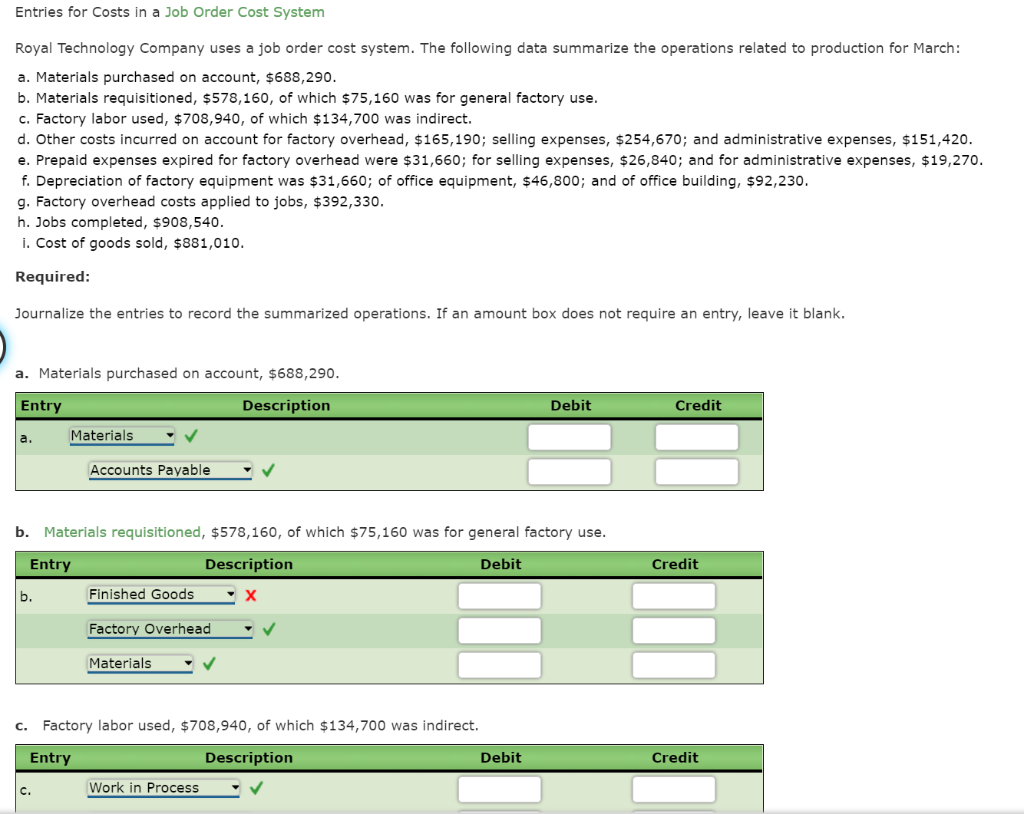

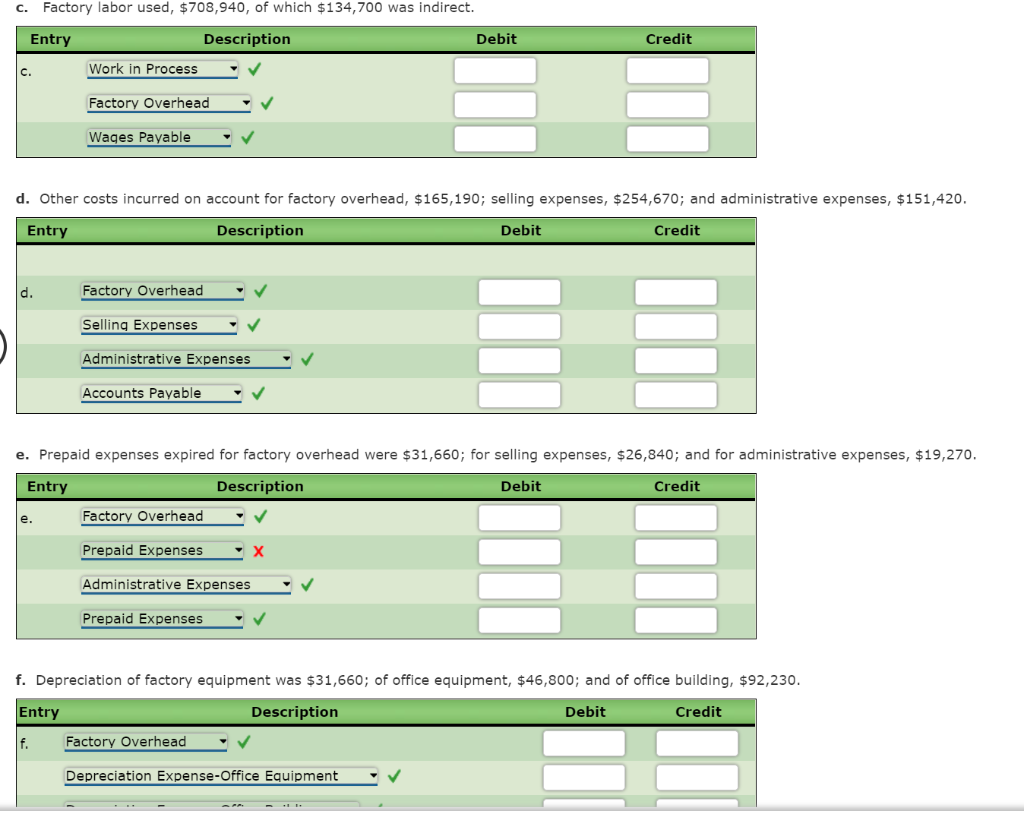

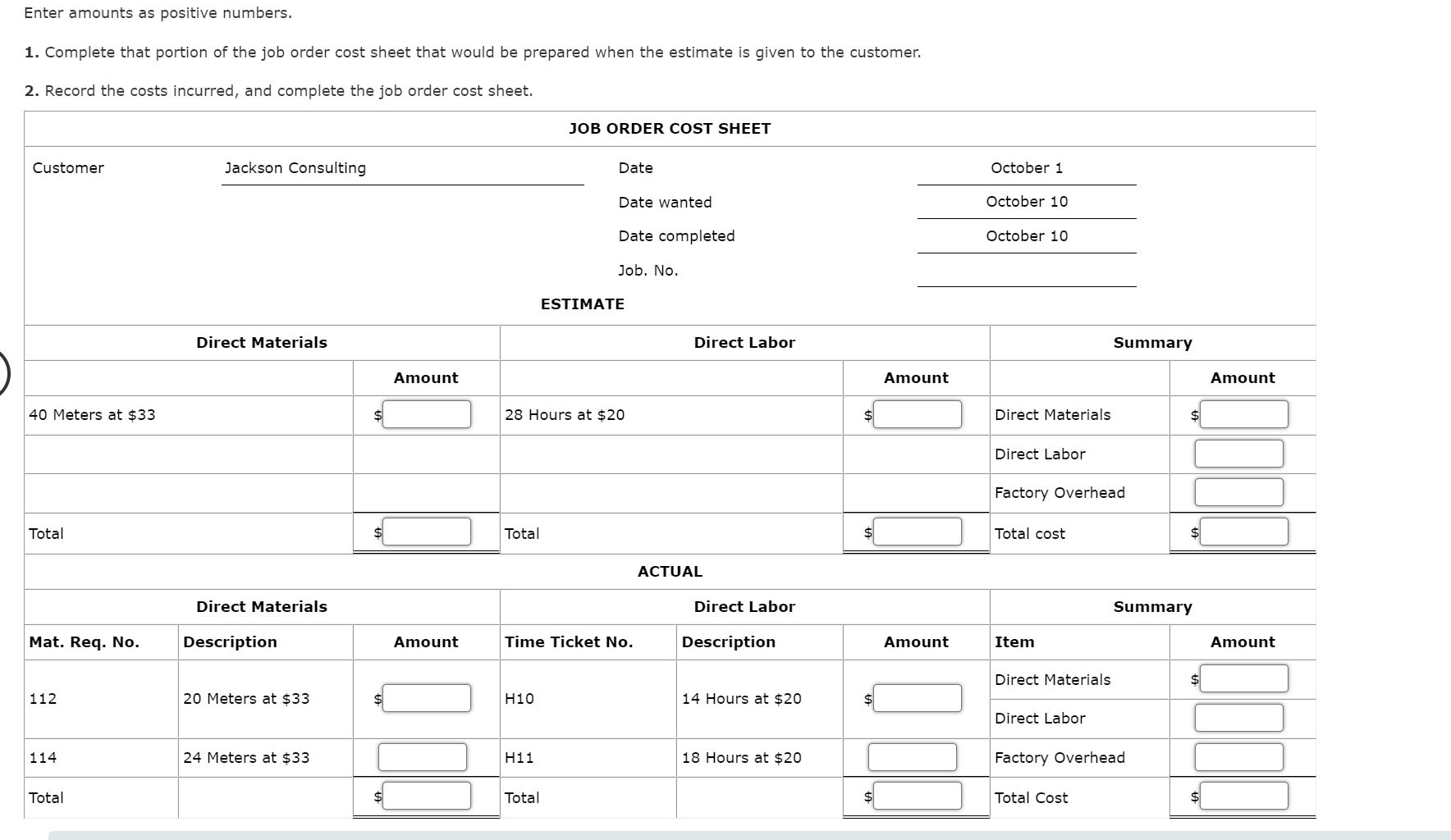

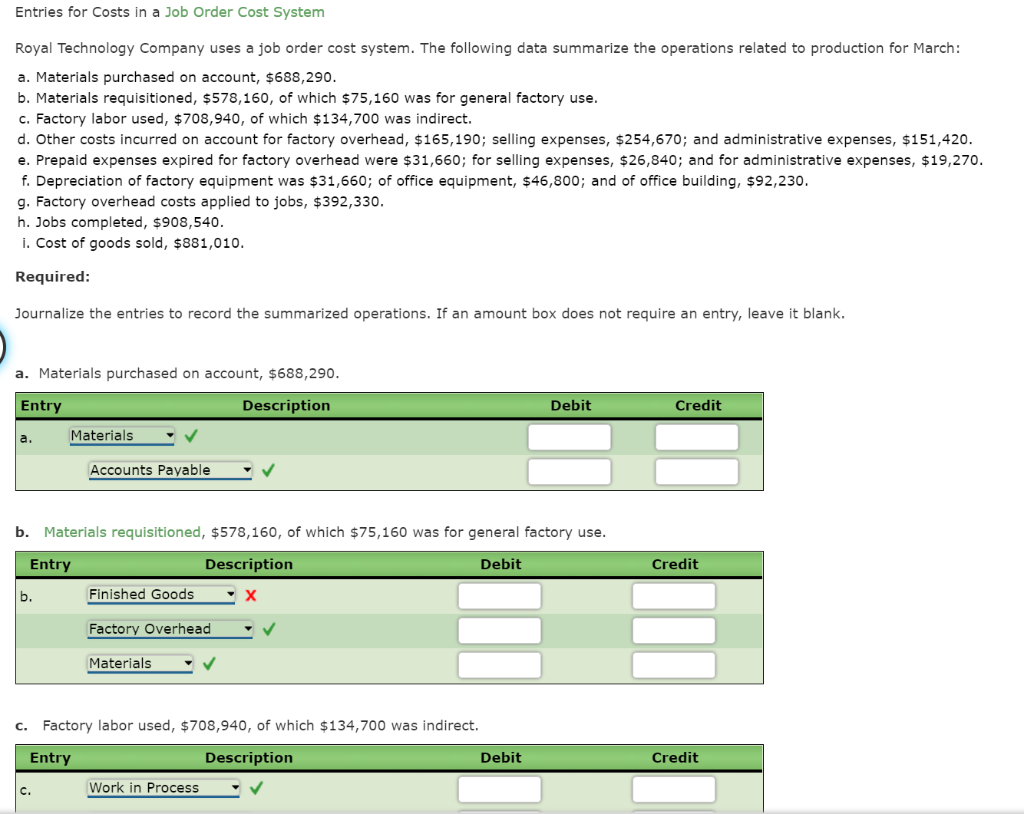

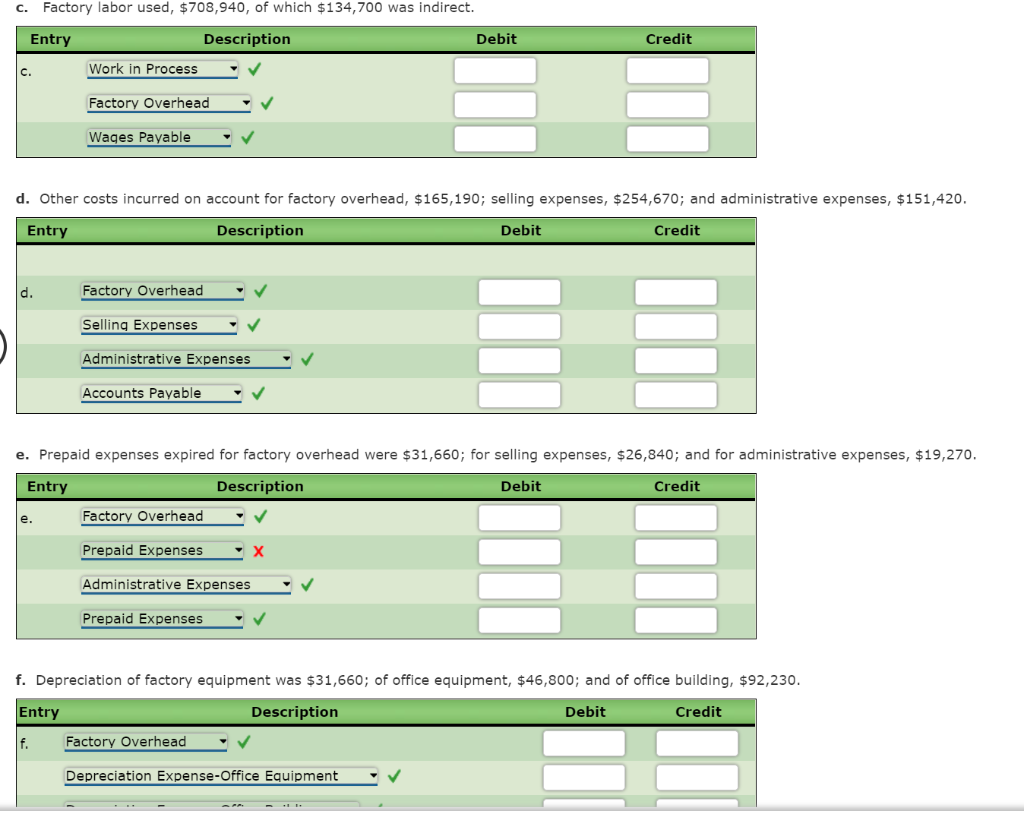

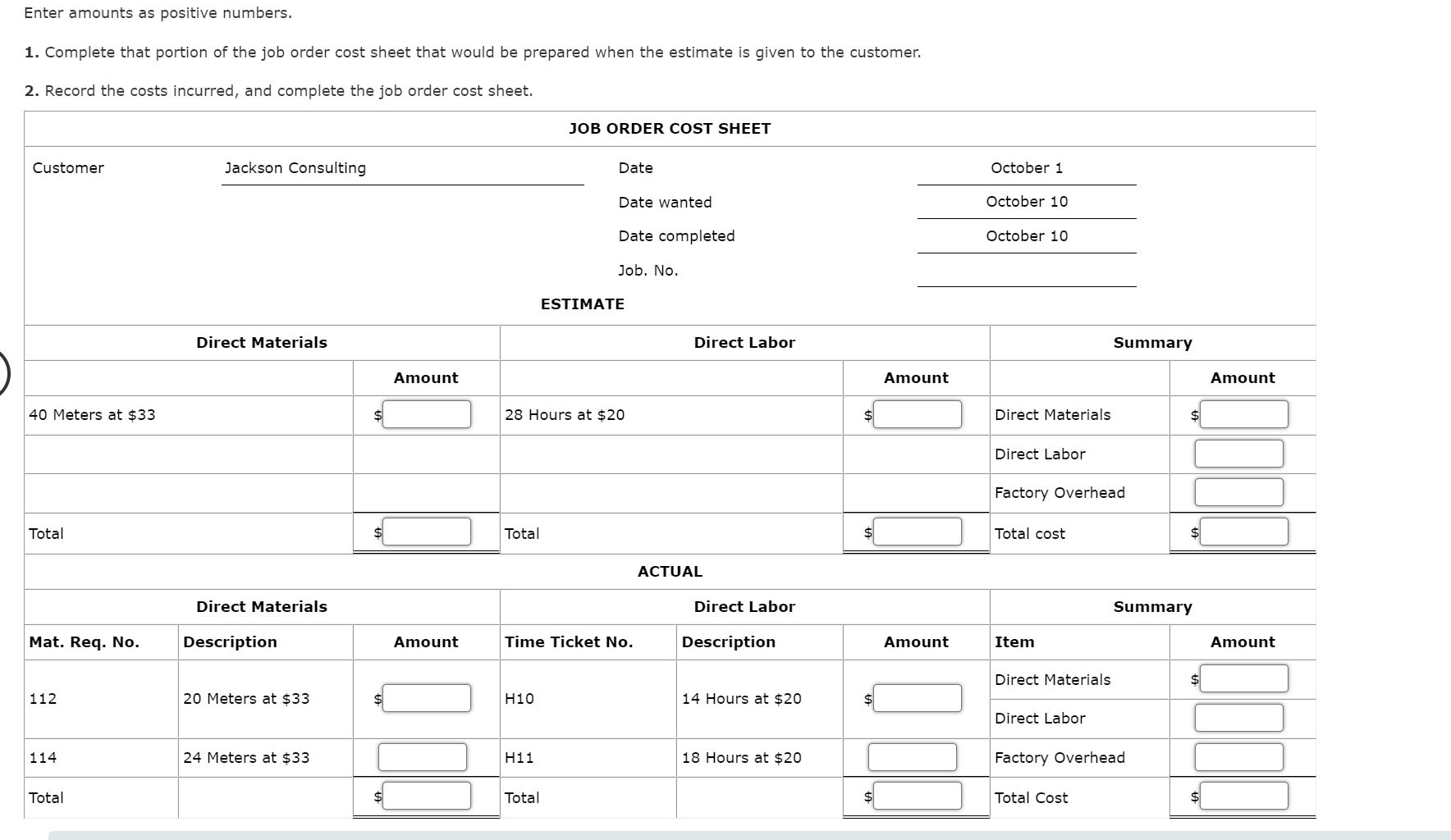

Entries for Costs in a Job Order Cost System Royal Technology Company uses a job order cost system. The following data summarize the operations related to production for March: a. Materials purchased on account, $688,290. b. Materials requisitioned, $578,160, of which $75,160 was for general factory use. c. Factory labor used, $708,940, of which $134,700 was indirect. d. Other costs incurred on account for factory overhead, $165, 190; selling expenses, $254,670; and administrative expenses, $151,420. e. Prepaid expenses expired for factory overhead were $31,660; for selling expenses, $26,840; and for administrative expenses, $19,270. f. Depreciation of factory equipment was $31,660; of office equipment, $46,800; and of office building, $92,230. g. Factory overhead costs applied to jobs, $392,330. h. Jobs completed, $908,540. i. Cost of goods sold, $881,010. Required: Journalize the entries to record the summarized operations. If an amount box does not require an entry, leave it blank. a. Materials purchased on account, $688,290. Entry Description Debit Credit a. Materials Accounts Payable b. Materials requisitioned, $578,160, of which $75,160 was for general factory use. Entry Description Debit Finished Goods X Credit Factory Overhead Materials c. Factory labor used, $708,940, of which $134,700 was indirect. Entry Description Debit Credit Work in Process c. Factory labor used, $708,940, of which $134,700 was indirect. Entry Description Debit Work in Process Credit Factory Overhead Wages Payable d. Other costs incurred on account for factory overhead, $165,190; selling expenses, $254,670; and administrative expenses, $151,420. Entry Description Debit Credit d. Factory Overhead Selling Expenses Administrative Expenses Accounts Payable e. Prepaid expenses expired for factory overhead were $31,660; for selling expenses, $26,840; and for administrative expenses, $19,270. Entry Description Debit Credit e. Factory Overhead Prepaid Expenses x Administrative Expenses Prepaid Expenses f. Depreciation of factory equipment was $31,660; of office equipment, $46,800; and of office building, $92,230. Entry Description Debit Credit f. Factory Overhead II Depreciation Expense-Office Equipment Enter amounts as positive numbers. 1. Complete that portion of the job order cost sheet that would be prepared when the estimate is given to the customer. 2. Record the costs incurred, and complete the job order cost sheet. JOB ORDER COST SHEET Customer Jackson Consulting Date October 1 Date wanted October 10 Date completed October 10 Job. No. ESTIMATE Direct Materials Direct Labor Summary Amount Amount Amount 40 Meters at $33 28 Hours at $20 $ Direct Materials $ Direct Labor Factory Overhead Total $ Total $ Total cost $ ACTUAL Direct Materials Direct Labor Summary Mat. Reg. No. Description Amount Time Ticket No. Description Amount Item Amount Direct Materials 112 20 Meters at $33 H10 14 Hours at $20 $ Direct Labor 114 24 Meters at $33 H11 18 Hours at $20 Factory Overhead Total Total Total Cost $