Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ensure answers are properly cited and referenced where necessary There was an answer for this question from your expert, but it is not straightforward. Can

Ensure answers are properly cited and referenced where necessary

There was an answer for this question from your expert, but it is not straightforward. Can you provide the full calculation for the question? By the way, when calculating the NPV, what WACC will you use Nominal Wacc(10%) or real Wacc(6%) in this particular case?

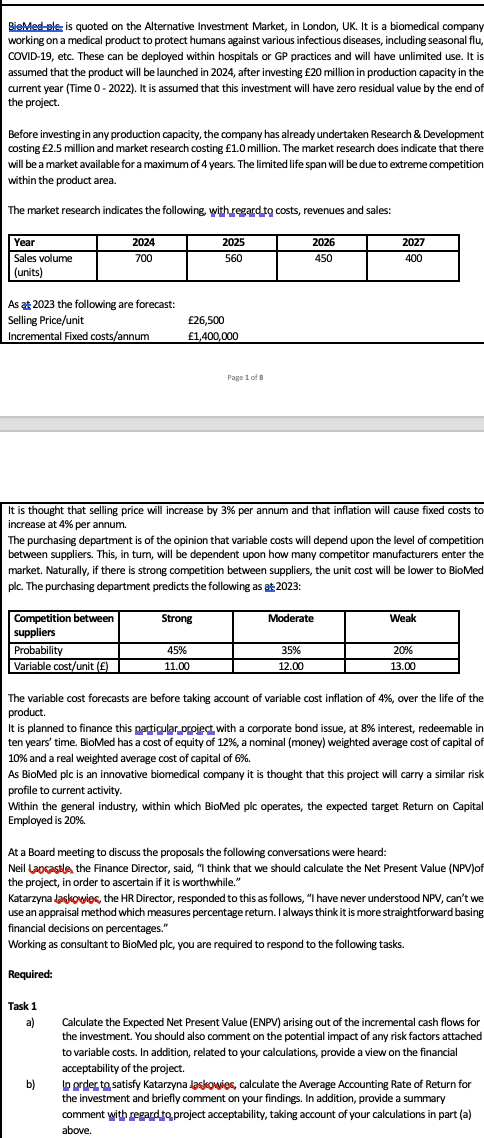

DiemAdd-ele is quoted on the Alternative Investment Market, in London, UK. It is a biomedical company working on a medical product to protect humans against various infectious diseases, including seasonal flu, COVID-19, etc. These can be deployed within hospitals or GP practices and will have unlimited use. It is assumed that the product will be launched in 2024, after investing 20 million in production capacity in the current year (Time 0 - 2022). It is assumed that this investment will have zero residual value by the end of the project. Before irvesting in any production capacity, the company has already undertaken Research \& Development costing 2.5 million and market research costing 1.0 million. The market research does indicate that there will be a market available for a maximum of 4 years. The limited life span will be due to extreme competition within the product area. The market research indicates the following, with regard to costs, revenues and sales: It is thought that selling price will increase by 3% per annum and that inflation will cause fixed costs to increase at 4% per annum. The purchasing department is of the opinion that variable costs will depend upon the level of competition between suppliers. This, in turn, will be dependent upon how many competitor manufacturers enter the market. Naturally, if there is strong competition between suppliers, the unit cost will be lower to BioMed plc. The purchasing department predicts the following as at2023: The variable cost forecasts are before taking account of variable cost inflation of 4%, over the life of the product. It is planned to finance this narticular proiect. with a corporate bond issue, at 8% interest, redeemable in ten years' time. BioMed has a cost of equity of 12%, a nominal (money) weighted average cost of capital of 10% and a real weighted average cost of capital of 6%. As BioMed plc is an innovative biomedical company it is thought that this project will carry a similar risk profile to current activity. Within the general industry, within which BioMed plc operates, the expected target Return on Capital Employed is 20% At a Board meeting to discuss the proposals the following conversations were heard: Neil Laocastle the Finance Director, said, "I think that we should calculate the Net Present Value (NPV)of the project, in order to ascertain if it is worthwhile." Katarzyna dashgviec, the HR Director, responded to this as follows, "I have never understood NPV, can't we use an appraisal method which measures percentage return. I always think it is more straightforward basing financial decisions on percentages." Working as consultant to BioMled plc, you are required to respond to the following tasks. Required: Task 1 a) Calculate the Expected Net Present Value (ENPV) arising out of the incremental cash flows for the investment. You should also comment on the potential impact of amy risk factors attached to variable costs. In addition, related to your calculations, provide a view on the financial acceptability of the project. b) In order to satisfy Katarzyna daskowiec, calculate the Average Accounting Rate of Return for the investment and briefly comment on your findings. In addition, provide a summary comment with regard to project acceptability, taking account of your calculations in part (a) aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started