Answered step by step

Verified Expert Solution

Question

1 Approved Answer

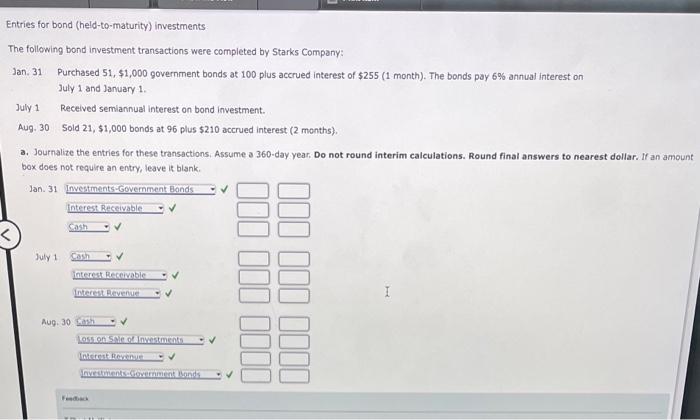

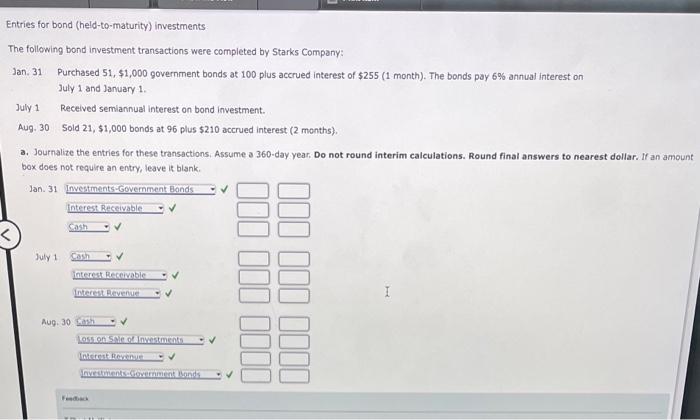

entries for bond (held-to-maturity) investments The following bond investment transactions were completed by Starks Company: Jan. 31 Purchased 51,$1,000 government bonds at 100 plus accrued

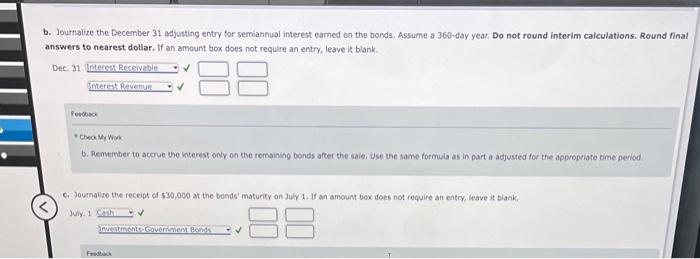

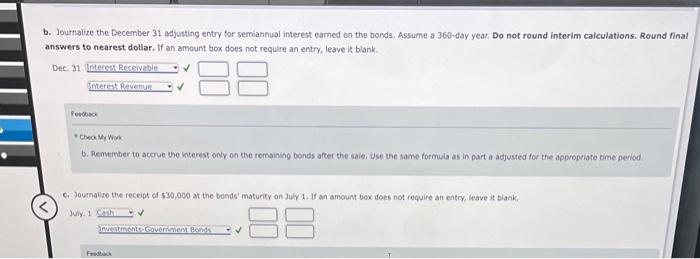

entries for bond (held-to-maturity) investments The following bond investment transactions were completed by Starks Company: Jan. 31 Purchased 51,$1,000 government bonds at 100 plus accrued interest of $255 ( 1 month). The bonds pay 6% annual interest on July 1 and January 1. July 1 Recelved semiannual interest on bond investment. Aug. 30 Sold 21,$1,000 bonds at 96 plus $210 accrued interest ( 2 months). a. Journalize the entries for these transactions, Assume a 360 -day year. Do not round interim calculations. Round final answers to nearest dellar. If a box does not require an entry, leave is blank. b. Journaize the December 31 adjusting entry for semiannual interest earned on the bonds, Assume a 360 -day year. Do not round interim calculations. Round fin answers to nearest dollar. If an amount box does not require an entry, leave it blank. Dec. 31 Pewoosck - Cheo Mr Viok b. Remember to accrue the interest only on the remaining bonds after the sale, Use the same formula as in part a adjusted for the appropriate time penod. c. Joumalize the receipt of $30,000 at the bonds' maturity on July 1. If an amount box does not require an entry, leave it biank; July- 1

entries for bond (held-to-maturity) investments The following bond investment transactions were completed by Starks Company: Jan. 31 Purchased 51,$1,000 government bonds at 100 plus accrued interest of $255 ( 1 month). The bonds pay 6% annual interest on July 1 and January 1. July 1 Recelved semiannual interest on bond investment. Aug. 30 Sold 21,$1,000 bonds at 96 plus $210 accrued interest ( 2 months). a. Journalize the entries for these transactions, Assume a 360 -day year. Do not round interim calculations. Round final answers to nearest dellar. If a box does not require an entry, leave is blank. b. Journaize the December 31 adjusting entry for semiannual interest earned on the bonds, Assume a 360 -day year. Do not round interim calculations. Round fin answers to nearest dollar. If an amount box does not require an entry, leave it blank. Dec. 31 Pewoosck - Cheo Mr Viok b. Remember to accrue the interest only on the remaining bonds after the sale, Use the same formula as in part a adjusted for the appropriate time penod. c. Joumalize the receipt of $30,000 at the bonds' maturity on July 1. If an amount box does not require an entry, leave it biank; July- 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started