Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Enter the appropriate word (s) to complete the statement. 17. During an audit, the IRS might require that the taxpayer produce the that underlie the

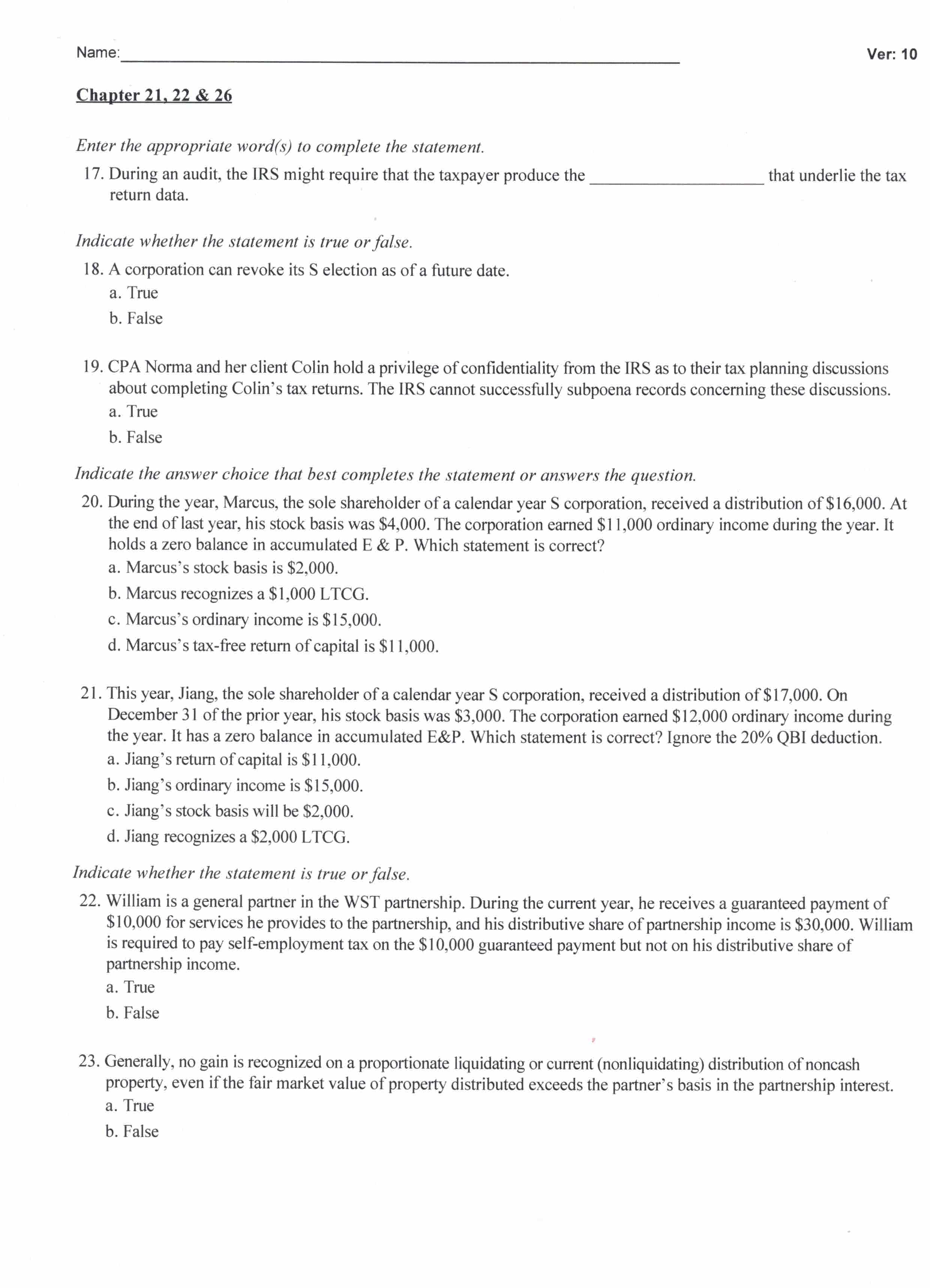

Enter the appropriate word (s) to complete the statement. 17. During an audit, the IRS might require that the taxpayer produce the that underlie the tax return data. Indicate whether the statement is true or false. 18. A corporation can revoke its S election as of a future date. a. True b. False 19. CPA Norma and her client Colin hold a privilege of confidentiality from the IRS as to their tax planning discussions about completing Colin's tax returns. The IRS cannot successfully subpoena records concerning these discussions. a. True b. False Indicate the answer choice that best completes the statement or answers the question. 20 . During the year, Marcus, the sole shareholder of a calendar year S corporation, received a distribution of $16,000. At the end of last year, his stock basis was $4,000. The corporation earned $11,000 ordinary income during the year. It holds a zero balance in accumulated E \& P. Which statement is correct? a. Marcus's stock basis is $2,000. b. Marcus recognizes a $1,000 LTCG. c. Marcus's ordinary income is $15,000. d. Marcus's tax-free return of capital is $11,000. 21. This year, Jiang, the sole shareholder of a calendar year S corporation, received a distribution of $17,000. On December 31 of the prior year, his stock basis was $3,000. The corporation earned $12,000 ordinary income during the year. It has a zero balance in accumulated E\&P. Which statement is correct? Ignore the 20%QBI deduction. a. Jiang's return of capital is $11,000. b. Jiang's ordinary income is $15,000. c. Jiang's stock basis will be $2,000. d. Jiang recognizes a $2,000 LTCG. Indicate whether the statement is true or false. 22. William is a general partner in the WST partnership. During the current year, he receives a guaranteed payment of $10,000 for services he provides to the partnership, and his distributive share of partnership income is $30,000. William is required to pay self-employment tax on the $10,000 guaranteed payment but not on his distributive share of partnership income. a. True b. False 23. Generally, no gain is recognized on a proportionate liquidating or current (nonliquidating) distribution of noncash property, even if the fair market value of property distributed exceeds the partner's basis in the partnership interest. a. True b. False

Enter the appropriate word (s) to complete the statement. 17. During an audit, the IRS might require that the taxpayer produce the that underlie the tax return data. Indicate whether the statement is true or false. 18. A corporation can revoke its S election as of a future date. a. True b. False 19. CPA Norma and her client Colin hold a privilege of confidentiality from the IRS as to their tax planning discussions about completing Colin's tax returns. The IRS cannot successfully subpoena records concerning these discussions. a. True b. False Indicate the answer choice that best completes the statement or answers the question. 20 . During the year, Marcus, the sole shareholder of a calendar year S corporation, received a distribution of $16,000. At the end of last year, his stock basis was $4,000. The corporation earned $11,000 ordinary income during the year. It holds a zero balance in accumulated E \& P. Which statement is correct? a. Marcus's stock basis is $2,000. b. Marcus recognizes a $1,000 LTCG. c. Marcus's ordinary income is $15,000. d. Marcus's tax-free return of capital is $11,000. 21. This year, Jiang, the sole shareholder of a calendar year S corporation, received a distribution of $17,000. On December 31 of the prior year, his stock basis was $3,000. The corporation earned $12,000 ordinary income during the year. It has a zero balance in accumulated E\&P. Which statement is correct? Ignore the 20%QBI deduction. a. Jiang's return of capital is $11,000. b. Jiang's ordinary income is $15,000. c. Jiang's stock basis will be $2,000. d. Jiang recognizes a $2,000 LTCG. Indicate whether the statement is true or false. 22. William is a general partner in the WST partnership. During the current year, he receives a guaranteed payment of $10,000 for services he provides to the partnership, and his distributive share of partnership income is $30,000. William is required to pay self-employment tax on the $10,000 guaranteed payment but not on his distributive share of partnership income. a. True b. False 23. Generally, no gain is recognized on a proportionate liquidating or current (nonliquidating) distribution of noncash property, even if the fair market value of property distributed exceeds the partner's basis in the partnership interest. a. True b. False Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started