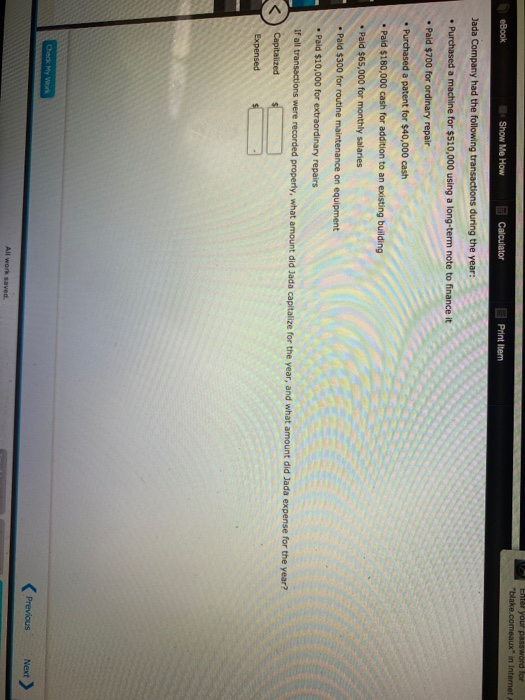

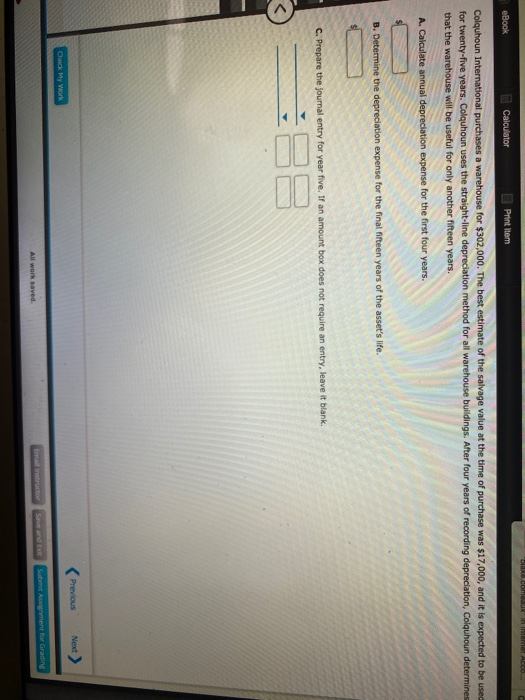

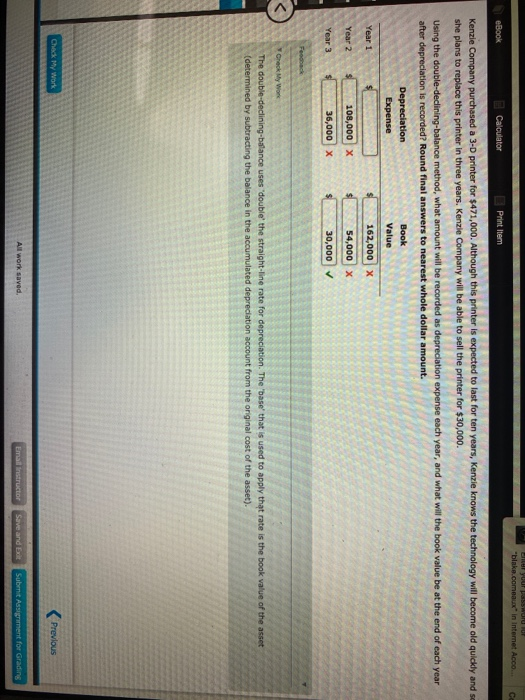

Enter your password for "blake.comeaux" in Internet ebook Show Me How Calculator Print Item Jada Company had the following transactions during the year: Purchased a machine for $510,000 using a long-term note to finance it Pald $700 for ordinary repair Purchased a patent for $40,000 cash Paid $180,000 cash for addition to an existing building Paid $65,000 for monthly salaries - Pald $300 for routine maintenance on equipment Paid $10,000 for extraordinary repairs If all transactions were recorded property, what amount did Jada capitalize for the year, and what amount did Jada expense for the year? Capitalized Expensed Check My Work Previous Next All work saved. Recome more ACCO. eBook Calculator Print Item Colquhoun International purchases a warehouse for $302,000. The best estimate of the salvage value at the time of purchase was $17,000, and it is expected to be used for twenty-five years. Colquhoun uses the straight-line depreciation method for all warehouse buildings. After four years of recording depreciation, Colquhoun determines that the warehouse will be useful for only another fifteen years. A. Calculate annual depreciation expense for the first four years. B. Determine the depreciation expense for the final fifteen years of the asset's life. C. Prepare the journal entry for year five. If an amount box does not require an entry, leave it blank. Previous Next > Check My Work All work saved. Sumt Assignment for Gradine All work saved. Emainstructor Save and her your phone "blake.com as in internet Acco. Ce eBook Calculator Print Item Kenzie Company purchased a 3-D printer for $471,000. Although this printer is expected to last for ten years, Kenzie knows the technology will become old quickly and s she plans to replace this printer in three years, Kenzie Company will be able to sell the printer for $30,000. Using the double-declining-balance method, what amount will be recorded as depreciation expense each year, and what will the book value be at the end of each year after depreciation is recorded? Round final answers to nearest whole dollar amount. Depreciation Expense Book Value value . Year 1 $ 162,000 X Year 2 108,000 x 54,000 x Year 3 36,000 30,000 V The double-declining-balance uses "double the straight-line rate for depreciation. The 'base that is used to apply that rate is the book value of the asset (determined by subtracting the balance in the accumulated depreciation account from the original cost of the asset). Check My Work Previous All work saved. Email Instructor Save and Exit Submit Assignment for Grading