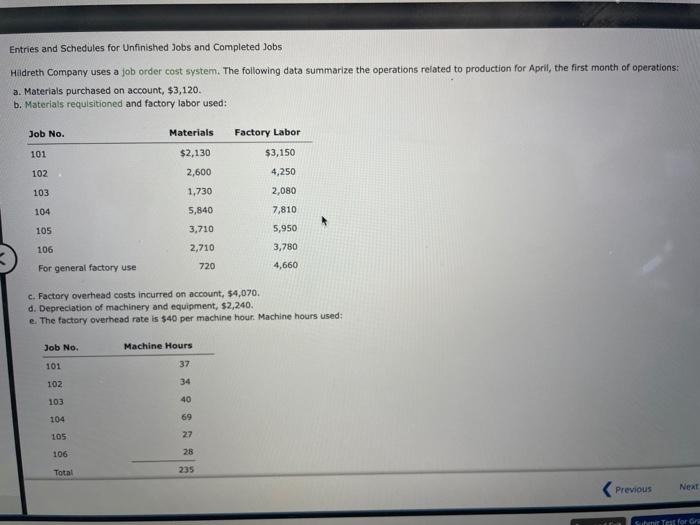

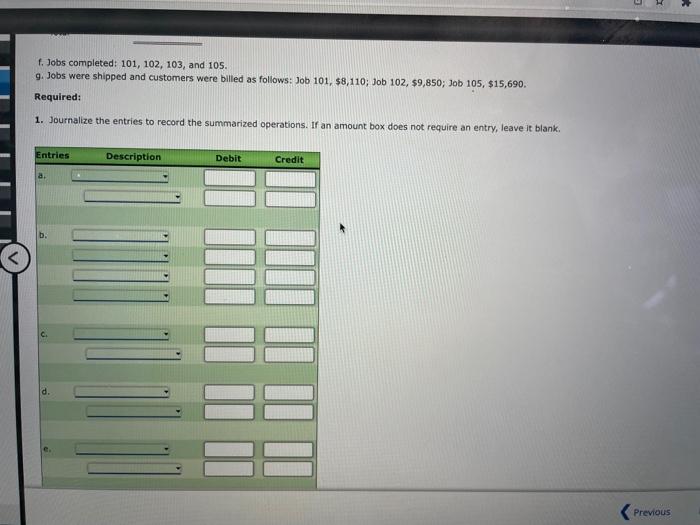

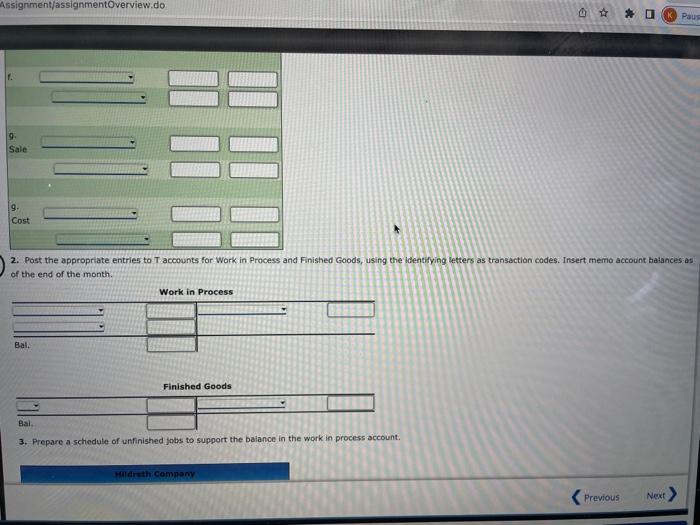

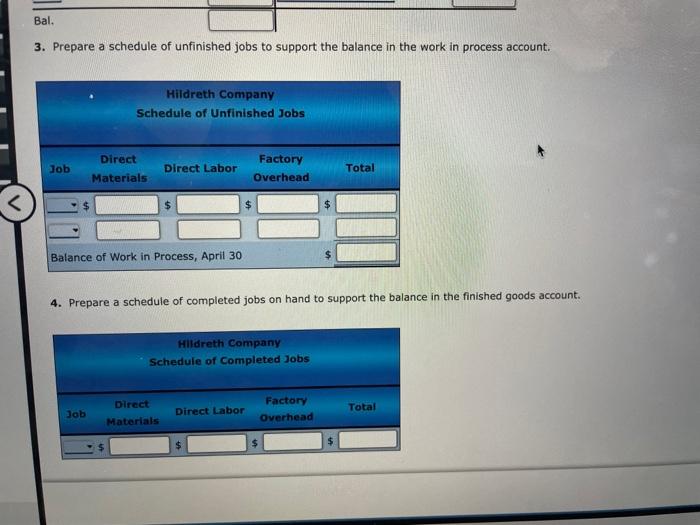

Entries and Schedules for Unfinished Jobs and Completed Jobs Hidreth Company uses a job order cost system. The following data summarize the operations related to production for April, the first month of operations: a. Materials purchased on account, $3,120. b. Materials requisitioned and factory labor used: c. Factory overhead costs incurred on account, 54,070 . d. Depreciation of machinery and equipment, $2,240. e. The factory overhead rate is $40 per machine hour. Machine hours used: f. Jobs completed: 101,102,103, and 105 . 9. Jobs were shipped and customers were bllled as follows: Job 101, $8,110; Job 102, $9,850; job 105, $15,690. Required: 1. Journalize the entries to record the summarized operations. If an amount box does not require an entry, leave it blank. 2. Post the appropriate entries to T accounts for Work in Process and Finished Goods, using the identifying letters as transaction codes. Insert memo account baiances as of the end of the month. 3. Prepare a schedule of unfinished jobs to support the balance in the work in proce-ss account. 3. Prepare a schedule of unfinished jobs to support the balance in the work in process account. 4. Prepare a schedule of completed jobs on hand to support the balance in the finished goods account. Entries and Schedules for Unfinished Jobs and Completed Jobs Hidreth Company uses a job order cost system. The following data summarize the operations related to production for April, the first month of operations: a. Materials purchased on account, $3,120. b. Materials requisitioned and factory labor used: c. Factory overhead costs incurred on account, 54,070 . d. Depreciation of machinery and equipment, $2,240. e. The factory overhead rate is $40 per machine hour. Machine hours used: f. Jobs completed: 101,102,103, and 105 . 9. Jobs were shipped and customers were bllled as follows: Job 101, $8,110; Job 102, $9,850; job 105, $15,690. Required: 1. Journalize the entries to record the summarized operations. If an amount box does not require an entry, leave it blank. 2. Post the appropriate entries to T accounts for Work in Process and Finished Goods, using the identifying letters as transaction codes. Insert memo account baiances as of the end of the month. 3. Prepare a schedule of unfinished jobs to support the balance in the work in proce-ss account. 3. Prepare a schedule of unfinished jobs to support the balance in the work in process account. 4. Prepare a schedule of completed jobs on hand to support the balance in the finished goods account