Question

Penny attended a four-year state college. She took out a student loan to pay for her tuition and room & board for the four

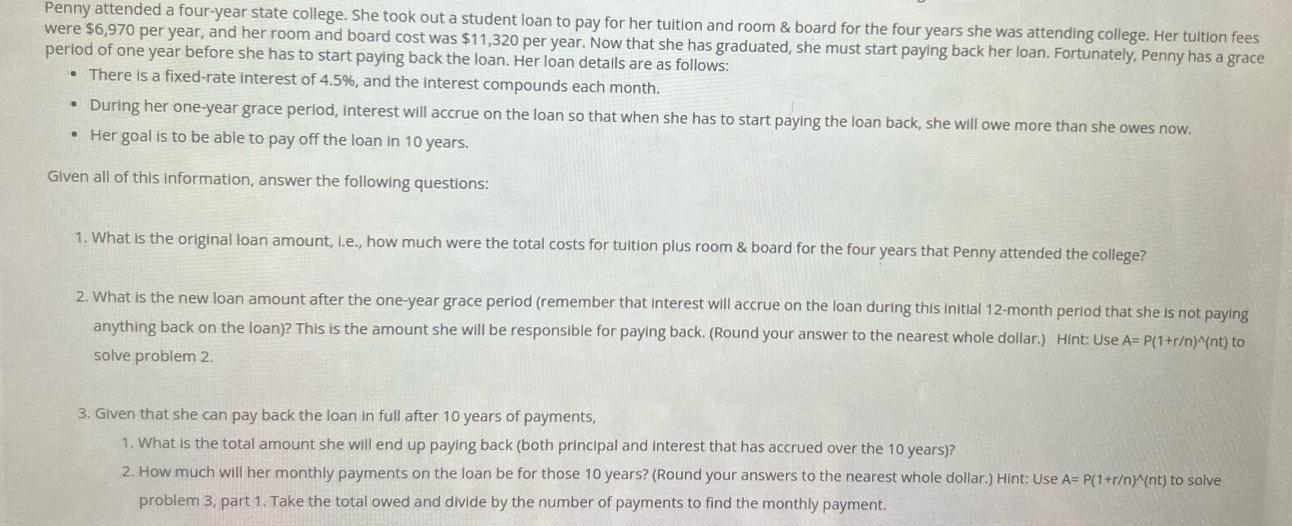

Penny attended a four-year state college. She took out a student loan to pay for her tuition and room & board for the four years she was attending college. Her tuition fees were $6,970 per year, and her room and board cost was $11,320 per year. Now that she has graduated, she must start paying back her loan. Fortunately, Penny has a grace period of one year before she has to start paying back the loan. Her loan details are as follows: There is a fixed-rate interest of 4.5%, and the Interest compounds each month. During her one-year grace period, Interest will accrue on the loan so that when she has to start paying the loan back, she will owe more than she owes now. Her goal is to be able to pay off the loan in 10 years. Given all of this Information, answer the following questions: 1. What is the original loan amount, l.e., how much were the total costs for tuition plus room & board for the four years that Penny attended the college? 2. What is the new loan amount after the one-year grace period (remember that Interest will accrue on the loan during this initial 12-month period that she is not paying anything back on the loan)? This is the amount she will be responsible for paying back. (Round your answer to the nearest whole dollar.) Hint: Use A= P(1+r/n)^(nt) to solve problem 2. 3. Given that she can pay back the loan in full after 10 years of payments, 1. What is the total amount she will end up paying back (both principal and interest that has accrued over the 10 years)? 2. How much will her monthly payments on the loan be for those 10 years? (Round your answers to the nearest whole dollar.) Hint: Use A= P(1+r/n)^(nt) to solve problem 3, part 1. Take the total owed and divide by the number of payments to find the monthly payment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started