Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Entity A is a first-time adopter with a date of transition to IFRSS of 1 January 2X20. Entity A acquired some subsidiaries, and applies

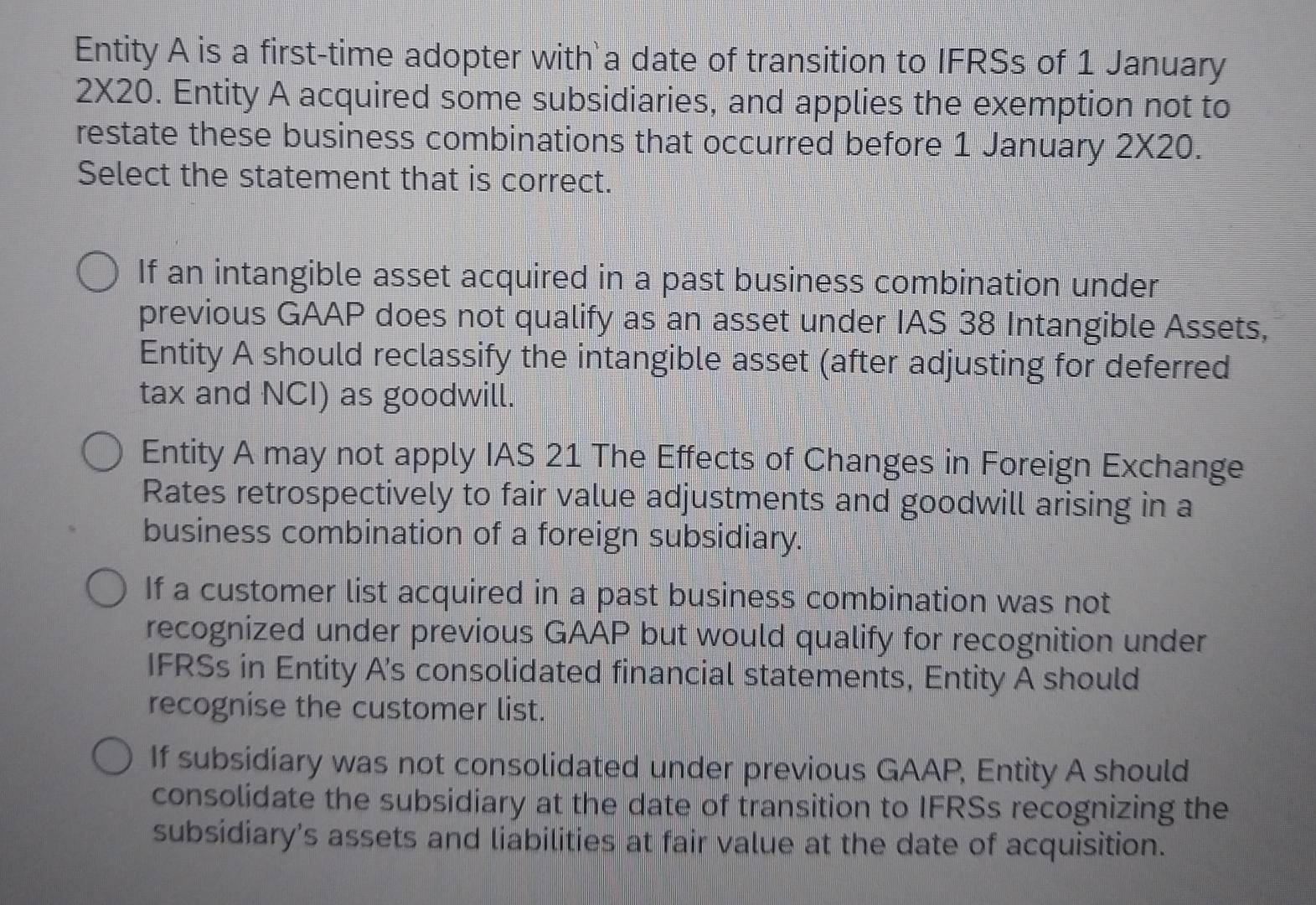

Entity A is a first-time adopter with a date of transition to IFRSS of 1 January 2X20. Entity A acquired some subsidiaries, and applies the exemption not to restate these business combinations that occurred before 1 January 2X20. Select the statement that is correct. If an intangible asset acquired in a past business combination under previous GAAP does not qualify as an asset under IAS 38 Intangible Assets, Entity A should reclassify the intangible asset (after adjusting for deferred tax and NCI) as goodwill. Entity A may not apply IAS 21 The Effects of Changes in Foreign Exchange Rates retrospectively to fair value adjustments and goodwill arising in a business combination of a foreign subsidiary. If a customer list acquired in a past business combination was not recognized under previous GAAP but would qualify for recognition under IFRSS in Entity A's consolidated financial statements, Entity A should recognise the customer list. If subsidiary was not consolidated under previous GAAP, Entity A should consolidate the subsidiary at the date of transition to IFRSS recognizing the subsidiary's assets and liabilities at fair value at the date of acquisition.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The image displays a multiplechoice question that relates to the transition to International Financial Reporting Standards IFRS by a hypoth...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started