Answered step by step

Verified Expert Solution

Question

1 Approved Answer

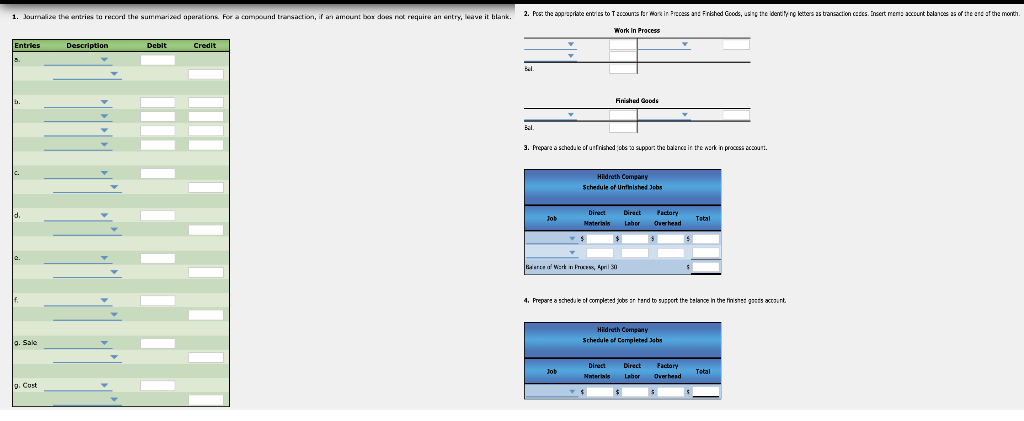

Entries and Schedules for Unfinished Jobs and Completed Jobs Hildreth Company uses a job order cost system. The following data summarize the operations related to

Entries and Schedules for Unfinished Jobs and Completed Jobs

Hildreth Company uses a job order cost system. The following data summarize the operations related to production for April, the first month of operations:

- Materials purchased on account, $2,380.

- Materials requisitioned and factory labor used:

Job No. Materials Factory Labor 101 $2,800 $1,940 102 3,420 2,620 103 2,270 1,280 104 7,670 4,810 105 4,870 3,670 106 3,560 2,330 For general factory use 950 2,870 - Factory overhead costs incurred on account, $5,350.

- Depreciation of machinery and equipment, $1,380.

- The factory overhead rate is $55 per machine hour. Machine hours used:

Job No. Machine Hours 101 29 102 39 103 31 104 72 105 33 106 26 Total 230 - Jobs completed: 101, 102, 103, and 105.

- Jobs were shipped and customers were billed as follows: Job 101, $7,600; Job 102, $9,820; Job 105, $15,240.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started