Question

Entries for equity investments: less than 20% ownership On February 22, Triangle Corporation acquired 6,200 shares of the 215,000 outstanding common stock of Jupiter Co.

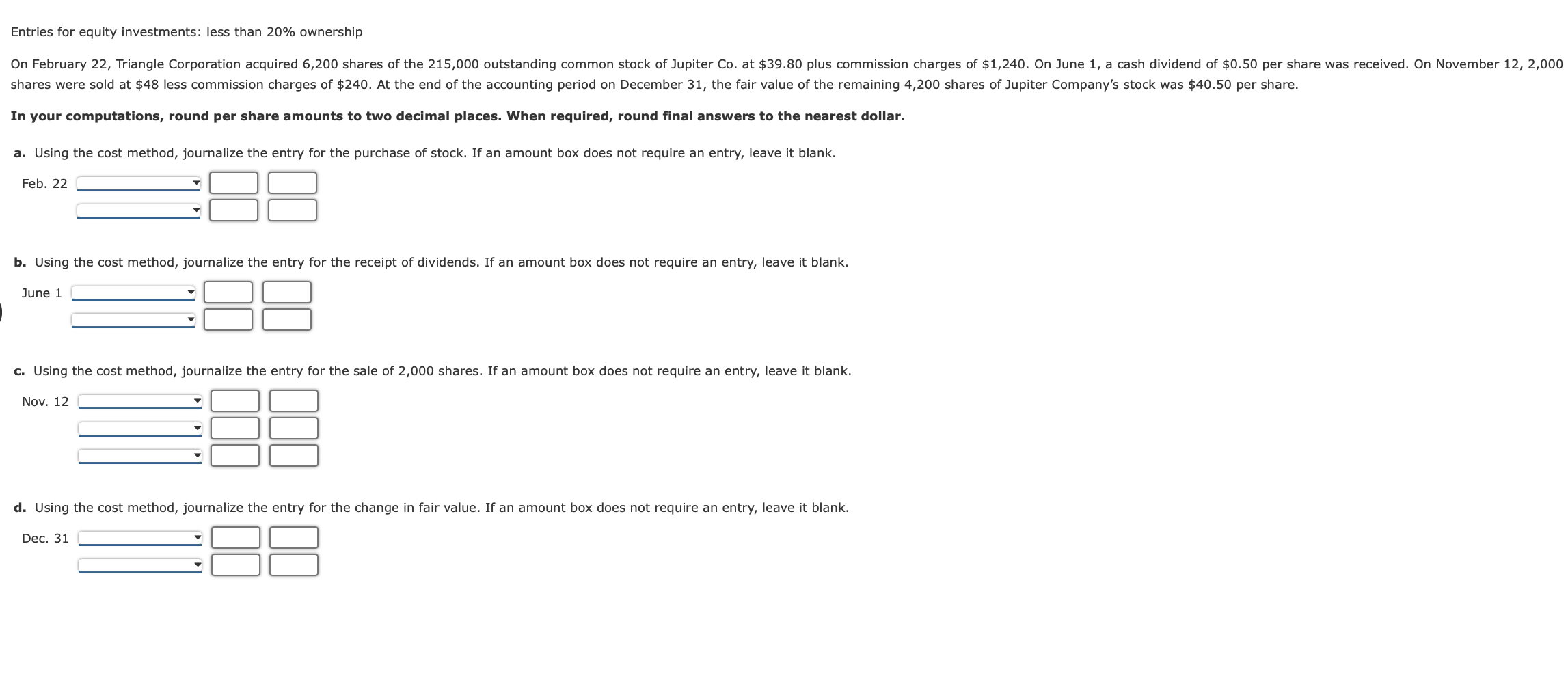

Entries for equity investments: less than 20% ownership

On February 22, Triangle Corporation acquired 6,200 shares of the 215,000 outstanding common stock of Jupiter Co. at $39.80 plus commission charges of $1,240. On June 1, a cash dividend of $0.50 per share was received. On November 12, 2,000 shares were sold at $48 less commission charges of $240. At the end of the accounting period on December 31, the fair value of the remaining 4,200 shares of Jupiter Companys stock was $40.50 per share.

In your computations, round per share amounts to two decimal places. When required, round final answers to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started