Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Entity A acquires an equipment on account with the following terms: P500,000 list price, 20%, 10%, 2/10, n/30. Entity A incurs the following additional

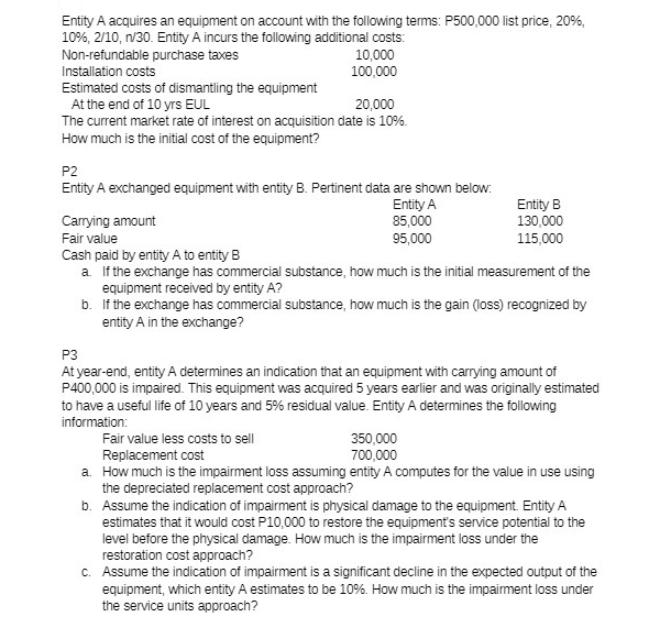

Entity A acquires an equipment on account with the following terms: P500,000 list price, 20%, 10%, 2/10, n/30. Entity A incurs the following additional costs: Non-refundable purchase taxes 10,000 100,000 Installation costs Estimated costs of dismantling the equipment At the end of 10 yrs EUL 20,000 The current market rate of interest on acquisition date is 10%. How much is the initial cost of the equipment? P2 Entity A exchanged equipment with entity B. Pertinent data are shown below: Entity A 85,000 95,000 Entity B 130,000 115,000 Carrying amount Fair value Cash paid by entity A to entity B a. If the exchange has commercial substance, how much is the initial measurement of the equipment received by entity A? b. If the exchange has commercial substance, how much is the gain (loss) recognized by entity A in the exchange? P3 At year-end, entity A determines an indication that an equipment with carrying amount of P400,000 is impaired. This equipment was acquired 5 years earlier and was originally estimated to have a useful life of 10 years and 5% residual value. Entity A determines the following information: 350,000 700,000 Fair value less costs to sell Replacement cost a. How much is the impairment loss assuming entity A computes for the value in use using the depreciated replacement cost approach? b. Assume the indication of impairment is physical damage to the equipment. Entity A estimates that it would cost P10,000 to restore the equipment's service potential to the level before the physical damage. How much is the impairment loss under the restoration cost approach? c. Assume the indication of impairment is a significant decline in the expected output of the equipment, which entity A estimates to be 10%. How much is the impairment loss under the service units approach?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 The initial cost of the equipment is computed as follows List price P500000 Less Trade discount 20 x P500000 P100000 Net price P500000 P100000 P4000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started