Answered step by step

Verified Expert Solution

Question

1 Approved Answer

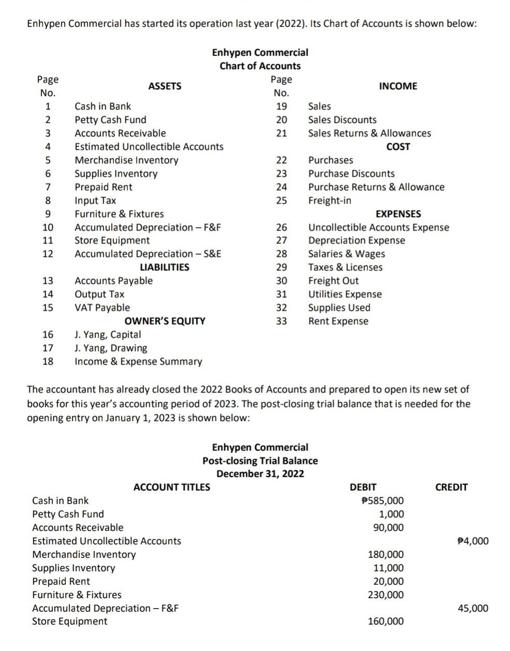

Enhypen Commercial has started its operation last year (2022). Its Chart of Accounts is shown below: Enhypen Commercial Chart of Accounts Page No. 1

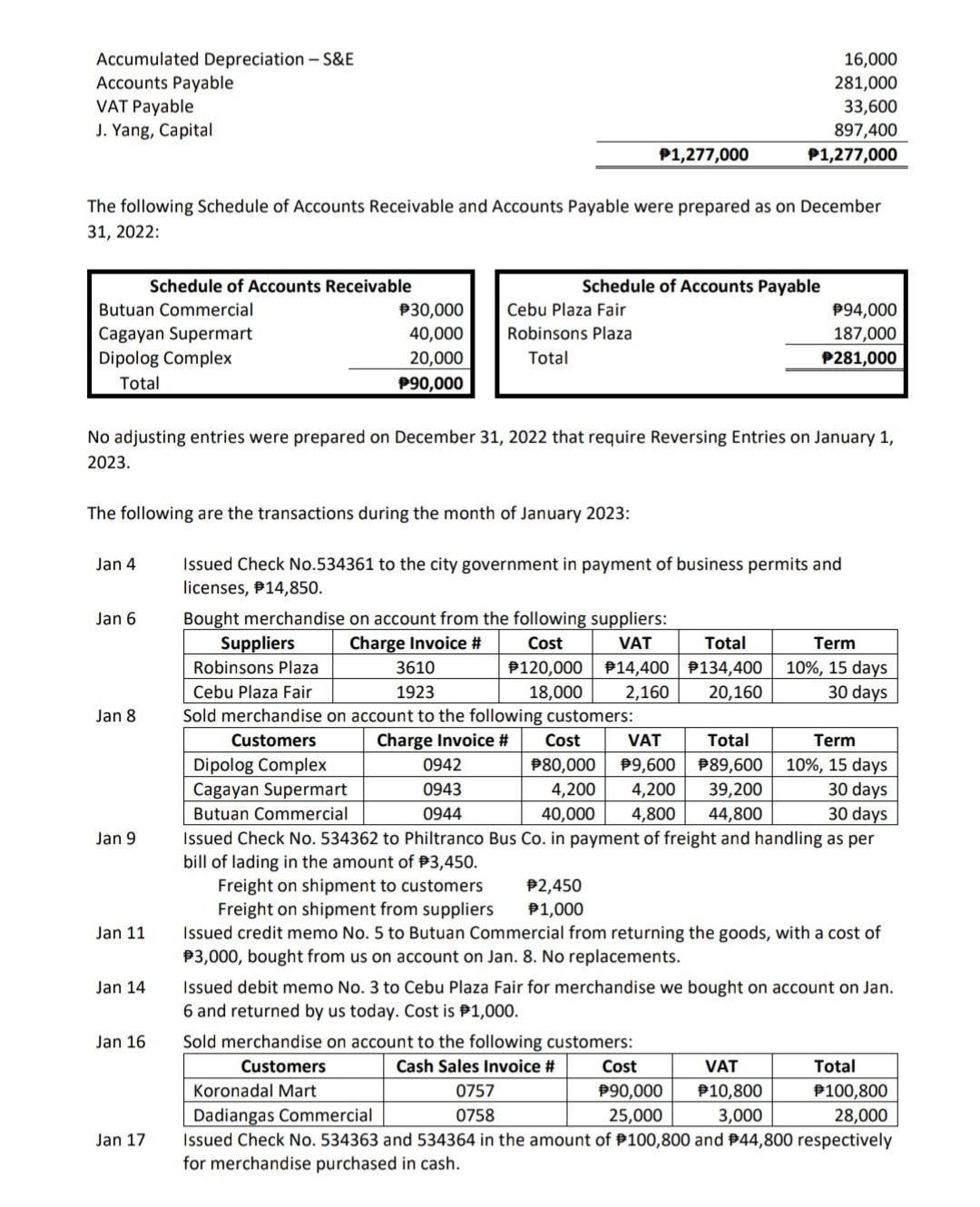

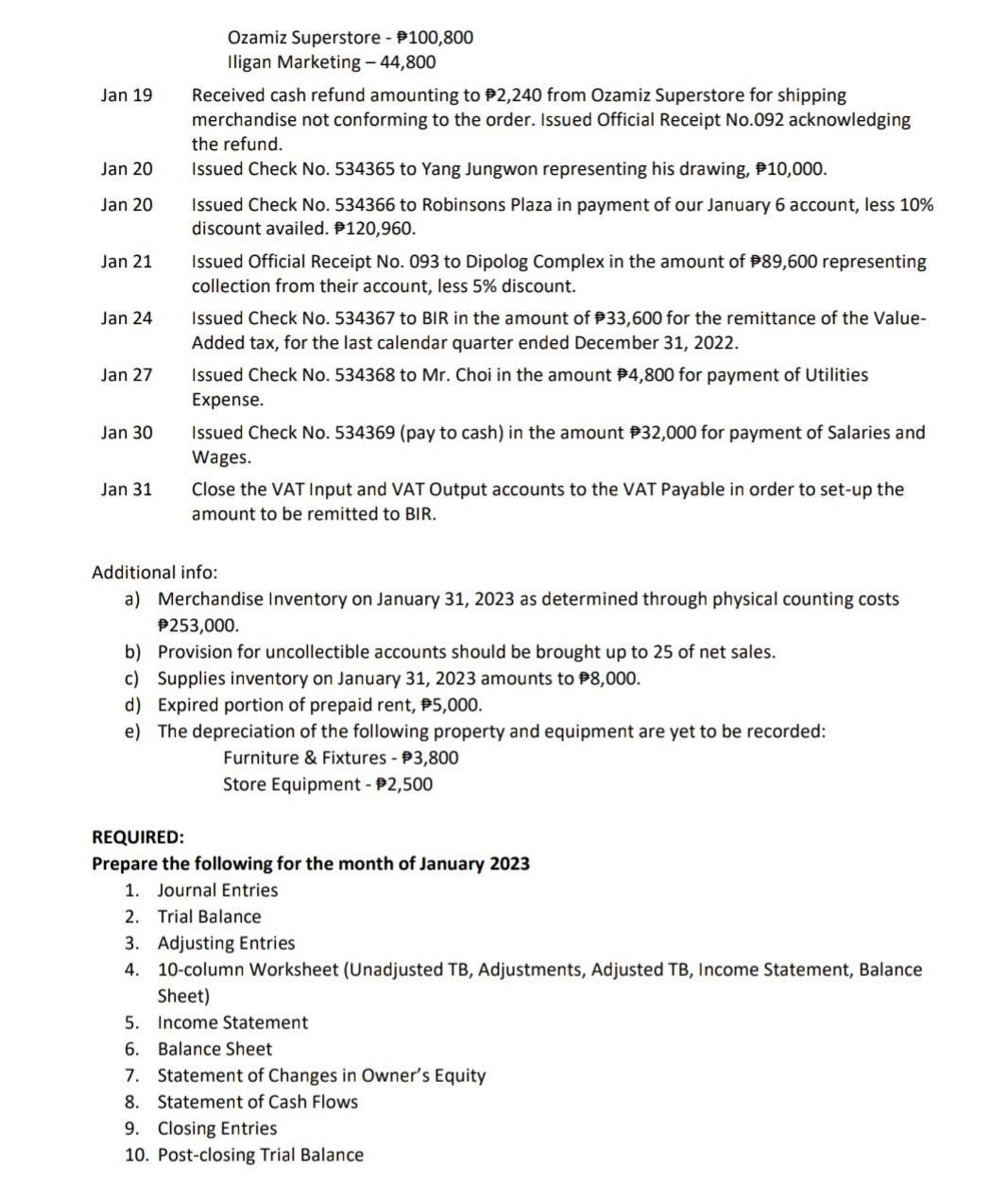

Enhypen Commercial has started its operation last year (2022). Its Chart of Accounts is shown below: Enhypen Commercial Chart of Accounts Page No. 1 2 5 6 3 Accounts Receivable 4 Estimated Uncollectible Accounts Merchandise Inventory 7 8 9 10 11 12 13 14 15 Cash in Bank Petty Cash Fund 16 17 18 ASSETS Supplies Inventory Prepaid Rent Input Tax Furniture & Fixtures Accumulated Depreciation - F&F Store Equipment Accumulated Depreciation - S&E LIABILITIES Accounts Payable Output Tax VAT Payable OWNER'S EQUITY J. Yang, Capital J. Yang, Drawing Income & Expense Summary Cash in Bank Petty Cash Fund ACCOUNT TITLES Accounts Receivable Estimated Uncollectible Accounts Merchandise Inventory Page No. 19 20 21 Supplies Inventory Prepaid Rent Furniture & Fixtures Accumulated Depreciation - F&F Store Equipment 2322 24 25 Sales Sales Discounts Sales Returns & Allowances COST INCOME Purchases Purchase Discounts Purchase Returns & Allowance Freight-in The accountant has already closed the 2022 Books of Accounts and prepared to open its new set of books for this year's accounting period of 2023. The post-closing trial balance that is needed for the opening entry on January 1, 2023 is shown below: EXPENSES Uncollectible Accounts Expense 26 27 Depreciation Expense Salaries & Wages 28 29 Taxes & Licenses 30 Freight Out Utilities Expense Supplies Used 31 32 33 Rent Expense Enhypen Commercial Post-closing Trial Balance December 31, 2022 DEBIT P585,000 1,000 90,000 180,000 11,000 20,000 230,000 160,000 CREDIT $4,000 45,000 Accumulated Depreciation - S&E Accounts Payable VAT Payable J. Yang, Capital The following Schedule of Accounts Receivable and Accounts Payable were prepared as on December 31, 2022: Butuan Commercial Cagayan Supermart Dipolog Complex Total Jan 4 Jan 6 Jan 8 The following are the transactions during the month of January 2023: Jan 9 Jan 11 Schedule of Accounts Receivable No adjusting entries were prepared on December 31, 2022 that require Reversing Entries on January 1, 2023. Jan 14 Jan 16 Jan 17 $30,000 40,000 20,000 P90,000 Suppliers Robinsons Plaza Cebu Plaza Fair Cebu Plaza Fair Robinsons Plaza Total Schedule of Accounts Payable Bought merchandise on account from the following suppliers: Charge Invoice # Cost VAT Dipolog Complex Cagayan Supermart Butuan Commercial P1,277,000 Issued Check No.534361 to the city government in payment of business permits and licenses, #14,850. 3610 1923 Sold merchandise on account to the following customers: Customers Charge Invoice # 120,000 18,000 0757 0758 14,400 2,160 $2,450 $1,000 16,000 281,000 33,600 897,400 P1,277,000 Total 134,400 20,160 VAT Total Term Cost $80,000 P9,600 0942 89,600 10%, 15 days 0943 4,200 4,200 39,200 30 days 0944 40,000 4,800 44,800 30 days Issued Check No. 534362 to Philtranco Bus Co. in payment of freight and handling as per bill of lading in the amount of $3,450. Freight on shipment to customers Freight on shipment from suppliers Issued credit memo No. 5 to Butuan Commercial from returning the goods, with a cost of $3,000, bought from us on account on Jan. 8. No replacements. $94,000 187,000 P281,000 Cost $90,000 25,000 Issued debit memo No. 3 to Cebu Plaza Fair for merchandise we bought on account on Jan. 6 and returned by us today. Cost is $1,000. Term 10%, 15 days 30 days Sold merchandise on account to the following customers: Customers Cash Sales Invoice # Koronadal Mart Dadiangas Commercial Issued Check No. 534363 and 534364 in the amount of 100,800 and 44,800 respectively for merchandise purchased in cash. VAT P10,800 3,000 Total P100,800 28,000 Jan 19 Jan 20 Jan 20 Jan 21 Jan 24 Jan 27 Jan 30 Jan 31 Ozamiz Superstore - $100,800 Iligan Marketing - 44,800 Received cash refund amounting to $2,240 from Ozamiz Superstore for shipping merchandise not conforming to the order. Issued Official Receipt No.092 acknowledging the refund. Issued Check No. 534365 to Yang Jungwon representing his drawing, $10,000. Issued Check No. 534366 to Robinsons Plaza in payment of our January 6 account, less 10% discount availed. #120,960. Issued Official Receipt No. 093 to Dipolog Complex in the amount of $89,600 representing collection from their account, less 5% discount. Issued Check No. 534367 to BIR in the amount of $33,600 for the remittance of the Value- Added tax, for the last calendar quarter ended December 31, 2022. Issued Check No. 534368 to Mr. Choi in the amount $4,800 for payment of Utilities Expense. Issued Check No. 534369 (pay to cash) in the amount $32,000 for payment of Salaries and Wages. Close the VAT Input and VAT Output accounts to the VAT Payable in order to set-up the amount to be remitted to BIR. Additional info: a) Merchandise Inventory on January 31, 2023 as determined through physical counting costs #253,000. b) Provision for uncollectible accounts should be brought up to 25 of net sales. c) Supplies inventory on January 31, 2023 amounts to $8,000. d) Expired portion of prepaid rent, $5,000. e) The depreciation of the following property and equipment are yet to be recorded: Furniture & Fixtures - $3,800 Store Equipment - $2,500 REQUIRED: Prepare the following for the month of January 2023 1. Journal Entries 2. Trial Balance 3. Adjusting Entries 4. 10-column Worksheet (Unadjusted TB, Adjustments, Adjusted TB, Income Statement, Balance Sheet) 5. Income Statement 6. Balance Sheet 7. 8. Statement of Cash Flows Statement of Changes in Owner's Equity 9. Closing Entries 10. Post-closing Trial Balance

Step by Step Solution

★★★★★

3.44 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 of 3 Journal entry for jan 2023 Date Account Dr Cr 20230104 taxes license 14850 bank 14850 check no534361 issued to city governent Date Account Dr Cr 20230106 purchase 120000 vat 14400 account ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started