Answered step by step

Verified Expert Solution

Question

1 Approved Answer

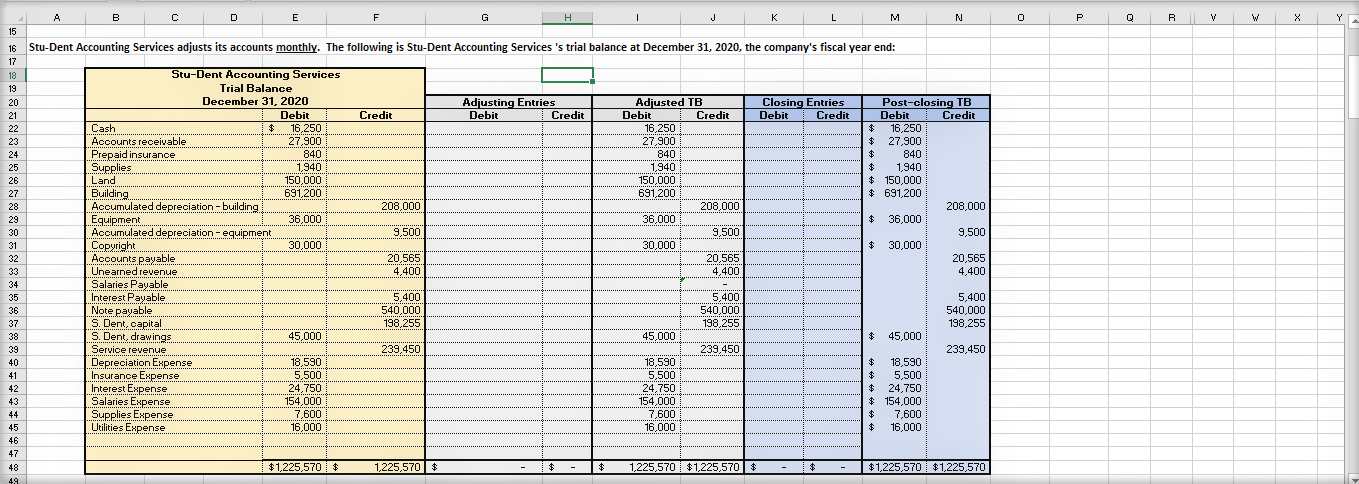

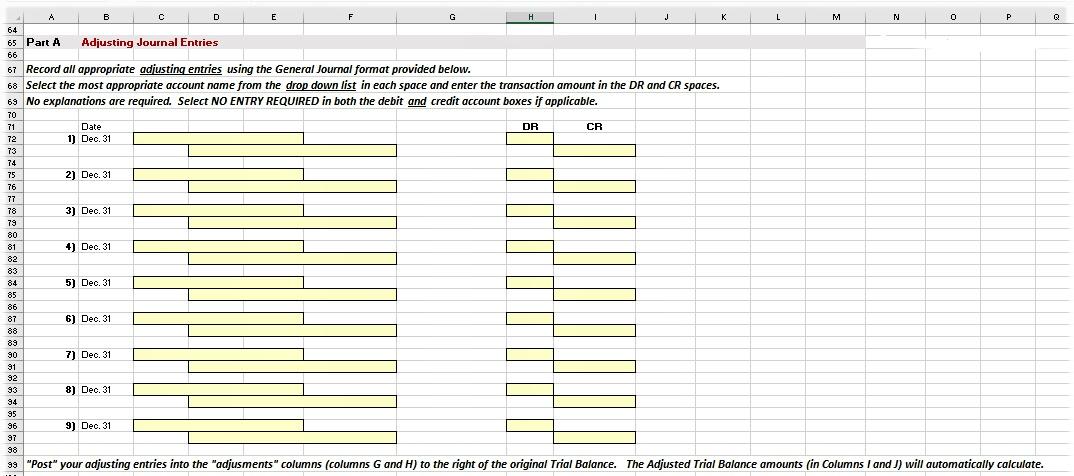

Enter the adjusting journal entries below in the appropriate boxes starting on row 71 (part a). Post the adjusting journal entries to the worksheet below

| Enter the adjusting journal entries below in the appropriate boxes starting on row 71 (part a). | |||||

| Post the adjusting journal entries to the worksheet below using columns G and H. | |||||

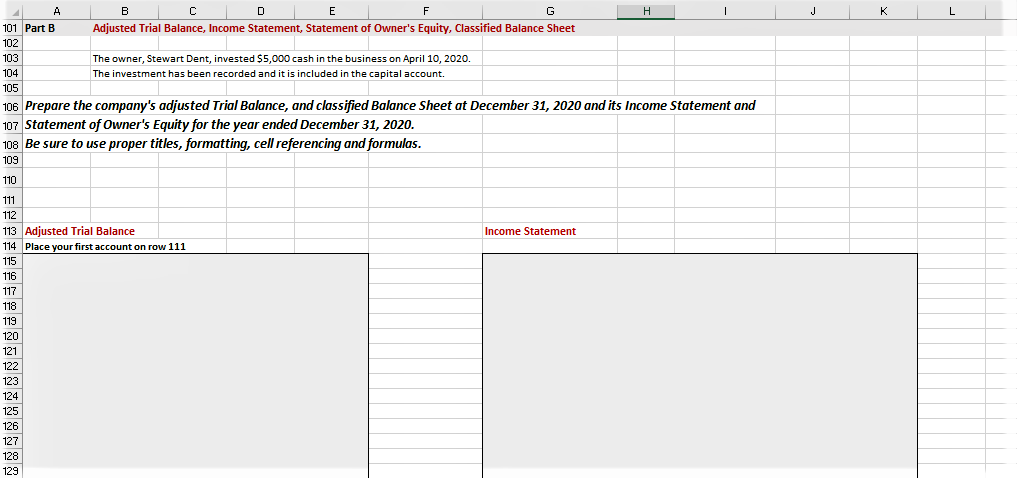

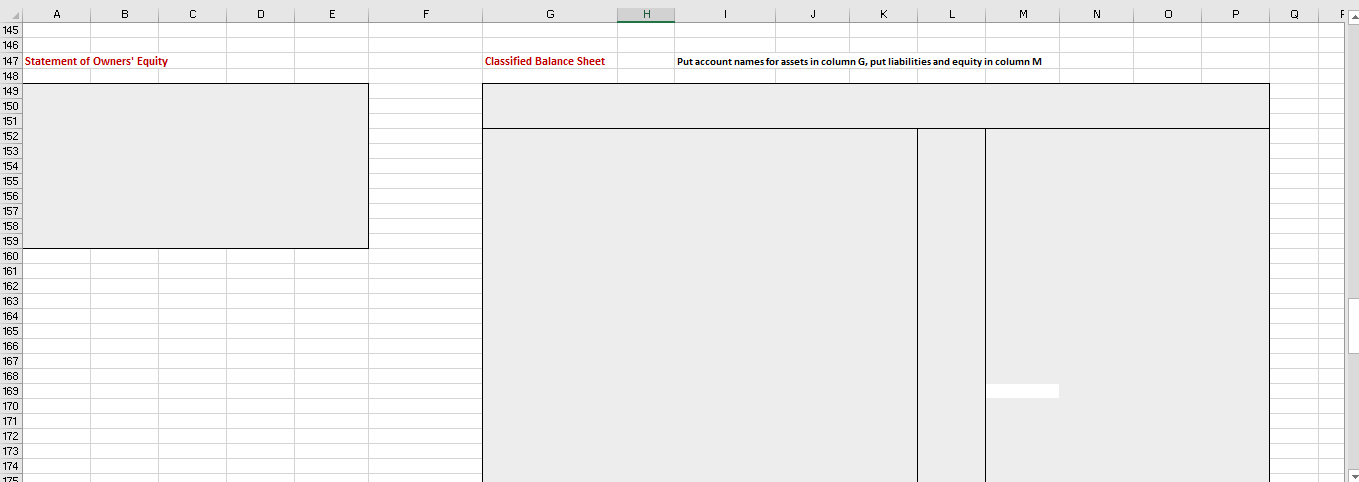

| Prepare the trial balance and the financial statements using cell referencing and formulas (part b). | |||||

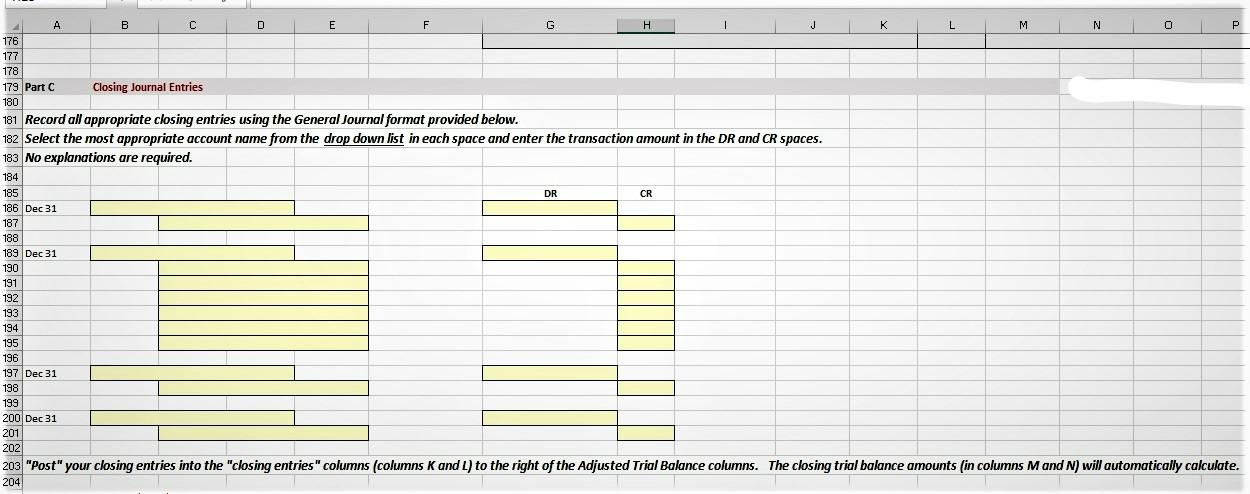

| Enter the closing journal entries below in the appropriate boxes starting on row 186 (part c). | |||||

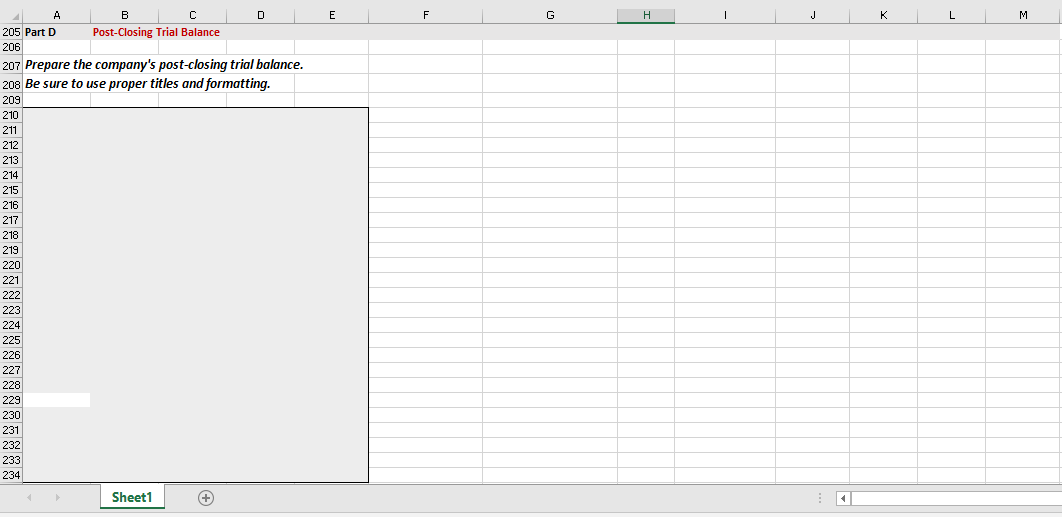

| Prepare the post-closing trial balance using cell referencing and formulas (part d). | |||||

| Additional information: | ||||||||

| 1) | For the Note Payable, Interest is paid on the first day of September for the previous 12 month's interest. The annual interest rate is: | |||||||

| 2) | On December 31, 2020, one-quarter of the unearned revenue was still unearned. | |||||||

| 3) | A physical count of supplies shows $1,010 on hand on December 31, 2020. | |||||||

| 4) | The building has an estimated useful life of 40 years. | |||||||

| 5) | The equipment has an estimated useful life of twelve years. | |||||||

| 6) | Service revenue earned but not recorded at December 31, 2020, was $8,700. | |||||||

| 7) | Salaries of $3,800 have been incurred but are unpaid at December 31, 2020. Payday will be on January 4, 2021. | |||||||

| 8) | During the next fiscal year, $20,000 of the note payable is to be repaid. | |||||||

| 9) | The 12-month insurance policy was purchased for $4,320 cash on February 1, 2020. | |||||||

Please follow the instructions, Do not add or delete rows and columns, use proper cell referencing as mentioned in the instructions above every part.

Please follow the instructions, Do not add or delete rows and columns, use proper cell referencing as mentioned in the instructions above every part.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started