Answered step by step

Verified Expert Solution

Question

1 Approved Answer

entrepreneur finance 6. [Liquidity Rotios and Cash Burn or Build) The Nio Products Compony was started in 2011. The company manufactures components for personal decision

entrepreneur finance

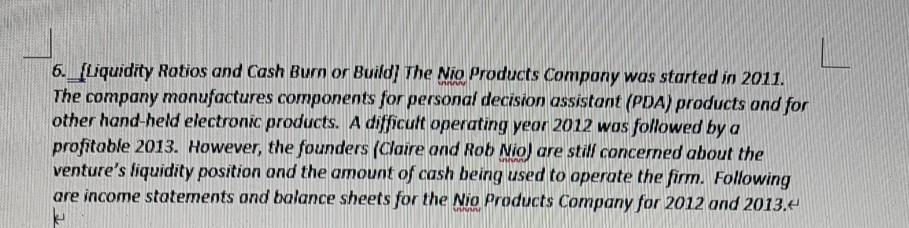

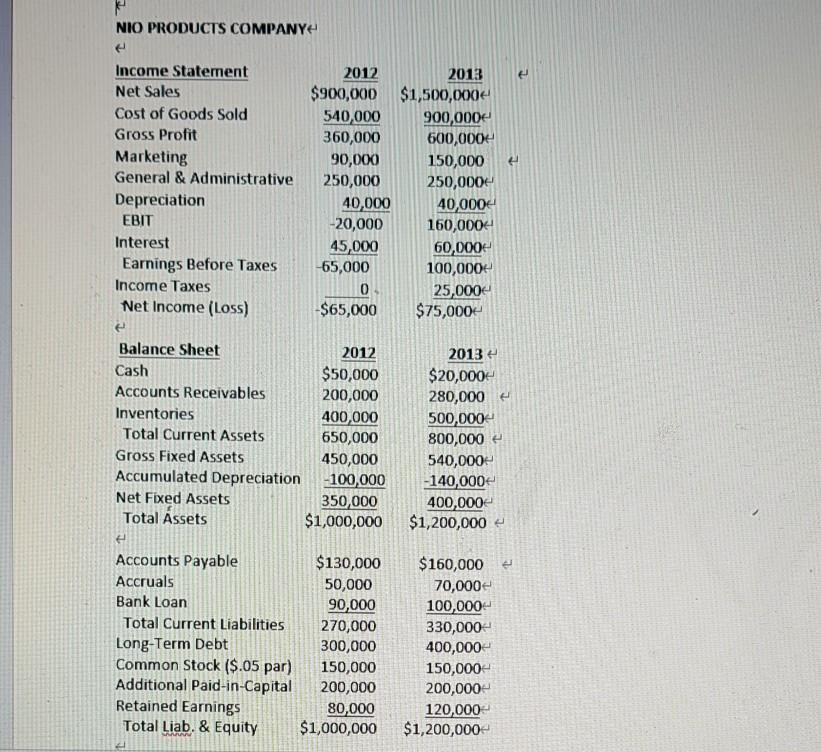

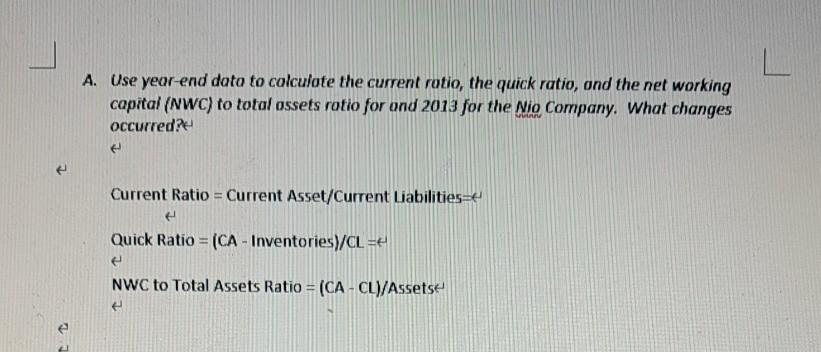

6. [Liquidity Rotios and Cash Burn or Build) The Nio Products Compony was started in 2011. The company manufactures components for personal decision assistant (PDA) products ond for other hand-held electronic products. A difficult operating yeor 2012 wos followed by a profitable 2013. However, the founders (Claire and Rob Nio) are still concerned about the venture's liquidity position ond the amount of cash being used to operate the firm. Following are income statements ond balance sheets for the Nio Products Company for 2012 ond 2013.4 NIO PRODUCTS COMPANY Income Statement Net Sales Cost of Goods Sold Gross Profit Marketing General & Administrative Depreciation EBIT Interest Earnings Before Taxes Income Taxes Net Income (Loss) 2012 $900,000 540,000 360,000 90,000 250,000 40,000 -20,000 45,000 -65,000 0 $65,000 2013 $1,500,000 900,000 600,000 150,000 250,000 40,000+ 160,000 60,000 100,000 25,000 $75,000 Balance Sheet 2012 Cash $50,000 Accounts Receivables 200,000 Inventories 400,000 Total Current Assets 650,000 Gross Fixed Assets 450,000 Accumulated Depreciation -100,000 Net Fixed Assets 350,000 Total Assets $1,000,000 2013 $20,000- 280,000 500,000 800,000 540,000+ -140,000 400,000 $1,200,000 Accounts Payable Accruals Bank Loan Total Current Liabilities Long-Term Debt Common Stock ($.05 par) Additional Paid-in-Capital Retained Earnings Total Liab. & Equity $130,000 50,000 90,000 270,000 300,000 150,000 200,000 80,000 $1,000,000 $160,000 70,000 100,000 330,000 400,000 150,000 200,000 120,000 $1,200,000 A. Use year-end data to calculate the current rotio, the quick ratio, ond the net working capital (NWC) to total ossets rotio for ond 2013 for the Nio Company. What changes occurred? Current Ratio = Current Asset/Current Liabilities - Quick Ratio = (CA - Inventories)/CL = e NWC to Total Assets Ratio = (CA - CL)/AssetsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started