Question

Enter Pierot Theater Companys trial balance amounts in the Trial Balance columns of a work sheet and complete the work sheet using the following information:

Enter Pierot Theater Companys trial balance amounts in the Trial Balance columns of a work sheet and complete the work sheet using the following information: a. Expired insurance, $17,400. b. Inventory of unused office supplies, $244. c. Inventory of unused cleaning supplies, $468. d. Estimated depreciation on the building, $14,000. e. Estimated depreciation on the theater furnishings, $36,000. f. Estimated depreciation on the office equipment, $3,160. g. The company credits all gift books sold during the year to the Gift Books Liability account. A gift book is a booklet of ticket coupons that is purchased in advance as a gift. The recipient redeems the coupons at some point in the future. On June 30 it was estimated that $37,800 worth of the gift books had been redeemed. h. Accrued but unpaid usher wages at the end of the accounting period, $860. 2. Prepare an income statement, a statement of owners equity, and a balance sheet. Assume no additional investments by the owner, Pierot Rieu. 3. Prepare adjusting and closing entries from the work sheet. 4. Can the work sheet be used as a substitute for the financial statements? Explain your answer.

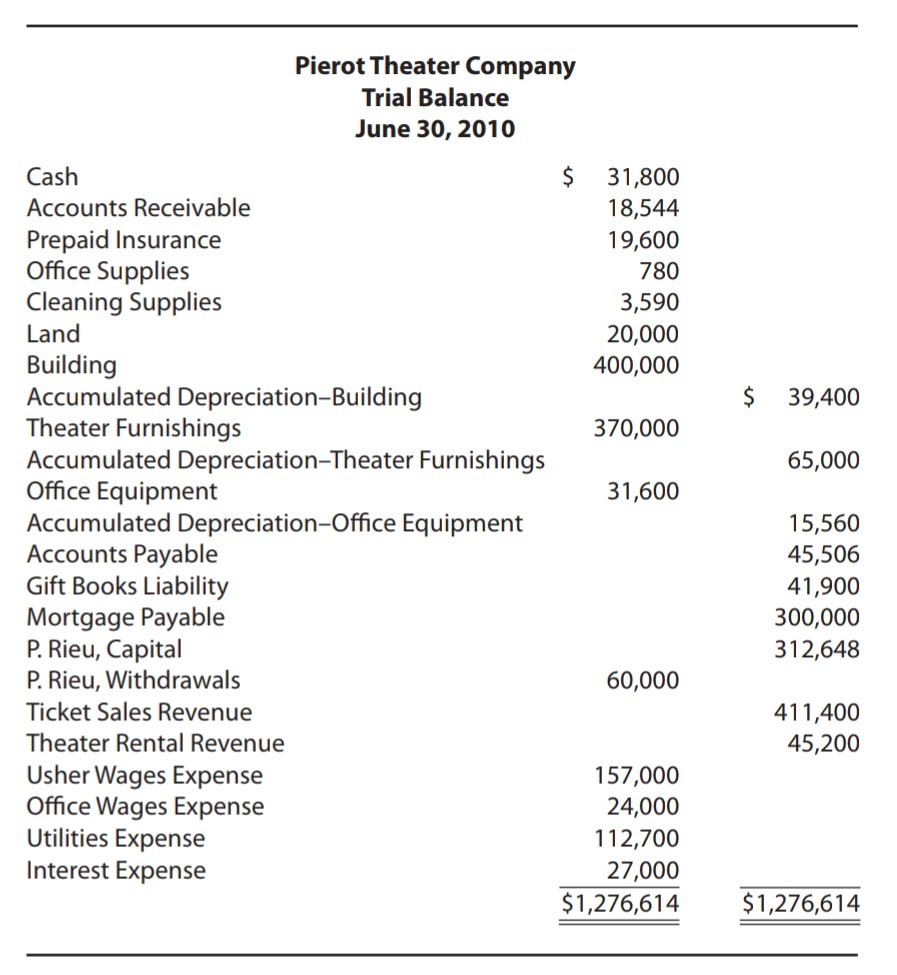

Pierot Theater Company Trial Balance June 30, 2010 Cash $ 31,800 Accounts Receivable 18,544 Prepaid Insurance Office Supplies Cleaning Supplies Land 19,600 780 3,590 20,000 Building Accumulated Depreciation-Building Theater Furnishings Accumulated Depreciation-Theater Furnishings Office Equipment Accumulated Depreciation-Office Equipment Accounts Payable Gift Books Liability Mortgage Payable P. Rieu, Capital P. Rieu, Withdrawals Ticket Sales Revenue 400,000 $ 39,400 370,000 65,000 31,600 15,560 45,506 41,900 300,000 312,648 60,000 411,400 Theater Rental Revenue 45,200 Usher Wages Expense Office Wages Expense Utilities Expense Interest Expense 157,000 24,000 112,700 27,000 $1,276,614 $1,276,614

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started