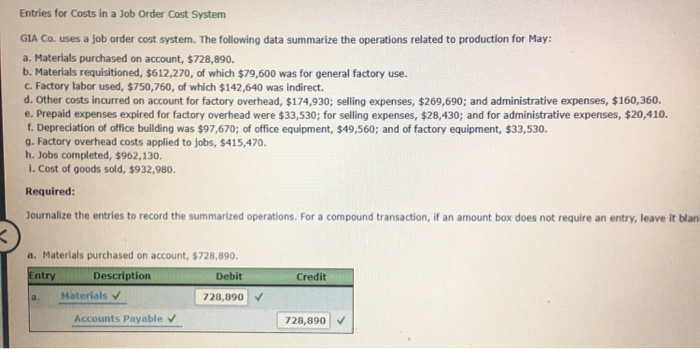

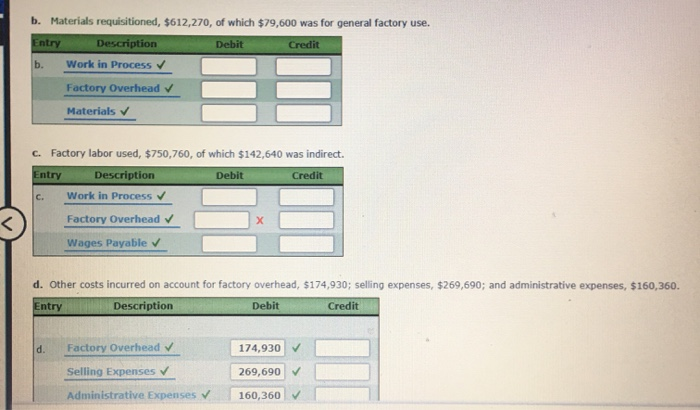

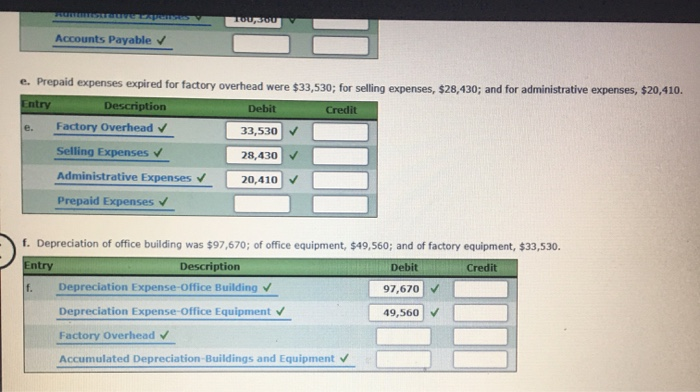

Entries for Costs in a Job Order Cost System GIA Co. uses a job order cost system. The following data summarize the operations related to production for May: a. Materials purchased on account, $728,890. b. Materials requisitioned, $612,270, of which $79,600 was for general factory use. c. Factory labor used, $750,760, of which $142,640 was indirect. d. Other costs incurred on account for factory overhead, $174,930; selling expenses. $269,690; and administrative expenses, $160,360. e. Prepaid expenses expired for factory overhead were $33,530; for selling expenses, $28,430; and for administrative expenses, $20,410. f. Depreciation of office building was $97,670; of office equipment, $49,560; and of factory equipment, $33,530. g. Factory overhead costs applied to jobs, $415,470. h. Jobs completed, $962,130. 1. Cost of goods sold, $932,980. Required: Journalize the entries to record the summarized operations. For a compound transaction, if an amount box does not require an entry, leave it blan Credit a. Materials purchased on account, $728,890. Entry D escription Debit Materials 728,890 Accounts Payable 728,890 b. Materials requisitioned, $612,270, of which $79,600 was for general factory use. Entry Description Debit Credit b. Work in Process Factory Overhead Materials c. Factory labor used, $750,760, of which $142,640 was indirect. Entry Description Debit Credit Work in Process Factory Overhead X I Wages Payable d. Other costs incurred on account for factory overhead, $174,930; selling expenses, $269,690; and administrative expenses, $160,360. Entry Description Debit Credit Factory Overhead 174,930 V 269,690 Selling Expenses Administrative Expenses 160,360 TUU Accounts Payable e. Prepaid expenses expired for factory overhead were $33,530; for selling expenses, $28,430; and for administrative expenses, $20,410. Entry Description Debit Credit e. Factory Overhead 33,530 Selling Expenses 28,430 Administrative Expenses 20,410 Prepaid Expenses f. Depreciation of office building was $97,670; of office equipment, $49,560; and of factory equipment, $33,530. Entry Description Debit Credit Depreciation Expense-Office Building 97,670 Depreciation Expense-Office Equipment 49,560 Factory Overhead Accumulated Depreciation Buildings and Equipment