Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Entity A started operations in 20x1. The following were the transactions for the year ended December 31, 20x1: 1. The owner invested P200,000 cash to

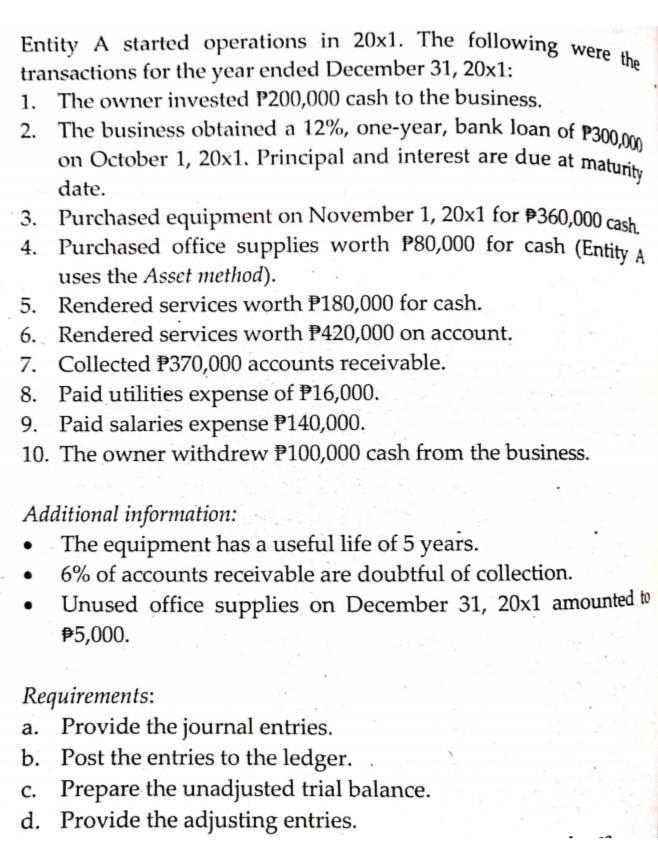

Entity A started operations in 20x1. The following were the transactions for the year ended December 31, 20x1: 1. The owner invested P200,000 cash to the business. 2. The business obtained a 12%, one-year, bank loan of P300,000 on October 1, 20x1. Principal and interest are due at maturity date. 3. Purchased equipment on November 1, 20x1 for $360,000 cash. 4. Purchased office supplies worth P80,000 for cash (Entity A uses the Asset method). 5. Rendered services worth P180,000 for cash. 6. Rendered services worth P420,000 on account. 7. Collected P370,000 accounts receivable. 8. Paid utilities expense of P16,000. 9. Paid salaries expense P140,000. 10. The owner withdrew P100,000 cash from the business. Additional information: The equipment has a useful life of 5 years. 6% of accounts receivable are doubtful of collection. Unused office supplies on December 31, 20x1 amounted to P5,000. Requirements: a. Provide the journal entries. b. Post the entries to the ledger. C. Prepare the unadjusted trial balance. d. Provide the adjusting entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started