Question

Entries for Installment Note Transactions On January 1, Year 1, Luzak Company issued a $66,000, 4-year, 8% installment note to McGee Bank. The note requires

Entries for Installment Note Transactions

On January 1, Year 1, Luzak Company issued a $66,000, 4-year, 8% installment note to McGee Bank. The note requires annual payments of $19,927, beginning on December 31, Year 1.

Journalize the entries to record the following:

| Year 1 | |

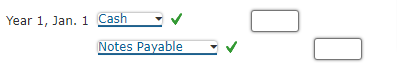

| Jan. 1 | Issued the note for cash at its face amount. |

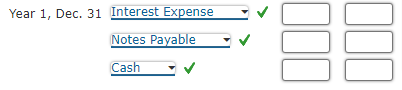

| Dec. 31 | Paid the annual payment on the note, which consisted of interest of $5,280 and principal of $14,647. |

| Year 4 | |

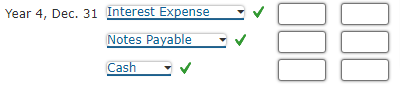

| Dec. 31 | Paid the annual payment on the note, including $1,476 of interest. The remainder of the payment reduced the principal balance on the note. |

Question Content Area

Issued the note for cash at its face amount.

Paid the annual payment on the note, which consisted of interest of $5,280 and principal of $14,647. For a compound transaction, if an amount box does not require an entry, leave it blank.

Paid the annual payment on the note, including $1,476 of interest. The remainder of the payment reduced the principal balance on the note. For a compound transaction, if an amount box does not require an entry, leave it blank.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started