Answered step by step

Verified Expert Solution

Question

1 Approved Answer

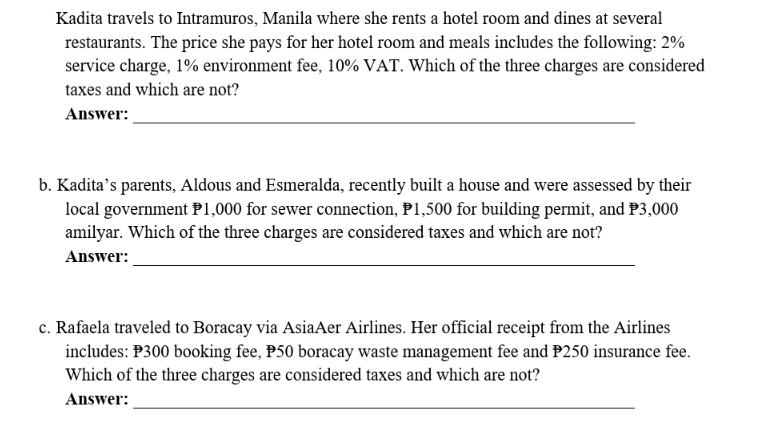

Kadita travels to Intramuros, Manila where she rents a hotel room and dines at several restaurants. The price she pays for her hotel room

Kadita travels to Intramuros, Manila where she rents a hotel room and dines at several restaurants. The price she pays for her hotel room and meals includes the following: 2% service charge, 1% environment fee, 10% VAT. Which of the three charges are considered taxes and which are not? Answer: b. Kadita's parents, Aldous and Esmeralda, recently built a house and were assessed by their local government P1,000 for sewer connection, P1,500 for building permit, and P3,000 amilyar. Which of the three charges are considered taxes and which are not? Answer: c. Rafaela traveled to Boracay via AsiaAer Airlines. Her official receipt from the Airlines includes: P300 booking fee, P50 boracay waste management fee and P250 insurance fee. Which of the three charges are considered taxes and which are not? Answer:

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a For Kaditas expenses in Intramuros Manila The 2 service charge and 1 environment fee are not considered taxes These are service charges and environm...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started