Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Entries for and Financial Statement Presentation of a Note Griddley Company borrowed $73,000 from the East Salvador Bank on February 1, 2023, on a

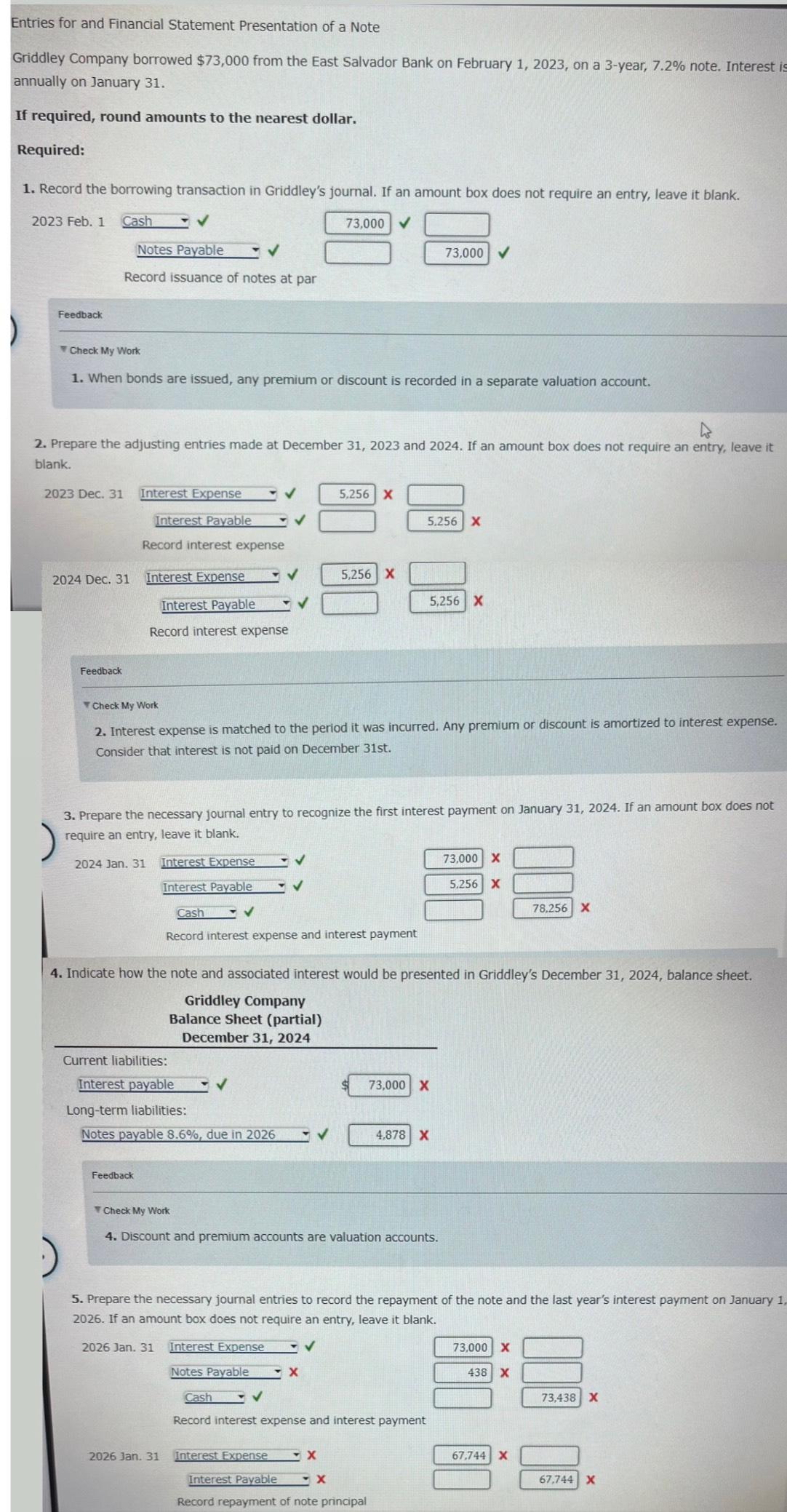

Entries for and Financial Statement Presentation of a Note Griddley Company borrowed $73,000 from the East Salvador Bank on February 1, 2023, on a 3-year, 7.2% note. Interest is annually on January 31. If required, round amounts to the nearest dollar. Required: 1. Record the borrowing transaction in Griddley's journal. If an amount box does not require an entry, leave it blank. 2023 Feb. 1 Cash Notes Payable Record issuance of notes at par Feedback 73,000 73,000 Check My Work 1. When bonds are issued, any premium or discount is recorded in a separate valuation account. 2. Prepare the adjusting entries made at December 31, 2023 and 2024. If an amount box does not require an entry, leave it blank. 2023 Dec. 31 Interest Expense Interest Payable 5,256 X 5,256 X Record interest expense 2024 Dec. 31 Interest Expense 5,256 X Interest Payable 5,256 X Feedback Record interest expense Check My Work 2. Interest expense is matched to the period it was incurred. Any premium or discount is amortized to interest expense. Consider that interest is not paid on December 31st. 3. Prepare the necessary journal entry to recognize the first interest payment on January 31, 2024. If an amount box does not require an entry, leave it blank. 2024 Jan. 31 Interest Expense Interest Payable Cash Record interest expense and interest payment 73,000 X 5.256 X 78,256 X 4. Indicate how the note and associated interest would be presented in Griddley's December 31, 2024, balance sheet. Current liabilities: Griddley Company Balance Sheet (partial) December 31, 2024 Interest payable Long-term liabilities: 73,000 X Notes payable 8.6%, due in 2026 4,878 X Feedback Check My Work 4. Discount and premium accounts are valuation accounts. 5. Prepare the necessary journal entries to record the repayment of the note and the last year's interest payment on January 1, 2026. If an amount box does not require an entry, leave it blank. 2026 Jan. 31 Interest Expense Notes Payable X Cash Record interest expense and interest payment 2026 Jan. 31 Interest Expense X Interest Payable Record repayment of note principal 73,000 X 438 X 73,438 X 67,744 X 67,744 X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started