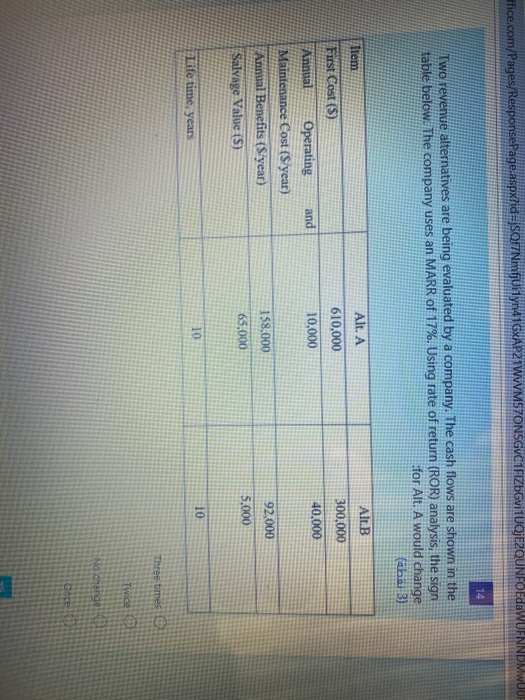

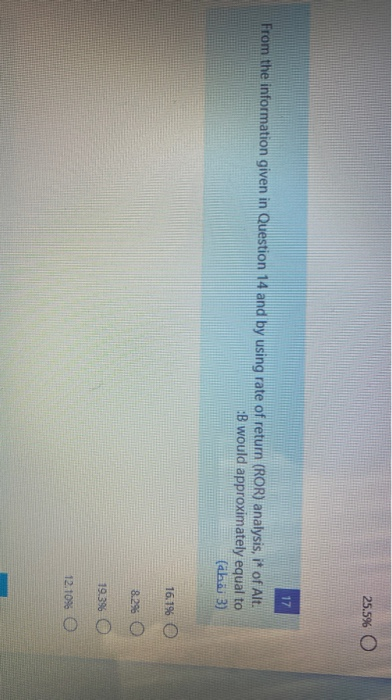

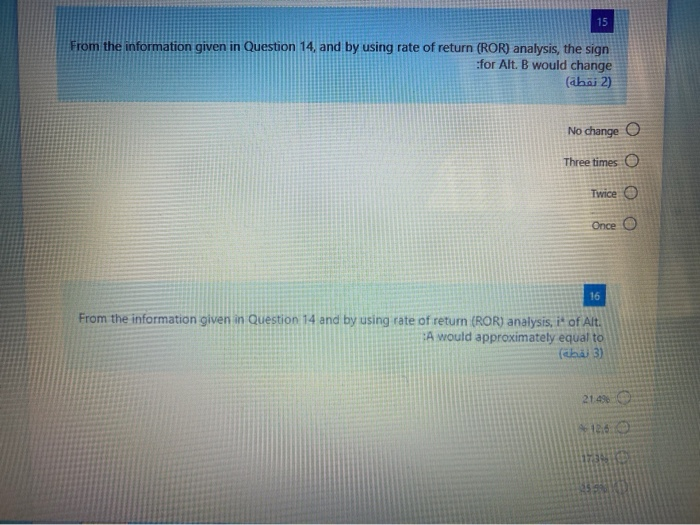

15 From the information given in Question 14, and by using rate of return (ROR) analysis, the sign for Alt. B would change (abai 2) No change o Three times o Twice o Once O 16 From the information given in Question 14 and by using rate of return (ROR) analysis, it of Alt. A would approximately equal to label 3) 2149 ffice.com/Pages/ResponsePage.aspx?id=jSQF7NmfjUilyn41GXAP21WWM570N5GVCAFIZOGVI1UQJEZQUNFOEDWUFNNDMWUOF 14 Two revenue alternatives are being evaluated by a company. The cash flows are shown in the table below. The company uses an MARR of 17%. Using rate of return (ROR) analysis, the sign for Alt. A would change (aha 3) AltB Alt. A 610,000 300,000 and 10,000 40,000 Item First Cost (5) Annual Operating Maintenance Cost (S/year) Annual Benefits (Skyear) Salvage Value (S) 158.000 92.000 65,000 5.000 10 10 Life time, years Three times Twice No change Dace 25.5% O 17 From the information given in Question 14 and by using rate of return (ROR) analysis, i* of Alt. :B would approximately equal to (aha 3) 16.1% 8.2% 0 19.396 12.1098 15 From the information given in Question 14, and by using rate of return (ROR) analysis, the sign for Alt. B would change (abai 2) No change o Three times o Twice o Once O 16 From the information given in Question 14 and by using rate of return (ROR) analysis, it of Alt. A would approximately equal to label 3) 2149 ffice.com/Pages/ResponsePage.aspx?id=jSQF7NmfjUilyn41GXAP21WWM570N5GVCAFIZOGVI1UQJEZQUNFOEDWUFNNDMWUOF 14 Two revenue alternatives are being evaluated by a company. The cash flows are shown in the table below. The company uses an MARR of 17%. Using rate of return (ROR) analysis, the sign for Alt. A would change (aha 3) AltB Alt. A 610,000 300,000 and 10,000 40,000 Item First Cost (5) Annual Operating Maintenance Cost (S/year) Annual Benefits (Skyear) Salvage Value (S) 158.000 92.000 65,000 5.000 10 10 Life time, years Three times Twice No change Dace 25.5% O 17 From the information given in Question 14 and by using rate of return (ROR) analysis, i* of Alt. :B would approximately equal to (aha 3) 16.1% 8.2% 0 19.396 12.1098