Answered step by step

Verified Expert Solution

Question

1 Approved Answer

entral The Canadian Dollar (CAD) has shown higher volatility in recent days. The spot rate is $0.6/CADT. Bank undertakes arbitrage transactions in CAD using a

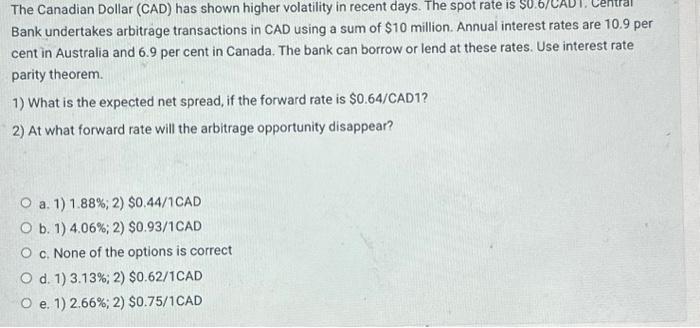

entral The Canadian Dollar (CAD) has shown higher volatility in recent days. The spot rate is $0.6/CADT. Bank undertakes arbitrage transactions in CAD using a sum of $10 million. Annual interest rates are 10.9 per cent in Australia and 6.9 per cent in Canada. The bank can borrow or lend at these rates. Use interest rate parity theorem. 1) What is the expected net spread, if the forward rate is $0.64/CAD1? 2) At what forward rate will the arbitrage opportunity disappear? O a. 1) 1.88%; 2) $0.44/1CAD O b. 1) 4.06%; 2) $0.93/1CAD O c. None of the options is correct O d. 1) 3.13%; 2) $0.62/1CAD O e. 1) 2.66%; 2) $0.75/1CAD

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started