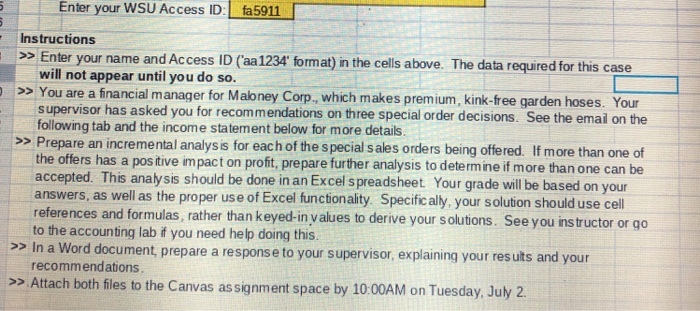

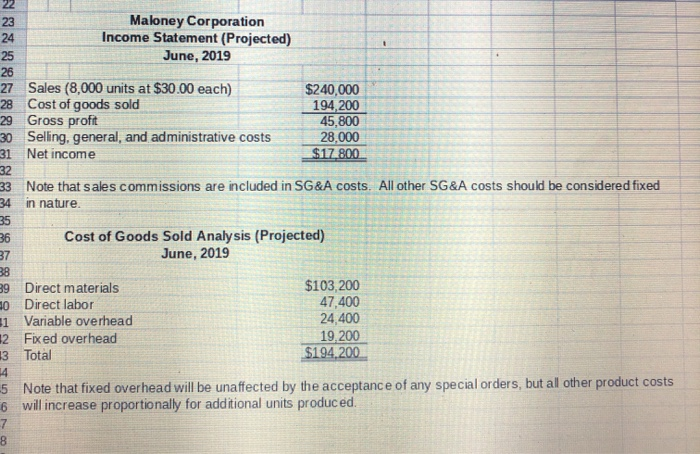

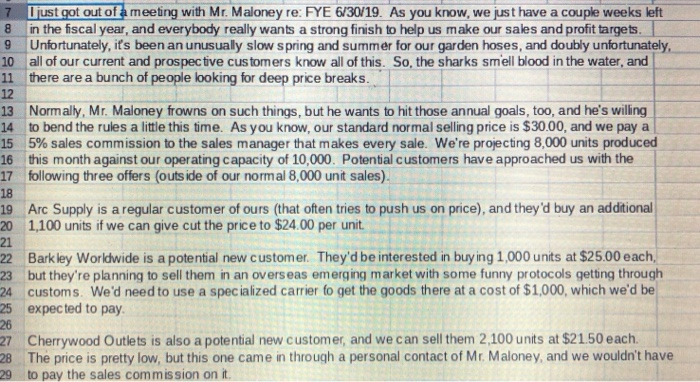

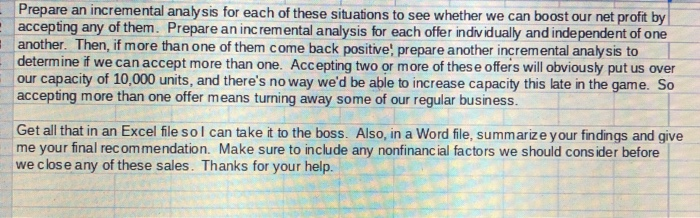

Enter your WSU Access ID: fa5911 Instructions >> Enter your name and Access ID (aa1234' format) in the cells above. The data required for this case will not appear until you do so. >You are a financial manager for Maloney Corp., which makes premium, kink-free garden hoses. Your supervisor has asked you for recommendations on three special order decisions. See the email on the following tab and the income statement below for more details. Prepare an incremental analys is for each of the s pecial s ales orders being offered. If more than one of the offers has a pos itive impact on profit, prepare further analysis to determ ine if more than one can be accepted. This analysis should be done in an Excel spreadsheet Your grade will be based on your answers, as well as the proper use of Excel functionality. Specifically, your solution should use cell references and formulas, rather than keyed-in values to derive your solutions. See you instructor or go to the accounting lab if you need he lp doing this. >> In a Word document, prepare a response to your supervisor, explaining your results and your >> recommendations. >>Attach both files to the Canvas assignment space by 10:00AM on Tuesday, July 2 22 Maloney Corporation Income Statement (Projected) 23 24 June, 2019 25 26 27 Sales (8,000 units at $30.00 each) 28 Cost of goods sold 29 Gross proft Selling, general, and administrative 30 Net income 31 $240,000 194,200 45,800 28,000 $17.800 Costs 32 Note that sales commissions are included in SG&A costs. All other SG&A costs shou ld be considered fixed 33 34 in nature. 35 Cost of Goods Sold Analysis (Projected) June, 2019 36 87 38 Direct materials Direct labor $103,200 47,400 24,400 19,200 $194.200 10 1 Variable overhead 2 Fixed overhead 3 Total 14 5 Note that fixed overhead will be unaffected by the acceptance of any special orders, but all other product costs 6 will increase proportionally for additional units produced. 7 8 7 Ljust got out of a meeting with Mr. Maloney re: FYE 6/30/19. As you know, we just have a couple weeks left in the fiscal year, and everybody really wants a strong finish to help us make our sales and profit targets. 9 Unfortunately, it's been an unusualy slow spring and summer for our garden hoses, and doubly unfortunately, 10 all of our current and prospective customers know all of this. So, the sharks smell blood in the water, and 11 there are a bunch of people looking for deep price breaks. 12 13 Normally, Mr. Maloney frowns on such things, but he wants to hit those annual goals, too, and he's willing 14 to bend the rules a little this time. As you know, our standard normal selling price is $30.00, and we pay a 15 5 % sales commission to the sales manager that makes every sale. We're projecting 8,000 units produced 16 this month against our operating capacity of 10,000. Potential customers have approached us with the 17 following three offers (outs ide of our normal 8,000 unit sales) 18 19 Arc Supply is a regular customer of ours (that often tries to push us on price), and they'd buy an additional 20 1100 units if we can give cut the price to $24.00 per unit 21 22 Bark ley Worldwide is a potential new customer. They'd be interested in buy ing 1,000 units at $25.00 each 23 but they're planning to sell them in an overseas emerging market with some funny protocols getting through 24 customs. We'd need to use a spec ialized carrier fo get the goods there at a cost of $1,000, which we'd be 25 expected to pay. 26 27 Cherrywood Outlets is also a potential new customer, and we can sell them 2,100 units at $21.50 each. 28 The price is pretty low, but this one came in through a personal contact of Mr. Maloney, and we wouldn't have to pay the sales commission on it. 29 Prepare an incremental analysis for each of these situations to see whether we can boost our net profit by accepting any of them. Prepare an incremental analysis for each offer individually and independent of one another. Then, if more than one of them come back positive, prepare another incremental analysis to determine if we can accept more than one. Accepting two or more of thes e offers will obviously put us over our capacity of 10,000 units, and there's no way we'd be able to increase capacity this late in the game. So accepting more than one offer means turning away some of our regular business. Get all that in an Excel file soI can take it to the boss. Also, in a Word file, summarize your findings and give me your final rec om me ndation. Make sure to include any nonfinanc ial factors we should consider before we c los e any of these sales. Thanks for your help