Question

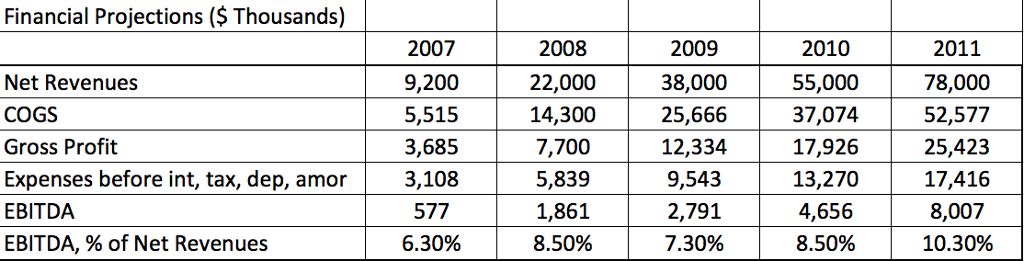

Entrepreneurial Finance 6th Edition Leach/Melicher Part 7 Capstone Cases Case 1: Eco- Products, Inc. (pages 617-634) G. In mid-2007, Eco-Products management prepared a five-year (2007-2011)

Entrepreneurial Finance 6th Edition Leach/Melicher Part 7 Capstone Cases Case 1: Eco- Products, Inc. (pages 617-634)

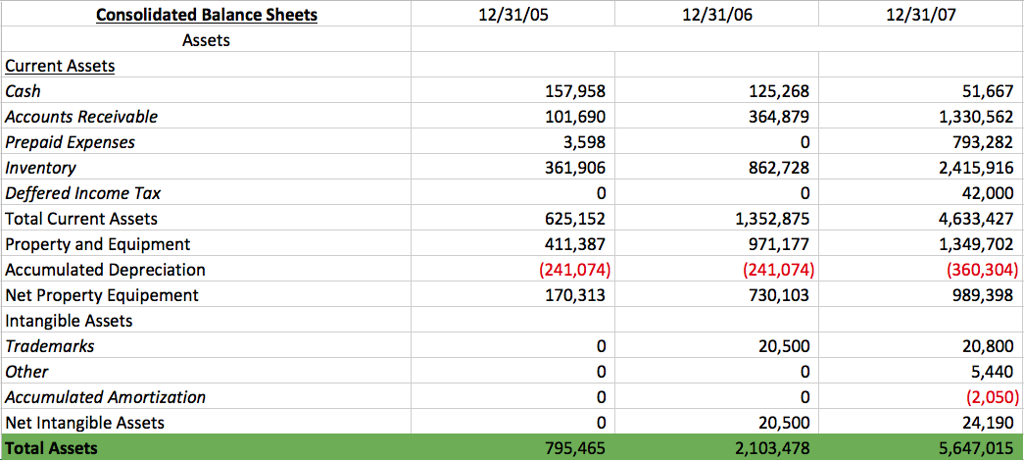

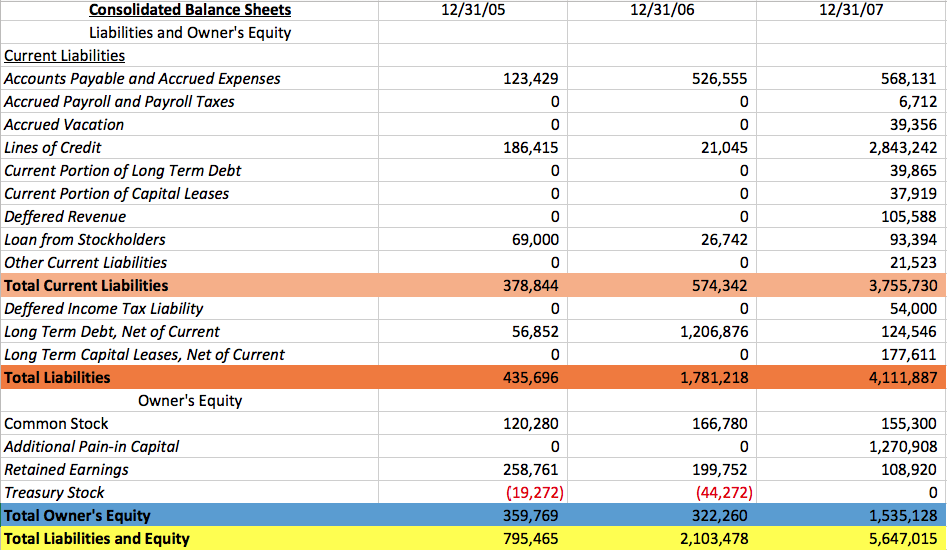

G. In mid-2007, Eco-Products management prepared a five-year (2007-2011) projection of revenues and expenses (see Table 1). What annual rates of growth were projected for net sales? Make a "back-of-the-envelope" estimate of the amounts of additional assets needed to support the sales forecasts. How might these assets be financed? Prepare a "rough" estimate of the possible size of external financing needed to support these sales projections

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started