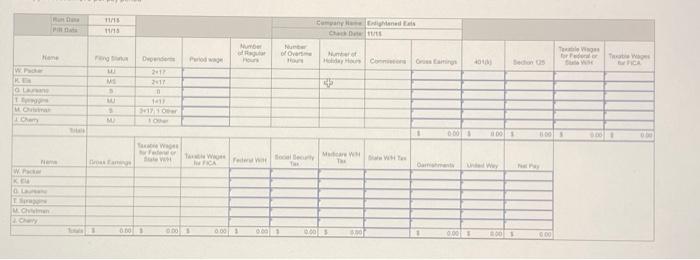

Enlightened Eats in Anchorage, Alaska, has six employees who are paid semimonthly, Calculate the net pay from the information provided below for the November 15 pay date. Assume that all waces are subject to Social Security and Medicare taxes. All 40164 and Section 125 amounts are pre-tax deductions. Use the percentege method for manual payroll systems with Forms W-4 from 2020 or later in Appendix. C. to compute federal income taoes. You do not need to complete the number of hours. Note: Round your intermediate calculations and final answers to 2 decimal places. Recutred: a. Wi Packer Married or Joint, two dependents 417, Box 2 checked Annust poy: $40,900 40104 deduction: $125 per pay period b. K. Ela Married or Separate, two dependents 47, Box 2 checked Antian pay: $53,280 401 W deduction: $250 per pay period C. G. Laureano Single, no dependents, Box 2 not checked Antiof poy: $50,280 Section 125 deduction: $75 per pay period 4010 deduction: $50 per pay period d. Tispraggins Married or Joint one dependent 47,802 not checked Annual pay: $43,920 United Way deductions $50 per pay period Girnishmunt $50 per pay period e. M. Chistman Single, two dependents 47 , one other dependent, Box 2 checked Anntutipory $64,200 Suction 12.5 deduction: $50 per pay period 401(k) deduction: 8 percent of gross pay per pay period t thetiviny Married or Joink, one other dependent, Box 2 checked Annual pay $48,940 40 ind deduction: 575 per pay period Enlightened Eats in Anchorage, Alaska, has six employees who are paid semimonthly, Calculate the net pay from the information provided below for the November 15 pay date. Assume that all waces are subject to Social Security and Medicare taxes. All 40164 and Section 125 amounts are pre-tax deductions. Use the percentege method for manual payroll systems with Forms W-4 from 2020 or later in Appendix. C. to compute federal income taoes. You do not need to complete the number of hours. Note: Round your intermediate calculations and final answers to 2 decimal places. Recutred: a. Wi Packer Married or Joint, two dependents 417, Box 2 checked Annust poy: $40,900 40104 deduction: $125 per pay period b. K. Ela Married or Separate, two dependents 47, Box 2 checked Antian pay: $53,280 401 W deduction: $250 per pay period C. G. Laureano Single, no dependents, Box 2 not checked Antiof poy: $50,280 Section 125 deduction: $75 per pay period 4010 deduction: $50 per pay period d. Tispraggins Married or Joint one dependent 47,802 not checked Annual pay: $43,920 United Way deductions $50 per pay period Girnishmunt $50 per pay period e. M. Chistman Single, two dependents 47 , one other dependent, Box 2 checked Anntutipory $64,200 Suction 12.5 deduction: $50 per pay period 401(k) deduction: 8 percent of gross pay per pay period t thetiviny Married or Joink, one other dependent, Box 2 checked Annual pay $48,940 40 ind deduction: 575 per pay period