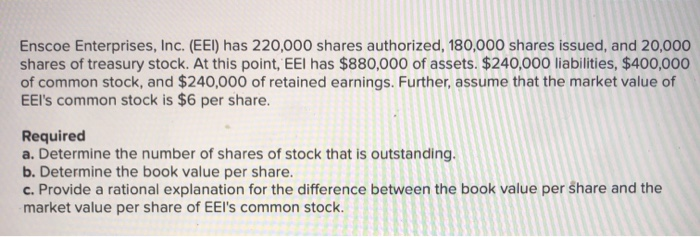

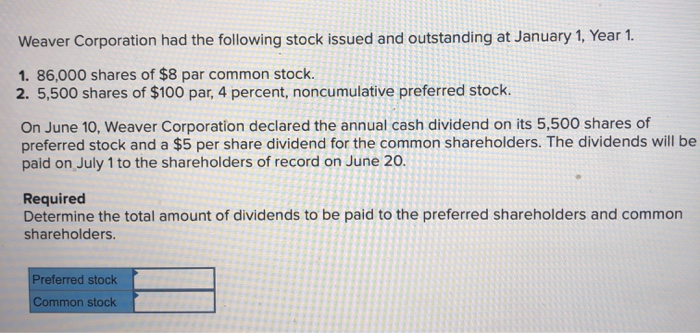

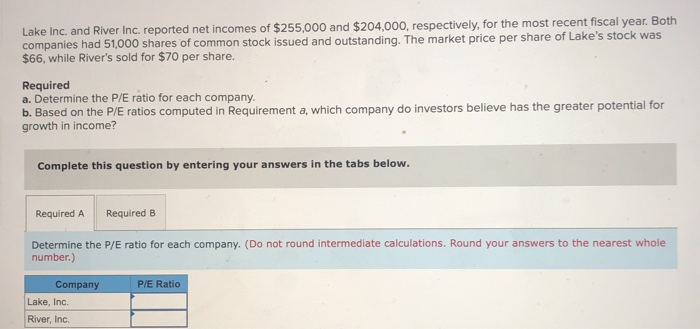

Enscoe Enterprises, Inc. (EEI) has 220,000 shares authorized, 180,000 shares issued, and 20,000 shares of treasury stock. At this point, EEl has $880,000 of assets. $240,000 liabilities, $400,000 of common stock, and $240,000 of retained earnings. Further, assume that the market value of EEI's common stock is $6 per share. Required a. Determine the number of shares of stock that is outstanding. b. Determine the book value per share. c. Provide a rational explanation for the difference between the book value per share and the market value per share of EEl's common stock. Weaver Corporation had the following stock issued and outstanding at January 1, Year 1. 1. 86,000 shares of $8 par common stock. 2. 5,500 shares of $100 par, 4 percent, noncumulative preferred stock. On June 10, Weaver Corporation declared the annual cash dividend on its 5,500 shares of preferred stock and a $5 per share dividend for the common shareholders. The dividends will be paid on July 1 to the shareholders of record on June 20. Required Determine the total amount of dividends to be paid to the preferred shareholders and common shareholders. Preferred stock Common stock Lake Inc. and River Inc. reported net incomes of $255,000 and $204,000, respectively, for the most recent fiscal year. Both companies had 51,000 shares of common stock issued and outstanding. The market price per share of Lake's stock was $66, while River's sold for $70 per share. Required a. Determine the P/E ratio for each company. b. Based on the P/E ratios computed in Requirement a, which company do investors believe has the greater potential for growth in income? Complete this question by entering your answers in the tabs below. Required A Required B Determine the P/E ratio for each company. (Do not round intermediate calculations. Round your answers to the nearest whole number.) Company Lake, Inc P/E Ratio River, Inc. Lake Inc. and River Inc. reported net incomes of $255,000 and $204,000, respectively, for the most recent fiscal year. Both companies had 51,000 shares of common stock issued and outstanding. The market price per share of Lake's stock was $66, while River's sold for $70 per share. Required a. Determine the P/E ratio for each company. b. Based on the P/E ratios computed in Requirement a, which company do investors believe has the greater potential for growth in income? Complete this question by entering your answers in the tabs below. Required A Required B Based on the P/E ratios computed in Requirement a, which company do investors believe has the greater potential for growth in income? Which company do investors believe has the greater potential for growth in income