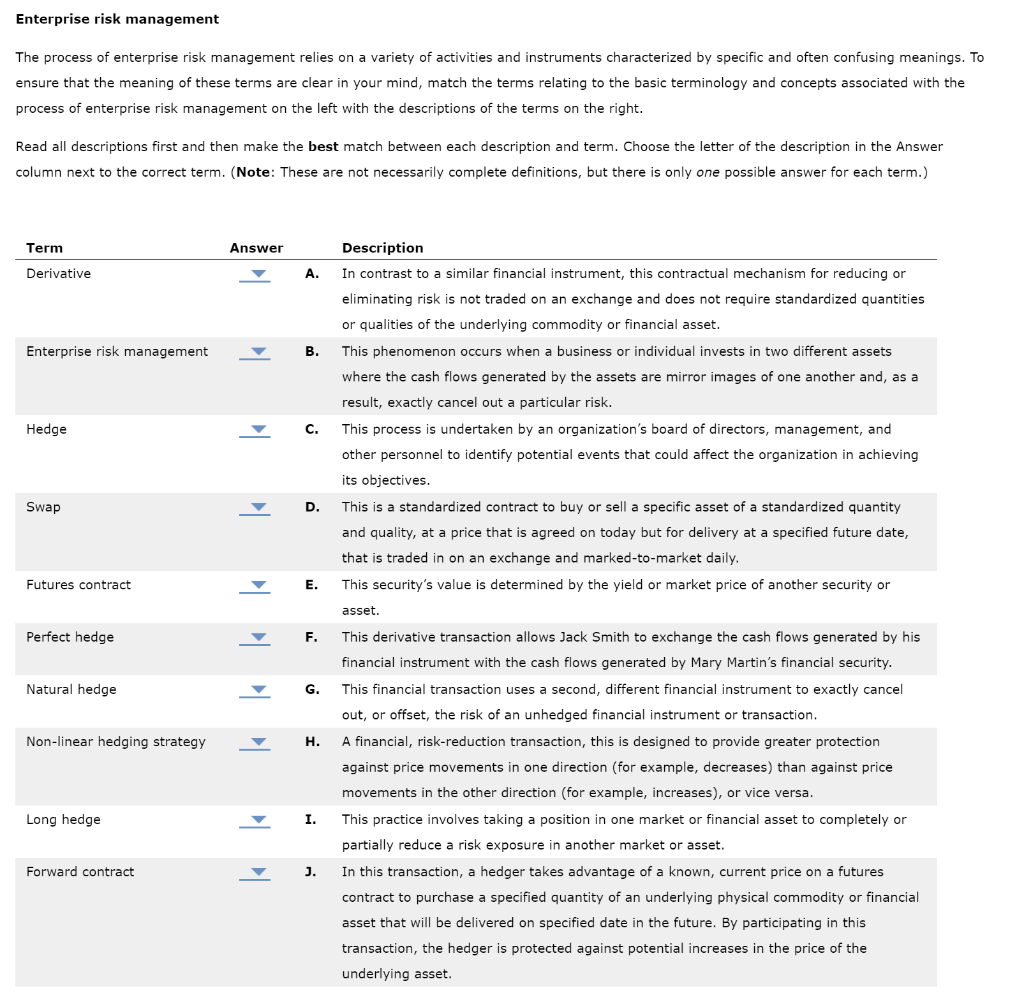

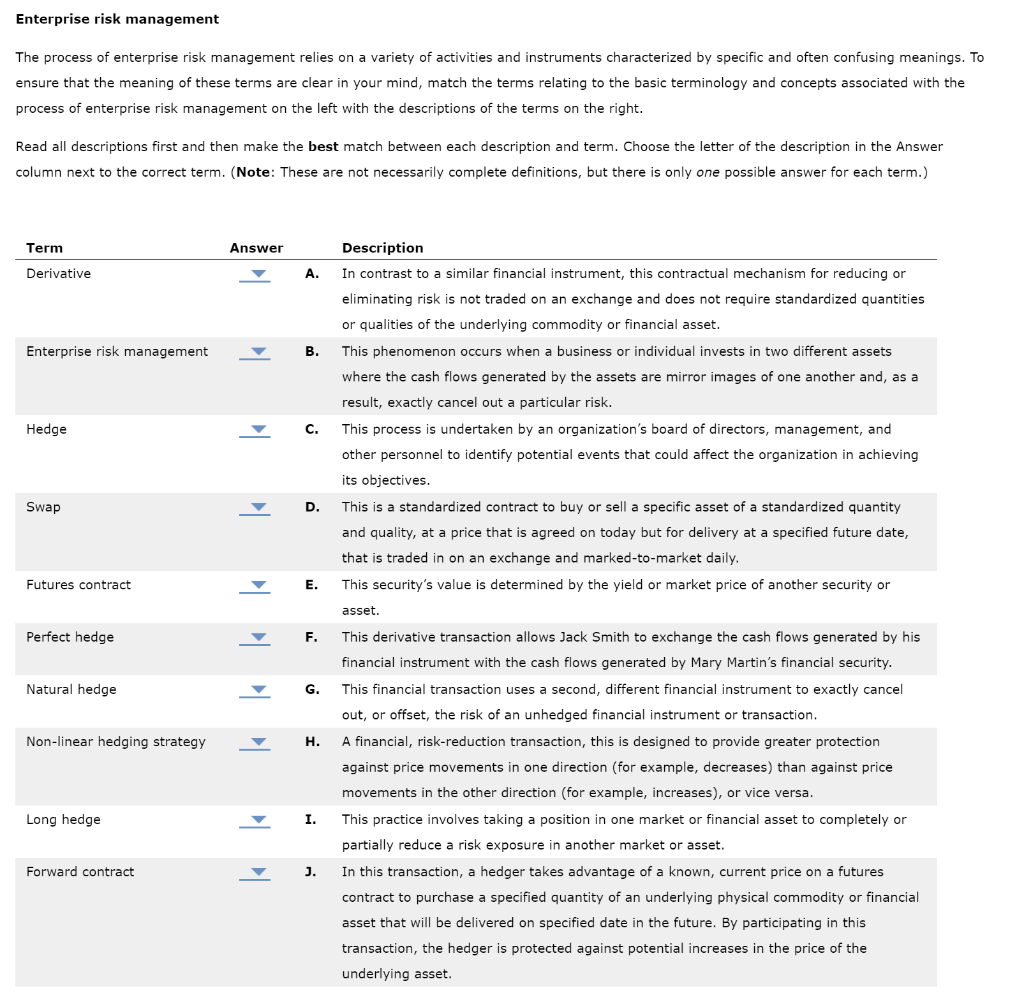

Enterprise risk management The process of enterprise risk management relies on a variety of activities and instruments characterized by specific and often confusing meanings. To ensure that the meaning of these terms are clear in your mind, match the terms relating to the basic terminology and concepts associated with the process of enterprise risk management on the left with the descriptions of the terms on the right. Read all descriptions first and then make the best match between each description and term. Choose the letter of the description in the Answer column next to the correct term. (Note: These are not necessarily complete definitions, but there is only one possible answer for each term.) Description Term Answer In contrast to a similar financial instrument, this contractual mechanism for reducing or Derivative A. eliminating risk is not traded on an exchange and does not require standardized quantities or qualities of the underlying commodity or financial asset. Enterprise risk management . This phenomenon occurs when a business or individual invests in two different assets where the cash flows generated by the assets are mirror images of one another and, as a result, exactly cancel out a particular risk. Hedge This process is undertaken by an organization's board of directors, management, and . other personnel to identify potential events that could affect the organization in achieving its objectives This is a standardized contract to buy or sell a specific asset of a standardized quantity Swap D. and quality, at a price that is agreed on today but for delivery at a specified future date, that is traded in on an exchange and marked-to-market daily. This security's value is determined by the yield or market price of another security or Futures contract . asset Perfect hedge This derivative transaction allows Jack Smith to exchange the cash flows generated by his F. financial instrument with the cash flows generated by Mary Martin's financial security Natural hedge This financial transaction uses a second, different financial instrument to exactly cancel G. out, or offset, the risk of an unhedged financial instrument or transaction Non-linear hedging strategy A financial, risk-reduction transaction, this is designed to provide greater protection . against price movements in one direction (for example, decreases) than against price movements in the other direction (for example, increases), or vice versa. Long hedge I. This practice involves taking a position in one market or financial asset to completely or partially reduce a risk exposure in another market or asset. Forward contract In this transaction, a hedger takes advantage of a known, current price on a futures J. contract to purchase a specified quantity of an underlying physical commodity or financial asset that will be delivered on specified date in the future. By participating in this transaction, the hedger is protected against potential increases in the price of the underlying asset